Calder assisted an experienced entrepreneur who had previously owned several businesses and was ready for his next venture in acquiring a strong, locally based company. After trying to find an acquisition independently, he turned to Calder for a more targeted and effective approach. What followed was a high-touch, off-market process that culminated in a successful closing, but not without many struggles and hurdles along the way.

Beginning & Preparation

In September 2023, the buyer engaged Calder’s Buy-Side team with a goal to find and acquire a profitable, off-market business within a 30-minute driving distance of his home. Although his geographic focus was narrow, he was open to a broad range of business types. At the outset, he never would have imagined being interested in the type of business he ultimately acquired – an evolution made possible by his flexibility and determination.

The buyer was well-versed in business fundamentals but needed a partner to expand his access to proprietary deal flow. Through Calder’s Buy-Side Gold engagement, the team worked closely with him to refine acquisition criteria and develop both a buyer and personal profile to share selectively with sellers, positioning the buyer as a credible operator with a successful background and a strong interest in preserving legacy.

Prospecting, Conversations & IOIs

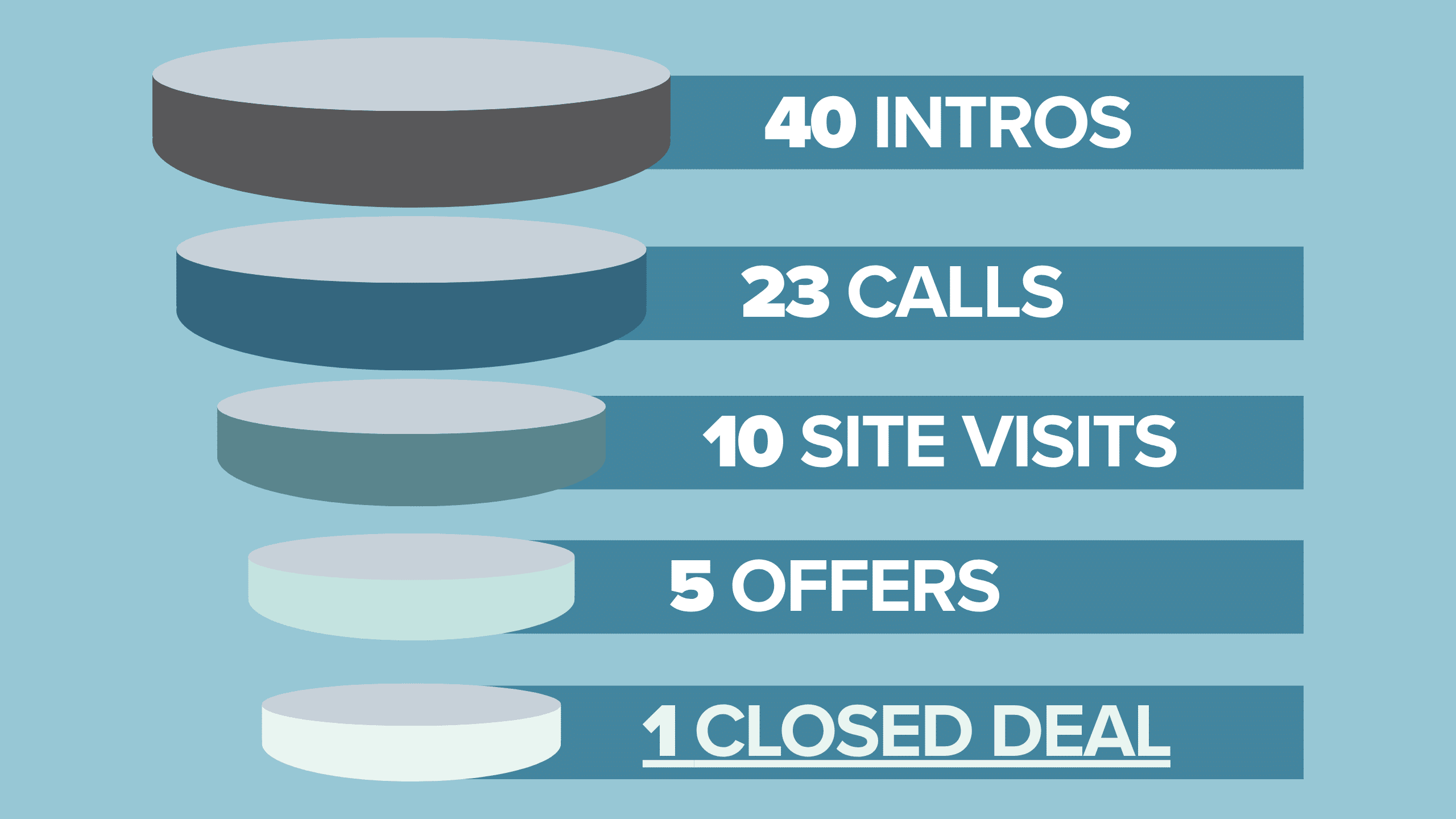

From September 2023 to December 2024, Calder’s team launched a focused outreach campaign. The effort led to 40 prospect introductions that led to 23 introductory calls, 10+ site visits, and deeper evaluations into numerous opportunities.

The buyer was especially proactive and persistent throughout the process. He showed a genuine commitment by meeting sellers in person, something that often set him apart and built a stronger rapport. His consistency paid off as five businesses emerged as high-potential targets. Offers were submitted on all five, and the grind of negotiation on each offer began. One after another the negotiation gap would start to close, only for something small to derail the deal and take it out of contention. The first four all proceeded in this fashion, seriously testing the resolve of the buyer. Finally, with offer number five, the buyer was able to reach a signed LOI, moving quickly into diligence and ultimately across the finish line! Retrospectively, the buyer told us that he never saw himself buying the business he acquired, but after owning it for several months, declared it the best business he could have bought out of all the options he pursued. Let’s dive deeper into the LOI process below.

LOI Execution & Overcoming Financing Hurdles

In September 2024, exactly one year from when the search began, an LOI was executed, triggering full diligence and financing effort. In the midst of the financing process, the buyer faced a major hurdle when the original lending partner unexpectedly pulled out of the deal due to a previous bankruptcy filing by our buyer, a fact that had been disclosed upfront and was disregarded as not being an issue.

Despite the setback, Calder stayed closely engaged and helped the buyer pivot quickly. We brought in Pioneer Capital, a trusted loan broker, who not only secured the most competitive terms but also helped keep the closing timeline intact (at no cost to our client). Their collaborative approach helped the deal stay on course.

Through continued diligence, thoughtful renegotiations, and close coordination between the buyer, seller, lender, and legal counsel, the acquisition successfully closed in April 2025, eight months later after the LOI and 19 months after launching the search.

Conclusion

This case study highlights the value of persistence, adaptability, and surrounding yourself with the right team. The buyer began with a specific geographic target and a broad view of business types, and ended up acquiring a company he wouldn’t have considered early on, proving the importance of staying open-minded.

With 40 prospect introductions, 23 meaningful conversations, five offers, and one major financing hurdle overcome, the buyer’s path to an acquisition wasn’t always smooth – but it was successful. Calder delivered not just deal flow, but strategic support, market access, and hands-on execution. Ultimately, this entrepreneur didn’t merely acquire a business. He found the right fit, and he did so by refusing to give up.

Why Work With Calder’s Buy-Side Team?

Buyer competition, research, calling/emailing bankers, lack of time for prospecting/pipeline building, and limited administrative resources: these are all factors that add to the difficulty of sourcing enough deal flow to be successful in buying one or more businesses. We understand these limitations, which is why we have created an aggressive buy-side M&A advisory firm focused on sourcing services designed to do the work that corporate, family office, private equity, and individual entrepreneurial buyers know is necessary but often falls to the bottom of the priority list.

Calder Capital’s Buy-Side M&A Advisory is focused on bringing buyers proprietary, off-market deal flow driven by high-quality, high-quantity direct outreach to potential sellers matching our client’s specific criteria and by leveraging our existing network. Our team can source and execute deals nationwide, as evidenced by having completed deals in 30+ different states to date. By completing all of the work in-house, our team can uphold professionalism and quality in establishing the first impression on behalf of our client, as well as guarantee leads and deal flow.

Our buy-side gold clients are guaranteed 10 introductions with sellers that meet their criteria (or they don’t pay) and often pay a .5x EBITDA multiple less than fair market value for these businesses. Similarly, our buy-side clients’ ability to consistently close transactions with off-market sellers is tied directly to our willingness to research, call, email, and qualify sellers diligently. Most firms offering buy-side services tap their existing network, issue a press release, and hope the phone rings. We contact each owner seven times through cold calling and emailing within two weeks. That’s how we get a “yes”, “no”, or “call me in a year” response from 40%+ of those owners we reach out to. And for those that say “yes”, we conduct a 30-minute interview with them to ensure that they’re a fit before we bother our client.

Additionally, we will reach out to acquisition targets that you already have in mind but haven’t been able to get a hold of or for confidentiality reasons, don’t feel comfortable reaching out to.

About Calder Capital

Calder Capital is a lower middle market investment bank providing mergers and acquisitions advisory services to business owners, entrepreneurs, family offices, and investors across the United States. Our dedicated team of professionals combines extensive industry experience, technological innovation, negotiation savvy, and key relationships to deliver exceptional execution. Calder’s services include mergers and acquisitions advisory, private funds and capital markets advisory, and business valuations. To learn more, please visit https://www.caldergr.com