March’s Off-Market Sellers

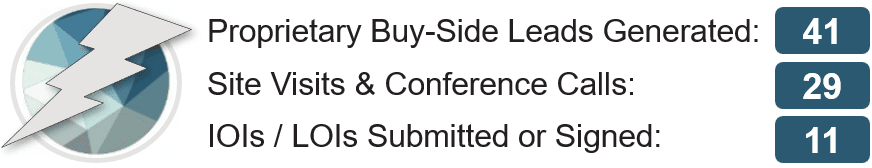

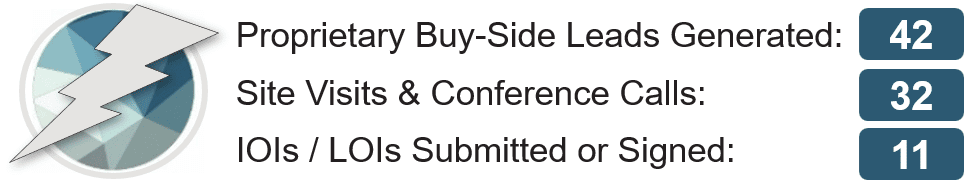

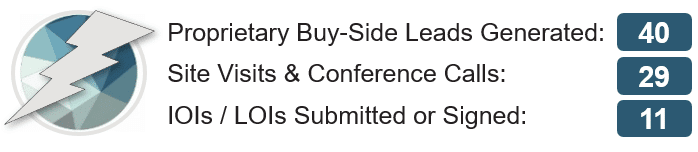

The Calder buy-side team has been off to a hot start this year with over $50M+ in transaction value closed across 5 separate transactions before the end of Q1 2023 representing half of Calder’s closed transactions so far this year. On the left-hand side of the chart below are current Calder Buy-Side Clients. On the […]

March’s Off-Market Sellers Read More »