Calder has been retained to assist a seasoned strategic buyer in acquiring a label or barcode-related business, with a focus on companies in manufacturing, converting or distribution.

Ideally, the target is generating $5M to $50M in revenue and is based in the United States.

Acquisition Criteria:

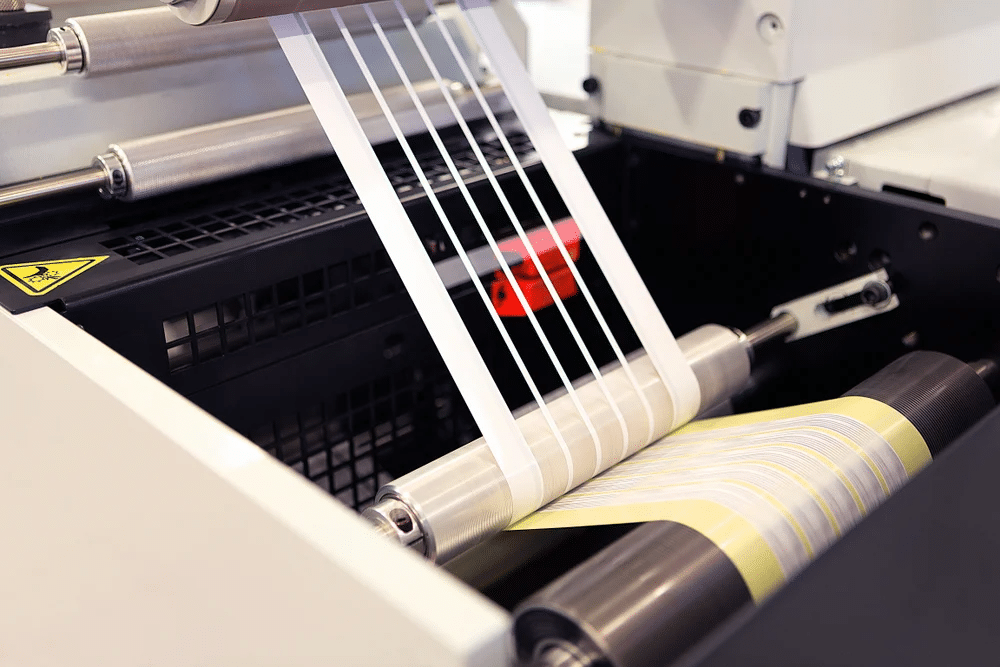

Target: Label or barcode manufacturers, converters, or distributors.

Geography: United States.

Revenue: $5M-$50M.

About Our Client:

Our client is a proven strategic acquirer and operator in the label, RFID, and flexible packaging industries, with a 15-year track record of successfully acquiring, integrating, and growing family- and legacy-owned businesses.

He has completed seven acquisitions in this space, driving consistent revenue growth of more than 15% annually, all while maintaining exceptionally high employee and customer retention. He is passionate about preserving the selling company’s culture and legacy, while leveraging his deep industry expertise and team-building skills to guide businesses through their next phase of growth, creating value for employees, customers, and stakeholders alike.

With over 60 years of combined executive and leadership experience, our client excels at smooth transitions, building trust, and operational excellence. His approach is grounded in core values of exceeding expectations, making a difference in employees’ lives, and delivering what customers need, when they need it, every time.

Our buyer’s goal is to acquire a well-run company with a strong culture, maintain its identity, and accelerate growth using shared resources, proven operational strategies, and a collaborative, team-based approach.

If you are interested or know of a potentially interested party, please fill out the confidentially connect form or contact:

Logan Granger

Direct: 616-485-4578

[email protected]