Calder Capital Wins Industrials Deal of the Year ($10MM-$50MM) for Acquisition of BCU Electric by Meptagon Group

Calder Capital is electrified to announce that it has been named winner of the Industrials Deal of the Year ($10MM-$50MM) at the 16th Annual International M&A Advisor Awards. The award recognizes Calder Capital’s role in the acquisition of BCU Electric by Meptagon Group. Winners will be honored onstage at a Black-Tie Gala during the 2025 […]

RestoraPet of Gaithersburg, MD acquired by Individual Entrepreneur of Rochester, MI

“Jared and the Calder Capital team were incredible to work with. Jared ensured that what I valued most was honored in this transaction. RestoraPet has great meaning to me, personally, and has positively touched so many lives of pets and pet parents across the globe. Jared’s attention to detail, transparency, and tenacity helped me navigate […]

Industrial Distributor in the Northeast Acquires Commercial Equipment Service Provider in the Midwest

“From engagement to close, the process took less than six months. This was truly an impressive timeline and we couldn’t be more pleased with Jon Pastoor’s work. Throughout that time, I had complete trust in the Calder Capital team. They were responsive, honest, and knowledgeable. Truly, Calder Capital was an invaluable partner in finding the […]

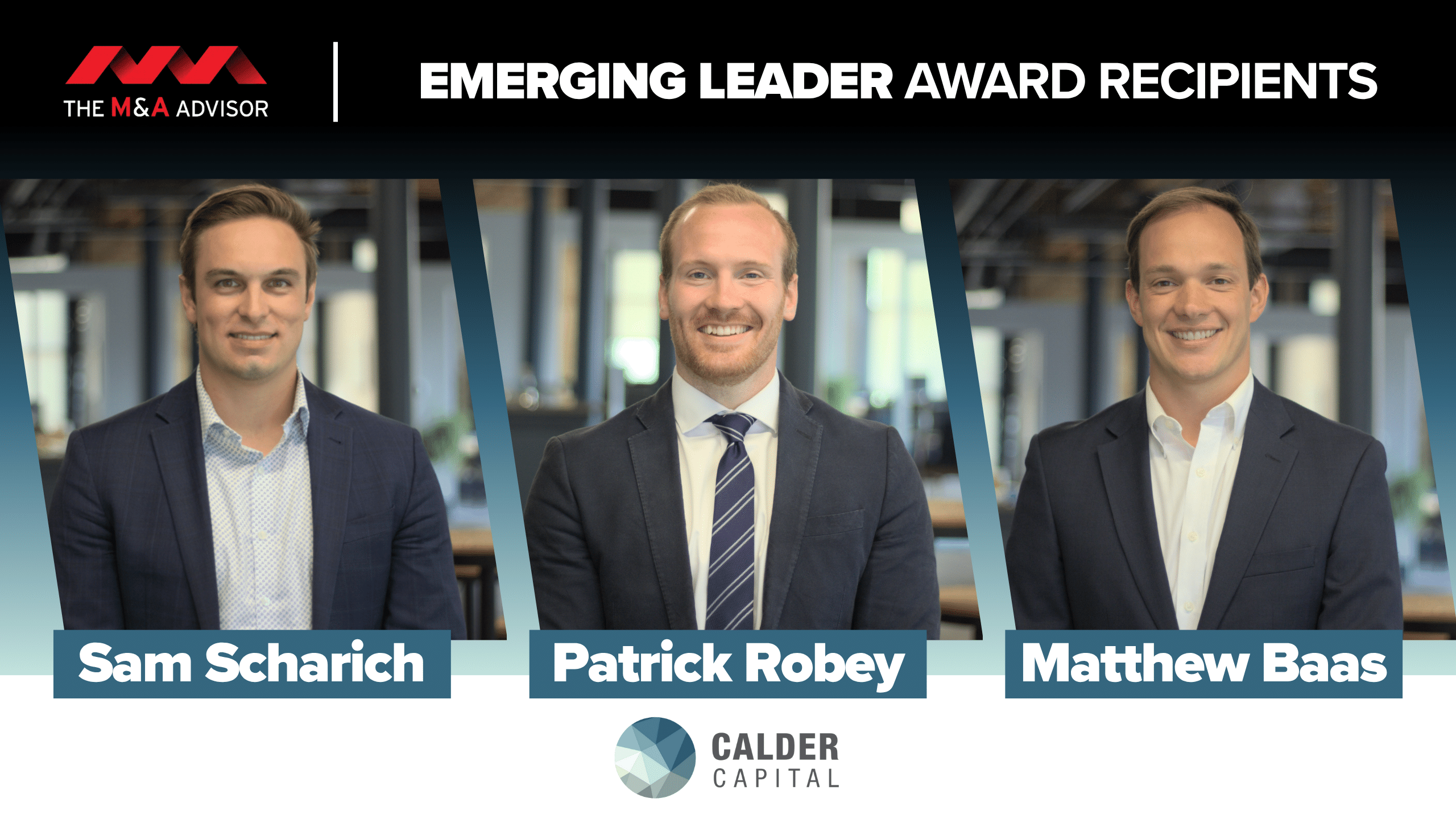

Calder Capital’s Matthew Baas, Patrick Robey, and Sam Scharich Named Recipients of The M&A Advisor’s Emerging Leaders Award

Calder Capital is proud to announce that three of its advisors, Matthew Baas, Patrick Robey, and Sam Scharich, have been named winners in The M&A Advisor’s 16th Annual Emerging Leaders Awards. This prestigious national award recognizes high-performing M&A, financing, and turnaround professionals under the age of 40 who have demonstrated outstanding achievements in the industry […]

Calder Capital’s Patrick Robey Honored as a Recipient of The M&A Advisor’s Emerging Leaders Award

Calder Capital is proud to announce that Patrick Robey, M&A Advisor, has been named a winner of The M&A Advisor’s Emerging Leaders Award. This national recognition honors top-performing M&A, financing, and turnaround professionals under the age of 40 who have made notable contributions to the industry and their communities. Since joining Calder Capital in 2016, […]

Calder Capital’s Matthew Baas Honored as a Recipient of The M&A Advisor’s Emerging Leaders Award

Calder Capital is proud to announce that Matthew Baas, M&A Advisor, has been named a winner of The M&A Advisor’s Emerging Leaders Award. This national recognition honors top-performing M&A, financing, and turnaround professionals under the age of 40 who have made notable contributions to the industry and their communities. Matt joined Calder Capital in 2016 […]

Calder Capital’s Sam Scharich Honored as a Recipient of The M&A Advisor’s Emerging Leaders Award

Calder Capital is proud to announce that Sam Scharich, Buy-Side Director and M&A Advisor, has been named a winner of The M&A Advisor’s Emerging Leaders Award. This national recognition honors top-performing M&A, financing, and turnaround professionals under the age of 40 who have made notable contributions to the industry and their communities. Since joining Calder […]

Glass Concepts of Hillside, IL partners with Leelanau Private Capital of Birmingham, MI

Hillside, IL

Has Partnered With

Birmingham, MI

Served as the Exclusive M&A Advisor to Glass Concepts

“Calder Capital was amazing and the experience was great. Shane and Jake, in particular, were instrumental in helping me find the right partner for Glass Concepts. Shane and Calder were there, all the way from the initial meeting to the closing of LPC’s investment. They kept things moving forward, helping me navigate a time consuming and […]

Hartland Auto Wash of Hartland, MI Acquired by Hartland Oil Change of Hartland, MI

“After I sold Mechigian Auto Washes with Garrett, I was nothing short of pleased with the result. I knew that when it was time to exit Hartland Auto Wash, that Calder Capital would get another call from me. With this sale, Jakob Simonds exhibited expertise and great integrity. Garrett and Jakob have been fantastic to […]

June 2025 Sell-Side Update

Welcome to our June 2025 Sell-Side Update! In this June 2025 Sell-Side Update, Garrett Monroe, Sell-Side Director at Calder Capital, speaks with Nicholas Browning, a Sell-Side Analyst at Calder Capital, to explore the daily life, responsibilities, and rewards of being a Sell-Side Analyst at Calder Capital. Whether you’re a business owner interested in selling a […]

May 2025 Off-Market Sellers Update

In our 5-minute May update, we cover the 2025 Manufacturing deal of the year, a 150+ year old business sale, overall year-to-date Calder results (a strong contrast to the overall market!) and more! Have questions? We’ve answered the top buy-side FAQs here. May’s Results: Have a question you’d like answered? Thanks for watching our May 2025 […]

Introducing Drew Woods: Calder Capital’s New Sell-Side Investment Banking Analyst

Calder Capital, a nationwide mergers and acquisitions advisory firm, is thrilled to welcome Drew Woods as our newest Sell-Side Investment Banking Analyst. Introducing Drew Empty heading Originally from Rockford, Michigan, Drew brings a strong foundation in finance and a growing passion for mergers and acquisitions. He completed an Investment Banking M&A Internship at Piper Sandler, […]

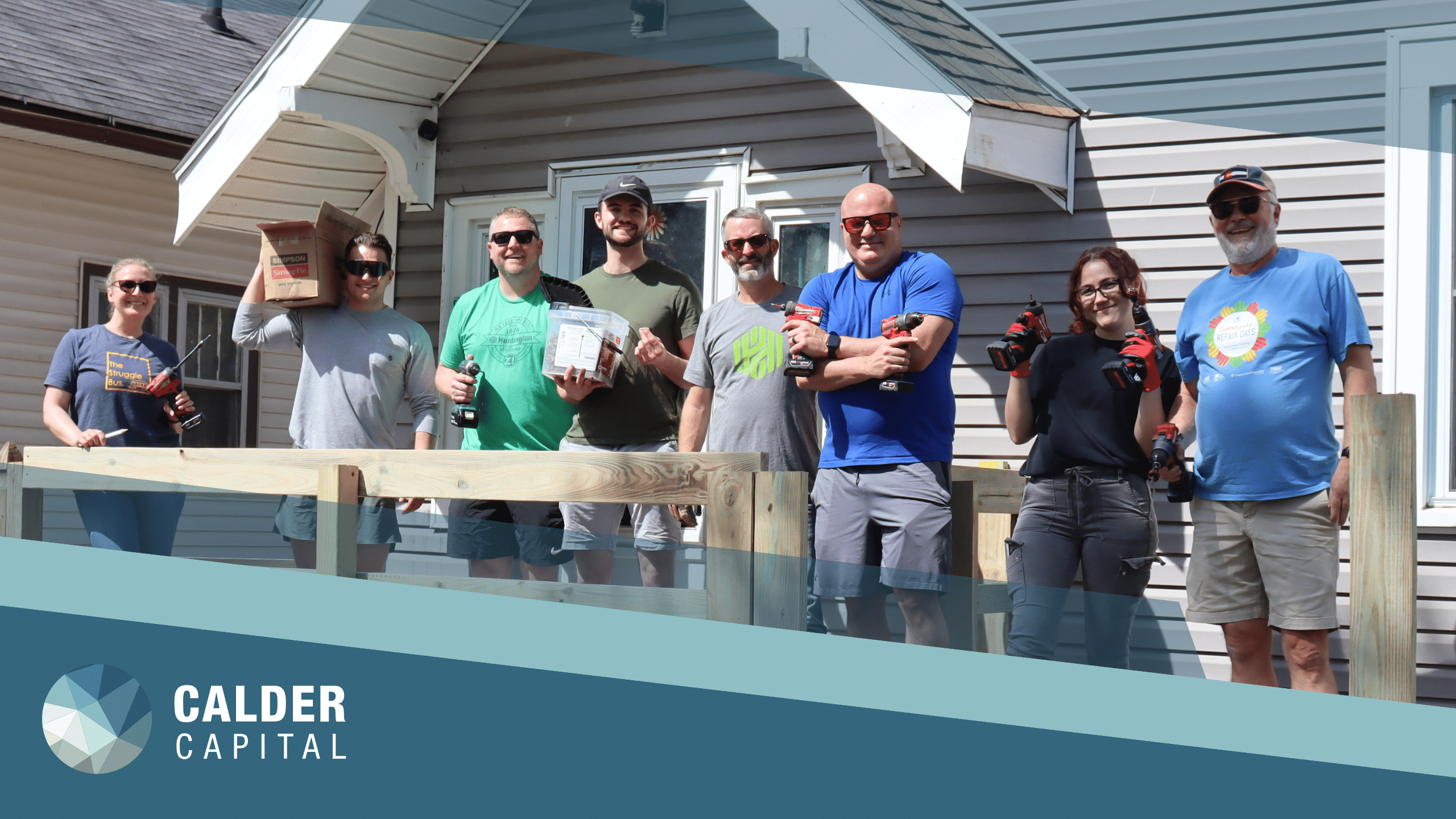

Calder Capital Serving The Grand Rapids Community With Home Repair Services

Recently, the Calder Capital team partnered with Home Repair Services of Kent County (HRS) and Huntington Bank to build a wheelchair ramp for a local Grand Rapids homeowner. Home Repair Services of Kent County is a non-profit organization based near Calder Capital’s headquarters in Grand Rapids. Its mission is to strengthen vulnerable Kent County homeowners, […]

Calder Capital’s M&A Market Update

Calder Capital’s market updates pull recent data from industry-wide reports, like BizBuySell, IBBA, M&A Source, GF Data, and internal transactions. We compile insights into current market conditions, published quarterly. With 40+ annual transactions closed, we offer accurate perspectives. Our analysis informs strategic decisions, backed by data and M&A expertise. Exceptional service is our pride.

AAA Engineering of Chicago, IL Acquired by Strategic Entrepreneurs in Chicago, IL

“The Calder Capital team was pleasant to work with, responsive, and financially organized throughout the entire process. They put together a great presentation of my business that accurately showcased its strengths and attracted multiple strong buyers.” – Rachel Borenstein, President, AAA Engineering, Chicago, IL (Seller) “Through the acquisition process, Calder Capital acted with tact, trust, […]

How Individual Buyers Can Compete with Private Equity

Calder Capital’s Buy-Side Director, Sam Scharich, recently joined Matthias Smith, Founder of Pioneer Capital Advisory, for a webinar on how individual buyers can successfully compete with private equity in today’s competitive M&A environment. Watch the full discussion below! What’s the key to standing out in a crowded buyer field? Sam and Matthias explore actionable strategies: […]

Extra Credit Projects of Grand Rapids, MI Acquired by Grand Rapids-area Entrepreneur

“I hired Calder Capital to assist me on the Buy-Side, and now that I’m through the process, I couldn’t be happier! Sam and his team were diligent, professional and had a refreshing sense of urgency. While the process took a bit longer than I expected, the team never wavered and frankly helped me through a […]

The Acquisition of Portland Products Named Crain’s Grand Rapids 2025 Manufacturing Deal of the Year

Calder Capital is proud to announce that the acquisition of Portland Products of Portland, MI, by Rick Slater and Ben Greve, backed by Sleeping Giant Capital of Kalamazoo, MI, has been named Crain’s Grand Rapids 2025 Deal of the Year in the Manufacturing category. This prestigious recognition by Crain’s serves to highlight transactions that create […]

Marine Software Company of CA Acquired by a Search Fund of NY

“Calder Capital was instrumental in finding the right buyer for our company. They understood our needs and ensured a smooth transition, allowing us to step back while knowing the business is in good hands.” – Founder, Marine Software Company, California (Seller) “Working with Calder Capital was a seamless experience. Their professionalism and deep market knowledge […]

May 2025 Sell-Side Update

Welcome to our May 2025 Sell-Side Update! In this May 2025 Sell-Side Update, Garrett Monroe, Sell-Side Director at Calder Capital, speaks with Chris George, an experienced M&A attorney at Varnum LLP, to uncover legal considerations that are crucial in any sell-side transaction. If you’re considering selling your business, understanding how specialized M&A legal counsel can […]

April 2025 Off-Market Sellers Update

In our 7-minute April update, we discuss April’s lead flow results, how to win deals over other buyers and differentiate yourself, and a quick lesson on persistence! April’s Results: Have a question you’d like answered? Thanks for watching our April 2025 Off-Market Sellers Update! Email [email protected] with any questions and Sam Scharich will do his best to […]

150+ Year Old Family Business, Requarth Co. of Dayton, OH, Acquired by Schockman Lumber of St. Henry, OH

“We were incredibly impressed with how Calder’s team connected us with Requarth within just three months of our initial engagement. That level of efficiency and precision reflects the strength of Calder’s process and network. We’ve been so pleased with the experience that we’re continuing to partner with their Buy-Side team, including Matt Uhl, to pursue […]

Assembly Masters of Elkhart, IN Acquired by Bay Motor Products of Traverse City, MI

“Jakob was wonderful to work with. Both Joe and I really appreciate his guidance and wisdom through this process. His commitment to us made us feel confident every step of the way. We are grateful for the level of care Calder Capital brought to the table and we are glad we partnered with them.” – […]

Tarpon Stainless of Tarpon Springs, FL, Acquired by AmeriKooler of Hialeah, FL

“We were glad that we picked Calder Capital to represent us. Sam and Parker were proactive, transparent, and incredibly resourceful in identifying and facilitating this off-market opportunity.” – Gian Carlo Alonso, CEO, AmeriKooler, Hialeah, FL (Buyer) “The approach and organization displayed by Calder Capital truly impressed us. They kept communication flowing and respected our timelines. […]

Introducing Aidan Cote: Calder Capital Buy-Side Search Director

Calder Capital, a nationwide mergers and acquisitions advisory firm, is thrilled to welcome Aidan Cote as our newest Buy-Side Search Director. Introducing Aidan Originally from Rockford, Michigan, Aidan brings a diverse background in finance, sales, and business strategy. He has previously worked at Sleeping Giant Capital, North American Senior Benefits, 44 North, and Innovia Wealth, […]

Midwest Juice of Grand Rapids, MI, Acquired by Leonard’s Syrups of Detroit, MI

“Working with Calder Capital proved to be incredibly valuable. Scott brought a level of expertise that made a big difference throughout the entire process. He was responsive, honest, and hard-working. I’m glad that he represented me.” – Founder, Midwest Juice, Grand Rapids, MI (Seller) “Scott and the Calder team brought focus to the transaction. Their […]

Calder Capital Honored as a Bronze Stevie® Award Winner in 2025 American Business Awards®

Stevie winners will be presented their awards on Tuesday, June 10 in New York. Calder Capital has been named the winner of the Bronze Stevie® Award in the Financial Services Company of the Year, Medium category in the 23rd Annual American Business Awards®. Between 2023 and 2025, Calder Capital, an emerging national leader in lower […]

Ada Logistics of Ada, MI, Acquired by The AGL Group of Boston, MA

“I’m incredibly grateful to Calder Capital and Matt Baas for their professionalism throughout this process. Their insights and responsiveness made the transaction efficient. It was clear from the beginning that they had Todd and Sheri’s best interests in mind, and they did an outstanding job bringing both parties together for a successful outcome.” – Steve […]

Is It A Good Time To Buy A Business?

In today’s volatile economic climate, many prospective business buyers hesitate, waiting for more stability before making significant investments. However, history and current market dynamics suggest that periods of uncertainty often present the most compelling opportunities. As Warren Buffett famously advised, “Be fearful when others are greedy, and greedy when others are fearful.” The Current Economic […]

Patrick Robey of Calder Capital Recognized as Dealmaker of the Year

Calder Capital proudly announces that Patrick Robey, a key member of its mergers and acquisitions advisory team, has been recognized by Crain’s Grand Rapids Business in their prestigious 2025 M&A Deals and Dealmakers Awards. As an investment banker who advised on numerous notable or complex deals over the last year, Patrick has been recognized as […]

April 2025 Sell-Side Update

Welcome to our April 2025 Sell-Side Update! As tax season ends and strategic planning begins, many business owners are turning their attention to the future. In this April 2025 update, Calder Capital’s Sell-Side Director, Garrett Monroe, shares the top five insights shaping small business mergers and acquisitions (M&A) right now. Whether you’re preparing to sell […]

March 2025 Sell-Side Update

Welcome to our March 2025 Sell-Side Update! In this March 2025 Sell-Side Update, Calder Capital’s Sell-Side Director, Garrett Monroe, sits down with Chicago-based advisor Shane Kissack to discuss key trends in the M&A market, what sets Calder apart in Chicago, and Shane’s personal experience as both a business owner and an M&A advisor. Shane shares […]

March 2025 Off-Market Sellers Update

In our 6-minute March update, we discuss March’s results, what our buyers currently have under LOI, a spotlight on a current buy-side client, a massive obstacle to avoid in the acquisition process, and more! March’s Results: Have a question you’d like answered? Thanks for watching our March 2025 Off-Market Sellers Update! Email [email protected] with any questions and […]

Calder Capital Opens 2025 with Momentum: 19 Deals Closed and First Middle Market SaaS Exit Achieved

Calder Capital began 2025 with a strong showing, closing 19 transactions in Q1 and marking a significant milestone, our first Middle Market SaaS business sale. While navigating a market that remains cautious due to interest rate uncertainty, lender conservatism, geopolitical concerns, and mixed economic data, Calder is providing consistent execution and a steady pipeline. Calder […]

EBW Electronics of Holland, MI Acquired by ADAC of Grand Rapids, MI

Calder Capital is pleased to announce the successful acquisition of EBW Electronics, headquartered in Holland, MI, by ADAC, based in Grand Rapids, MI. ADAC, a diversified solutions provider to the automotive, industrial, medical, marine and other industries, founded in 1975 is renowned for its development and production of vehicle access systems, sensor technologies, lighting components, […]

Calder Capital Listed on 2025 Inc. Regionals: Midwest List of Fastest-Growing Private Companies

Calder Capital, a nationwide M&A firm headquartered in Grand Rapids, Michigan has climbed the ranks to No. 30 on Inc.’s fifth annual Inc. Regionals: Midwest list. This prestigious ranking by Inc. recognizes the fastest-growing private companies in the Midwest, including Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, and Wisconsin. […]