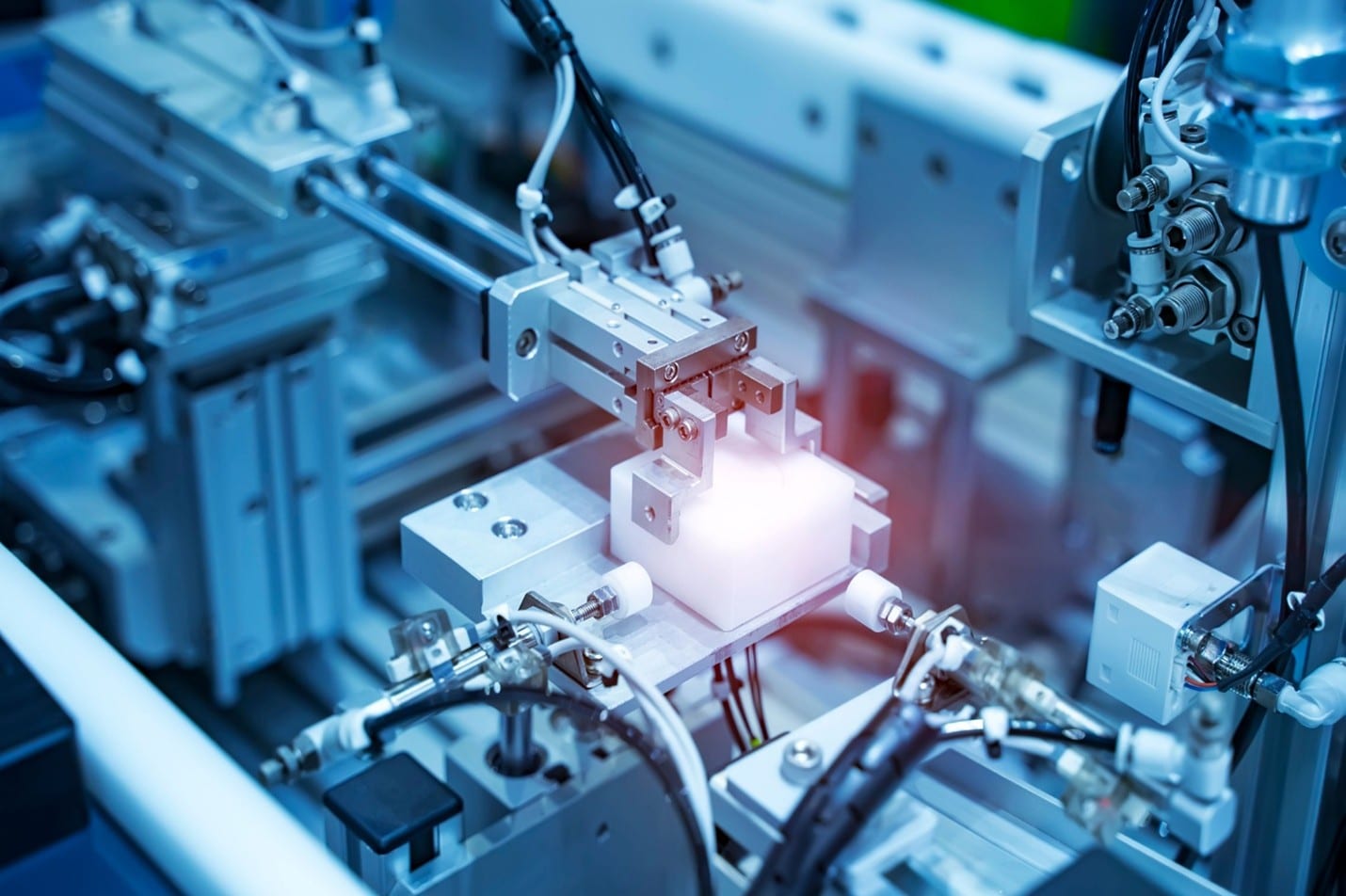

Calder is working with a buyer seeking a medical device or testing equipment manufacturer, or companies that provide machined components and assembly.

The ideal target should generate revenue between $500K and $3M and be in Michigan. However, our buyer will consider opportunities elsewhere.

Acquisition Criteria:

Target: Medical device or testing equipment manufacturers. Machined component or assembly providers are also of interest.

Geography: Preference for Michigan, but open to considering acquisitions elsewhere.

Revenue: $500K-$3M.

About Our Client:

Calder’s buyer has over 20 years of executive leadership experience, including extensive work in acquiring and growing manufacturing businesses. He has successfully led organizations through organic and inorganic growth, including building FDA-registered and ISO 13485-certified operations with a global customer base. His background includes driving innovation in medical devices, scaling production to meet worldwide demand during critical healthcare events, and establishing a reputation for uncompromising quality and customer focus. This experience provides a strong foundation for elevating an acquired business.

Through acquisition, our buyer’s objective is to create long-term value by identifying opportunities where the combined companies are stronger together. He is well-positioned to add value through operational efficiencies, facility capacity, cross-selling opportunities, and shared compliance costs, while also ensuring a smooth and respectful transition for employees and customers. His philosophy is rooted in building on the legacy of the seller, honoring what makes the business successful, and bringing fresh perspective and resources to unlock new levels of growth. For owners seeking the right steward for their company, he offers both stability and a vision for making “1 + 1 = 3.”

If you are interested or know of a potentially interested party, please fill out the confidentially connect form or contact:

Tyler Tingley

Direct: 616-227-5008

[email protected]