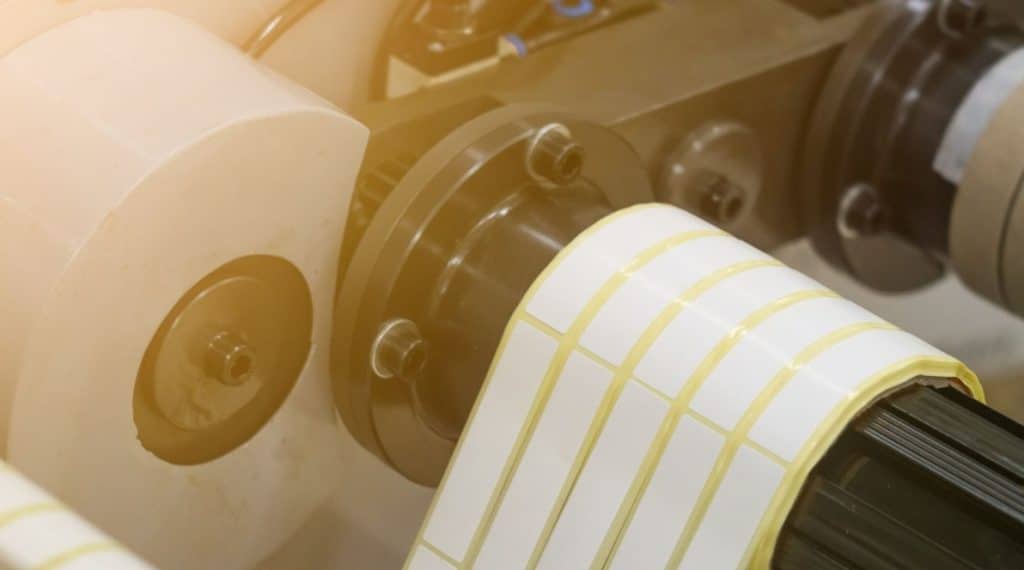

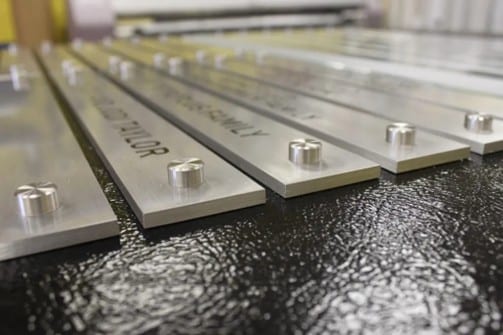

Calder is working with a strategic buyer to acquire a specialty manufacturing business. The buyer is interested in nameplate, tag, or label manufacturers, but companies that manufacture other products related to identification are also of interest.

Ideally, the target company generates between $1.5M and $20.0M in revenue and is located within the continental United States.

Acquisition Criteria:

Target: Specialty manufacturing businesses producing nameplates, tags, labels, or other identification products

Geography: Continental United States

Revenue: $1.5M-$20.0M

About Our Client:

Calder’s strategic buyer is an experienced operator with more than 20 years of hands-on leadership across manufacturing, industrial services, and other operationally intensive environments. Since acquiring their current business, our buyer has grown revenue by 89 percent through disciplined operational improvements, stronger commercial strategy implementation, and a commitment to serving customers with consistency and care.

Our buyer brings stability, operational discipline, and a long-term ownership mindset to acquired businesses. Our buyer intends to remain a hands-on operator rather than a passive or financial owner, ensuring continuity for employees, customers, and suppliers. Their focus is on protecting the legacy of the company while investing in better systems, process improvements, and steady commercial expansion.

If you are interested or know of a potentially interested party, please fill out the confidentially connect form or contact:

Tyler Tingley

Direct: 616-227-5008

[email protected]