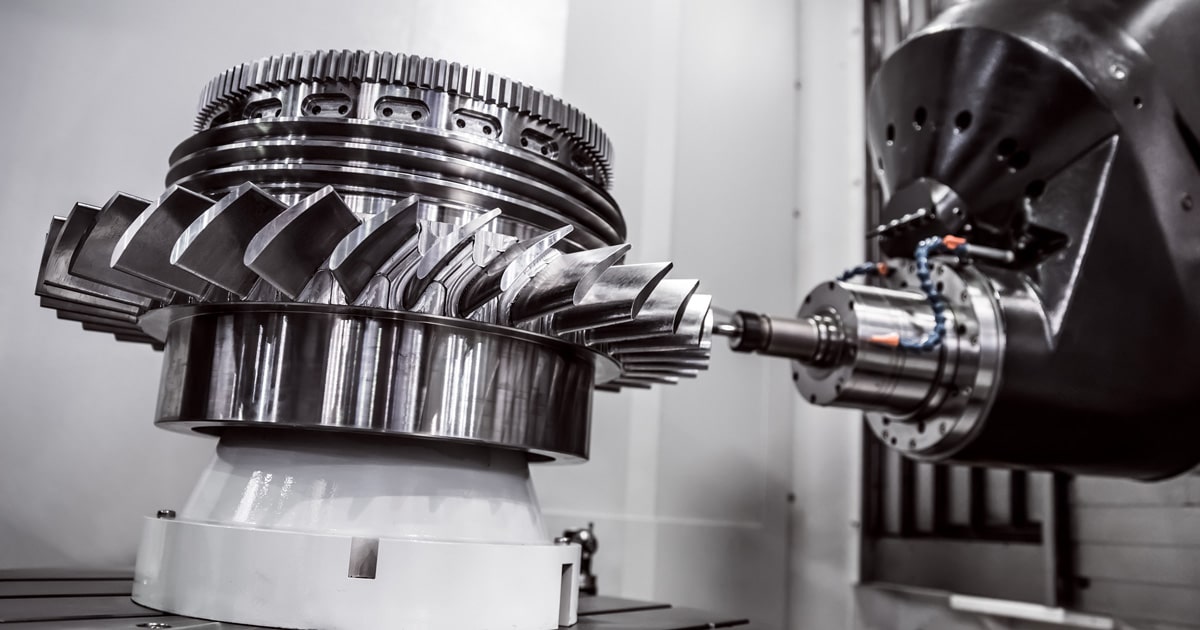

Calder is working with an individual buyer to identify a business ready for its next phase of ownership. Our buyer is primarily focused on niche manufacturing and industrial service companies, with areas of interest including, but are not limited to, aerospace and defense, medical devices, energy, heat treatment, injection molding, testing, industrial maintenance, and industrial waste removal.

The ideal target generates $5M to $30M in revenue and is located on the East Coast, Texas, Colorado, or Puerto Rico.

Acquisition Criteria:

Target: Niche manufacturing or industrial services.

Geography: East Coast, Texas, Colorado, or Puerto Rico.

Revenue: $5M – $30M.

About Our Client:

Our buyer is a seasoned executive with over 15 years of global leadership experience, having served twice as CEO, Corporate Vice President, and strategic advisor across multiple industries and geographies. He has successfully led six acquisitions and integrations in ten countries, driving operational improvements, cultural alignment, and sustainable growth. His leadership portfolio includes managing complex cross-border operations with a focus on precision manufacturing and industrial services and overseeing teams of more than 2,400 employees.

With experience rooted in his family business, our buyer has a deep understanding of the complexities involved in such environments. He approaches acquisitions with an open mind and a creative spirit, striving to create mutually beneficial deals for all parties involved.

Recognized for his people-centered leadership style and strong values rooted in respect, integrity, and empowerment, he fosters positive organizational cultures that emphasize employee development and collaboration. He is deeply committed to preserving the legacy of the business he acquires, focusing on continuity, empowering key employees, and implementing thoughtful strategies for greater efficiency and innovation. Our buyer takes a patient, growth-oriented approach, viewing the acquisition as an opportunity to steward and strengthen the business and its community for the long term.

If you are interested or know of a potentially interested party, please fill out the confidentially connect form or contact:

Logan Granger

Direct: 616-485-4578

[email protected]