Calder is assisting a private Family Office in acquiring a well-established specialty manufacturing or services business. Our buyer brings deep experience across technical, regulated, and process-driven industries. Areas of particular interest include ingredients and formulated products, material handling equipment, environmental remediation, metal coating and finishing, regulated ingredients and components, and specialty chemical manufacturing.

Ideally, the target company generates $3M–$20M in revenue and is located east of the Rockies.

Acquisition Criteria:

Target: Niche and technical businesses, including:

- Ingredients and formulated products

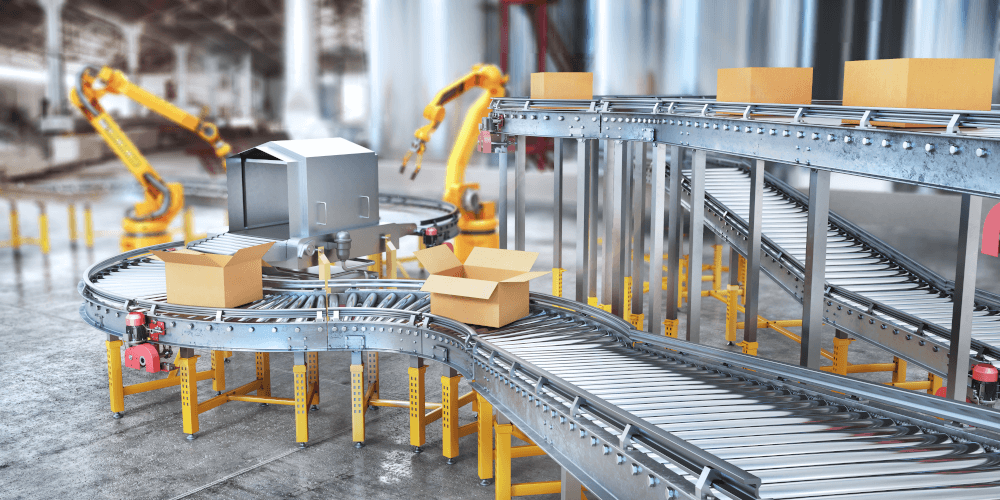

- Material handling equipment and systems

- Environmental remediation or related services

- Metal coating, finishing, and surface treatment

- Regulated ingredients, components, or assemblies

- Specialty chemical manufacturing

- Other process-driven or engineered manufacturing companies

Geography: East of the Rockies.

Revenue: $3M – $20M.

About Our Client:

Our buyer is an experienced business executive who will be actively involved in the company’s next chapter. With a background spanning technical, regulated, and process-driven industries, he has led teams through growth, operational improvement, and meaningful transformation. His approach emphasizes building strong teams, strengthening systems, and creating steady, sustainable performance.

The acquisition is backed by long-term family capital — patient, committed, and designed for continuity rather than rapid turnarounds. This model does not rely on a fund structure or predetermined exit timeline. Instead, the strategy is to acquire, invest in, grow, and operate a business for the long run, with a focus on stability, responsible stewardship, and durable value creation.

Our buyer is committed to honoring the company’s legacy, partnering closely with existing management, and ensuring a respectful transition that invests in the people who built the business.

If you are interested or know of a potentially interested party, please fill out the confidentially connect form or contact:

Logan Theodorou

Direct: 419-418-1719

[email protected]