News

-

Southeast USA-Based Lake and Pond Management Company Acquired by Florida-Based Private Equity Firm’s Environmental Services Portfolio Company

Calder Capital is pleased to announce the successful acquisition of a Southeast USA-based Lake and Pond Management Company (the “Seller”) by an Environmental Services Portfolio Company (the “Portfolio Company”), owned by a Florida-based Private Equity Firm (the “Buyer”). The Buyer invests in lower middle market operating companies primarily in North America. As the Buyer’s Portfolio Company was…

-

Exit Planning & Sell-Side Strategies for Selling Your Business

Planning to sell your business? In this video, Calder Capital’s Sell-Side Director Garrett Monroe, and Exit Planning Director Jared Friar, share actionable advice on selling a business, sell-side services, and exit planning services. They reveal how to prepare up to five years in advance by focusing on key areas like financial clarity, leadership alignment, and…

-

Calder Named Finalist in Four Categories in the 23rd Annual M&A Advisor Awards

New York, New York – The M&A Advisor has announced winners for the 23rd Annual M&A Advisor Awards, and Calder Capital was named a finalist in several award categories. These awards recognize the organizations leading the industry in categories, such as Private Equity, M&A Transactions, Corporate/Strategic, Financing Deals, and more. “These outstanding individuals and firms…

-

Calder Recognized as Finalist for M&A Deal of the Year and Industrials Deal of the Year $50-100M at the 23rd Annual M&A Advisor Awards in New York

Calder Capital, a leading middle-market investment bank, proudly announces its recognition in two major categories at the 23rd Annual M&A Advisor Awards for its advisory role in the majority stake investment and recapitalization of SERVPRO of Saginaw by City Capital Ventures. The transaction earned Calder Capital accolades as the recipient of both the Industrials Deal…

-

Master Precision Mold of Greenville, MI Acquired by Big Shoulders Capital of Northbrook, IL

Calder Capital is pleased to announce the successful acquisition of certain assets of Master Precision Mold of Greenville, Michigan by Big Shoulders Capital of Northbrook, Illinois. Founded in 1962, Master Precision Mold has been a cornerstone in the mold design, engineering, and manufacturing industry. Under the leadership of Steve Drake Jr., Master Precision Mold has…

-

Introducing Logan Granger: Calder Capital Buy-Side Associate

Calder Capital, a nationwide mergers and acquisitions advisory firm, is thrilled to welcome Logan Granger as its newest Buy-Side Associate. Introducing Logan Originally from Grand Rapids, Michigan, Logan brings financial expertise to Calder Capital, having worked in investment banking. He previously held roles at JPMorgan Chase in Plano, Texas, and Houlihan Lokey in New York…

-

Introducing Brad Wallace: Calder Capital Mergers & Acquisitions Advisor

Calder Capital, a nationwide mergers and acquisitions advisory firm, is thrilled to welcome Brad Wallace as our newest Mergers & Acquisitions Advisor. Introducing Brad Originally from Dallas, Texas, Brad brings a unique blend of investment banking expertise and entrepreneurial experience to Calder Capital. His career began at Bank of America’s Investment Bank, followed by a…

-

Calder Capital’s Mya Stone, Earns CEPA Credential

Mya Stone receives CEPA Credential and Joins International Community of Business Advisors at the Exit Planning Institute The Exit Planning Institute is proud to announce that Mya Stone, Director of Human Capital and Exit Planning Advisor at Calder Capital, recently earned the Certified Exit Planning Advisor (CEPA) credential after completing the Institute’s intensive five-day executive…

-

Calder Capital Advisor, Andrew Williams, Earns CEPA Credential

Andrew Williams receives CEPA Credential and Joins International Community of Business Advisors at the Exit Planning Institute The Exit Planning Institute is proud to announce that Andrew Williams recently earned the Certified Exit Planning Advisor (CEPA) credential after completing the Institute’s intensive five-day executive MBA-style program. Williams joins an elite group of business advisors who…

-

Calder Capital Advisor, Matthew Baas, Earns CEPA Credential

Matthew Baas receives CEPA Credential and Joins International Community of Business Advisors at the Exit Planning Institute The Exit Planning Institute is proud to announce that Matthew Baas recently earned the Certified Exit Planning Advisor (CEPA) credential after completing the Institute’s intensive five-day executive MBA-style program. Baas joins an elite group of business advisors who…

-

Calder Capital’s Matthew Baas Recognized as Finalist for Investment Banker of the Year at 23rd Annual M&A Advisor Awards

Calder Capital proudly announces that Matthew Baas, M&A Advisor, was named a Finalist for Investment Banker of the Year at the 23rd Annual M&A Advisor Awards. This recognition underscores Matt’s exceptional contributions to the field of mergers and acquisitions and his dedication to delivering outstanding results for clients. As a Managing Partner and Co-Founder of…

-

January’s 2025 Off-Market Sellers

Welcome to January’s 2025 Off-Market Sellers update! In our 3-minute January update, Buy-Side Directors Ben Sundquist and Sam Scharich discuss January’s results and what buyers are missing without proprietary deal flow. January’s Results: Have a question you’d like answered? Thanks for watching this January’s 2025 Off-Market Sellers update! Email [email protected] with any questions and Sam Scharich will…

-

Introducing Cade Peterson: Calder Capital Buy-Side Associate

Calder Capital, a nationwide mergers and acquisitions advisory firm, is thrilled to welcome Cade Peterson as its newest Buy-Side Associate. Introducing Cade Originally from Traverse City, Michigan, Cade brings a strong background in finance and business management, with experience in both private equity and business solutions. He previously worked at Blackford Capital, where he was…

-

Introducing Brandon Sinclair: Calder Capital’s Marketing & Public Relations Associate

Calder Capital, a nationwide mergers and acquisitions advisory firm, is thrilled to welcome Brandon Sinclair as its Marketing and Public Relations Associate. Introducing Brandon Originally from Rockford, Michigan, and now residing in Lowell, Michigan, Brandon brings a wealth of experience across multiple sectors. He has held roles at Blackford Capital, the U.S. House of Representatives,…

-

Calder Capital Recognized By Axial As A Top 10 Lower Middle Market M&A Advisor

Calder Capital proudly announces that it was recognized as a Top 10 Lower Middle Market M&A Advisor by Axial for the period 2020-2024. This recognition acknowledges M&A advisory excellence in the sub-$10M M&A market. Calder Capital is ranked #10 nationally, is the only Michigan-based firm on the list, and only one of three firms in…

-

Breck Graphics, Inc. of Grand Rapids, MI Acquired by Foremost Graphics Group of Walker, MI

“Calder Advisor Jon Pastoor has been reasonable, reachable, and professional throughout this process. His expertise and guidance helped make this all possible and it’s been a pleasure to work with him. I’m looking forward to any future deals we may work on together.” – Ron Bush, CFO, Foremost Graphics, Walker, MI (Buyer) “Calder has been…

-

2024 Buy-Side Recap

See what Yan Vinarskiy (Buyer) who acquired Floorguard Products had to say about working with the buy-side team to source and close the deal! Take a listen to Calder buy-side client Will Gano’s success story in the acquisition of food products manufacturer Bear Stewart Corp on the Acquiring Minds podcast. Also, featured on the podcast,…

-

Buy-Side Services Testimonial: Yan Vinarskiy

Yan Vinarskiy, a buy-side client of Calder Capital, recently shared his experience of working with the Calder team and successfully completing a business acquisition in just six months. Tune in to hear more about his journey and how Calder’s expertise helped make his acquisition a success! About the Acquisition: Floorguard Products has established itself as…

-

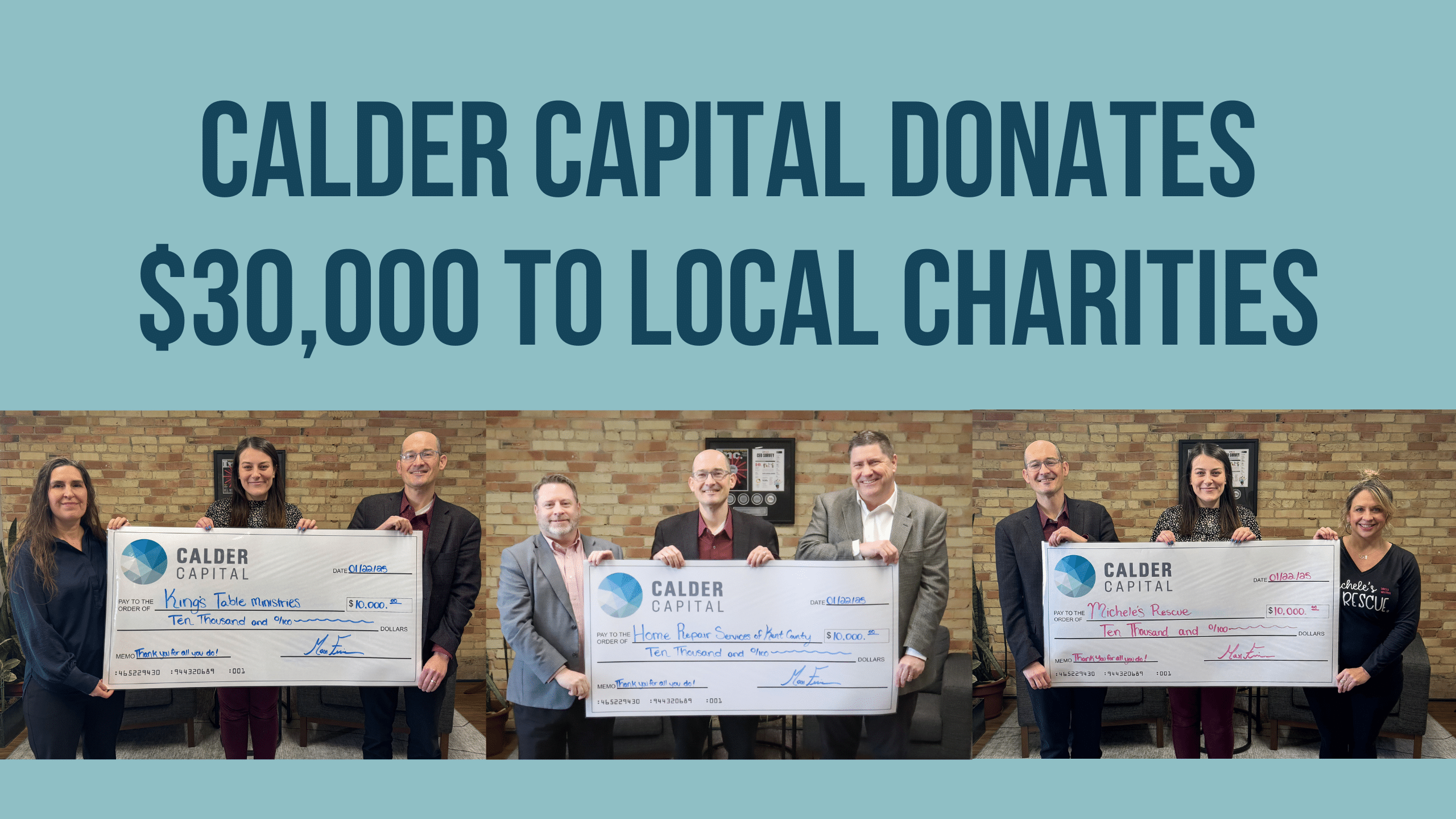

Calder Capital Donates $30,000 to Local Charities at the 2024 Calder Deal Ball

Grand Rapids, MI – December 6, 2024 – Calder Capital, a leader in mergers and acquisitions advisory services, celebrated a year of growth and gratitude by donating $30,000 to three local charities during its annual Calder Deal Ball. Held at The Rutledge in Grand Rapids, the event brought together 150 attendees, including clients, business associates,…

-

Majority Stake in Midwest-based Capital Stoneworks Strategically Acquired by Leelanau Private Capital

“Thank you to Calder Capital for your dedication and hard work. This is a monumental milestone for me, representing half a lifetime of commitment and passion.” – Brandon Hornung, CEO, Capital Stoneworks (Seller) Calder Capital is pleased to announce the successful majority equity investment in Capital Stoneworks, headquartered in Bridgeport, Michigan, by Leelanau Private Capital…