Calder Capital is working with a strategic buyer to identify value-added metal and/or plastic contract manufacturers. Our client prefers a customer base within the medical or aerospace industries but will consider others outside of those parameters.

Geographically, our client is seeking businesses in the southern half of the United States, plus Indiana, Missouri, Ohio, or Kansas.

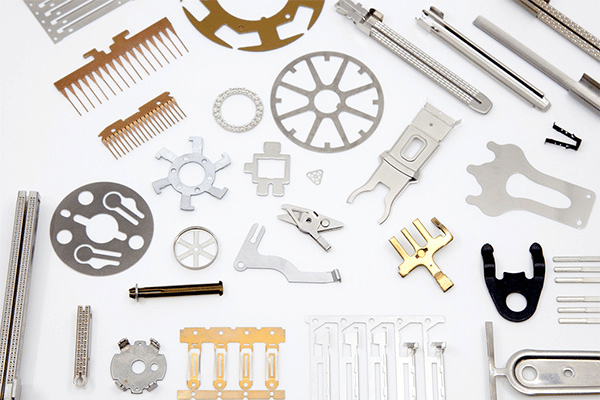

Preferred candidates will have a strong foundation in engineering and technology and a demonstrated track record as a value-added supply chain partner to large, sophisticated customers. For example, our client prefers companies with the ability to consistently meet customers’ stringent quality requirements, including holding tight dimensional tolerances. In addition, companies that provide value-added services through secondary operations, including assembly, laser etching, pad printing, painting/coating, etc. are also preferred.

Ideal companies are focused on serving the recurring production needs of OEM customers and generating at least $5M in revenue.

Acquisition Criteria:

Target: OEM metal and/or plastic contract manufacturers, preferably in the medical and/or aerospace industries. Ideal candidates will have a strong proficiency in engineering and technology and a differentiated skill set relative to its peers. Preferred production capabilities include metal machining and tube making, as well as plastic molding and extrusion.

Geography: Preference for the southern half of the United States, as well as Indiana, Missouri, Ohio, or Kansas.

Revenue: $5M+

Valuation/Deal Structure: Companies with a management team in place are preferred but not required.

About Our Client:

Our client has a proven track record over the last 25 years of helping middle market businesses drive profitability and accelerate growth and is looking for a new platform that fits its investment criteria. Our client has a proven track record of investing in both the medical and aerospace industries and works closely with a network of seasoned industry operators for additional support.

Our client is committed to maintaining a company’s existing management and workforce and will keep a company’s existing operations in place, providing the local community with stable employment and career growth opportunities. Finally, our client is investing outside of a fund structure and prefers a multi-decade holding period.

If you are interested or know of a potentially interested party, please fill out the form below or contact:

Hannah Nabhan

Direct: 219-841-2064

[email protected]