Calder is representing a seasoned entrepreneur in his search for add-on acquisitions to supplement companies in his diversified portfolio, as well as acquisitions that would expand his current verticals.

Portfolio add-on acquisitions include industrial heat exchange manufacturers, HVAC equipment manufacturers, and distributors of gifts and collectible goods. Expansion verticals include ERP implementation companies and equipment manufacturers (other than HVAC).

The ideal targets operate in the United States and generate a minimum of $4M in revenue.

Acquisition Criteria:

Add-On Target:

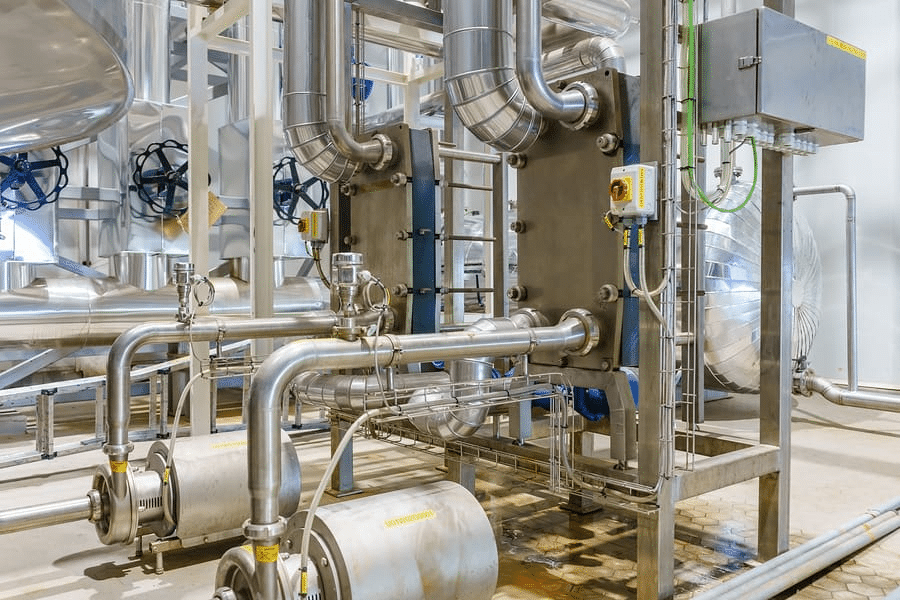

- Manufacturers producing shell and tube, plate and frame, or air-cooled heat exchangers

- HVAC equipment manufacturers of air handling units, make-up air, rooftop units, dedicated outside air systems, remote condenser, fluid cooler, fan coil unit, or ventilators

- Distributors of gift and collectible goods

Expansion Target:

- General equipment manufacturers, with a preference for producers of pumps, compressors, industrial controls, or PCB packaging equipment

- ERP implementation companies, with a preference for companies that focus on NetSuite, Microsoft Dynamics, Acumatica, Odoo, ERPNext, Epicor, Syspro, Cetec, or Sage implementations

Geography: United States.

Revenue: $4M+.

About Our Client:

Calder’s buyer currently owns and operates two established platforms: a New England-based distributor of collectible dolls with a strong e-commerce focus, and a national manufacturer of industrial heating and cooling coils serving specialized end markets. He is seeking add-on acquisitions to grow these platforms through the acquisitions of gift and collectible distributors, as well as heat exchanger and HVAC equipment manufacturers.

In addition, the buyer is looking to expand the two verticals above by acquiring an ERP implementation firm or other complementary equipment manufacturers, where operational systems and integration expertise can drive long-term growth.

Strategically and operationally focused, the buyer brings a proven system for professionalizing and elevating businesses through manufacturing efficiency, process improvement, and organizational development. Rather than imposing unnecessary change, our buyer and his team preserve culture, absorb the best practices of each acquired company, and implement shared improvements while offering key employees opportunities for shared ownership. This disciplined, long-term approach to growth and stability makes Calder’s buyer a strong steward for owners seeking to protect their business, people, and legacy.

If you are interested or know of a potentially interested party, please fill out the confidentially connect form or contact:

Andy Garza

Direct: 847-650-4203

[email protected]