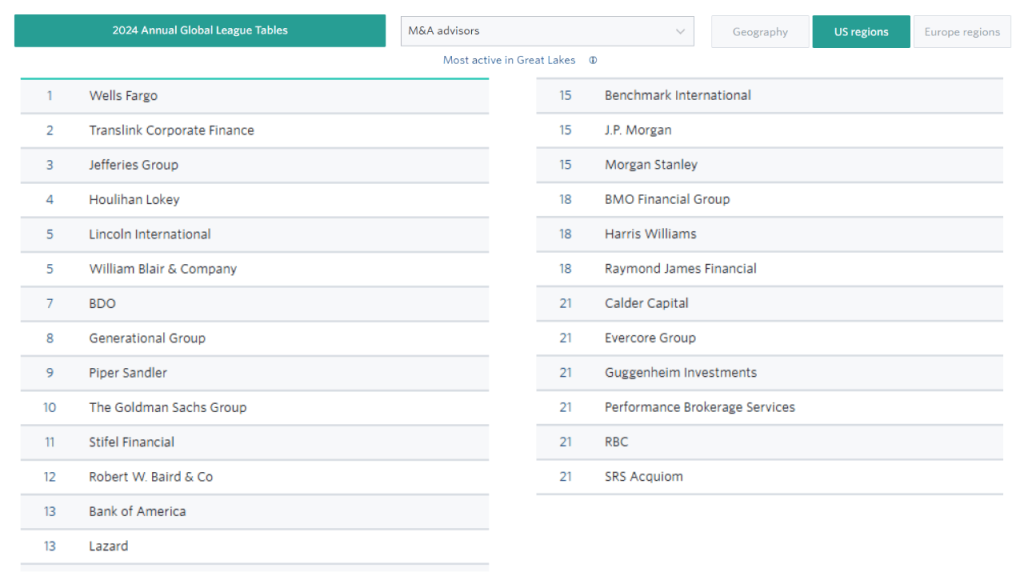

Calder Capital is proud to announce its inclusion in PitchBook’s 2024 Annual Global League Tables, earning the #21 position among the most active M&A advisors in the Great Lakes region, based on Calder’s volume of Midwest deals in 2024.

This recognition places Calder among the top-closing advisory firms facilitating transactions across the Great Lakes region and beyond, marking an important milestone as the firm continues to expand its national footprint and strengthen its position within the lower middle market and middle market.

Calder’s presence on the list stands out from many of the other firms ranked alongside it. While much of the list is composed of large national or global investment banks headquartered in major financial hubs, Calder remains distinctly headquartered in the Midwest and lower-middle-market focused, primarily advising owner-operated businesses in the $1–$100M enterprise value range.

A sell-side and buy-side advisory firm, Calder Capital serves clients across all industries and has developed a specialization in closing transactions in the manufacturing, distribution, construction, and business services sectors. Since its founding in 2013, Calder has closed more than 300 transactions, supported by a rapidly growing team of over 50 M&A professionals nationwide.

“We are honored to be recognized as one of the most active advisors in the Great Lakes region,” stated Max Friar, Founder and Managing Partner of Calder. “While we remain ambitious about climbing even higher in future rankings as we continue to close more deals per year, being acknowledged by PitchBook is a grand accomplishment. When I started Calder nearly 13 years ago, I never imagined in my wildest dreams being on the same lists as Goldman Sachs, Morgan Stanley, or Lazard. It is truly a compliment to the machine we’ve built: the effectiveness of our team, our process, as well as our commitment to delivering exceptional outcomes for our clients.”

PitchBook’s League Tables are determined by the volume of completed, publicly disclosed M&A transactions captured in its global private-market database. Rankings reflect the total number of closed deals within a defined region and deal type, offering an objective, data-driven view of advisor activity. Because PitchBook evaluates firms strictly on completed and disclosed transaction count, rather than size, value, or subjective criteria, its League Tables serve as a transparent benchmark of market presence and consistency across the industry.

To view complete results for Pitchbook’s Annual 2024 Global League Table, click here.

About Pitchbook:

PitchBook is a leading financial data and technology provider delivering comprehensive information on private and public capital markets, including M&A activity, private equity, venture capital, and emerging industries. PitchBook’s Annual Global League Tables are widely regarded as an objective, data-driven benchmark for advisor performance and transactional activity. To learn more, please visit www.Pitchbook.com.

About Calder Capital:

Founded in 2013, Calder Capital is a cross-industry mergers and acquisitions advisory firm with offices across the United States. Calder provides valuation, sell-side, and buy-side services. We are nationally recognized for excellence in advising $1-100M enterprise value transactions in manufacturing, construction, distribution, and business services. Calder serves business owners, entrepreneurs, family offices, financial buyers, and investors. Learn more at www.CalderGR.com.