In the dynamic world of mergers and acquisitions (M&A), 2024 presents a unique set of challenges and opportunities for buyers. With the landscape evolving rapidly, this blog post delves into what makes buying businesses in 2024 more complex and competitive, especially in the face of a surge in private equity (PE) investment and the growing importance of off-market deal flow.

A Bold Prediction for M&A in 2024: Selling Gets Easier, Buying Gets Harder

2024 is anticipated to be a year where sellers find an increasingly favorable market. In contrast, buyers face tougher terrain, marked by intensified competition and rising costs. This shift is driven by several key factors, including the influx of private equity capital and the strategic shift towards smaller, more easily digestible deals.

The Surge of Private Equity Capital

Recent years have seen a significant increase in private equity funding, with more capital being raised for deployment.

In 2023, “notwithstanding [choppy financial conditions and] challenges, according to Buyouts Insider data, the average closed fund size of private equity funds in the first half of the year was $692 million, surpassing annual averages from the past decade.”

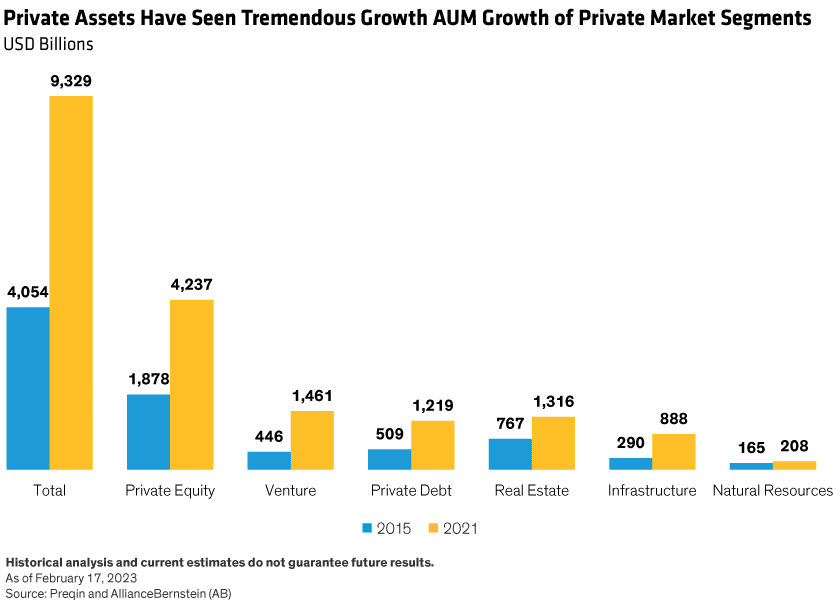

Looking back as far as 2015, it is easy to see that private equity AUM has grown substantially and dwarfs other comparable asset classes in its allocation.

This influx has led to PE firms becoming a standard component and greater allocation of many existing investment portfolios, while simultaneously also making it easier for retail investors and non-traditional PE investors to gain access to PE investing.

This shift is partly due to the rise of new platforms and investment products that lower the entry barriers, such as private equity ETFs (Exchange-Traded Funds) and mutual funds that offer exposure to private equity.

Fierce Competition and Rising Multiples

With more capital and players in the field, the competition for acquiring businesses has become fiercer. This heightened competition is reflected in PE firms increasingly targeting smaller deals, making acquisitions more expensive and challenging for prospective buyers, and rising multiples for businesses generating $2M+ in EBITDA.

Private-equity firms typically accustomed to gobbling up large companies have been going after smaller businesses instead. The average value of private-equity deals so far this year (2023) sits at $65.9 million, or the lowest it's been since the start of the 2008 financial crisis, reports The Wall Street Journal.

There are many reasons private equity is moving downstream, including, tighter financing, lower risk, the ability to “average down” the purchase price multiple for platform acquisitions, and a lack of supply of quality larger businesses for sale.

The Rise in Entrepreneurial Acquisitions (ETA)

There's a notable increase in search funders and online search communities, indicating a rise in entrepreneurial acquisitions. These groups are actively seeking businesses to acquire, adding to the competitive environment.

Search funds have established their presence quite considerably. Search funds alone [the volume of new searchers has] jumped 37% year over year [in 2023], according to Axial.

The Importance of Off-Market Deal Flow

It is not getting easier for buyers. In such a competitive landscape, off-market deal flow becomes increasingly valuable.

Focusing solely on listed deals can lead to overbidding. For instance, across 48 closings in 2023, Calder received an average of 5 offers per engagement. Nearly every business was sold through a competitive bidding process. This can be frustrating to buyers who have invested time and money into a process that may yield nothing; not to mention the immense amount of time and effort to identify and sift through lower-quality opportunities until a higher-quality business of interest is found.

Besides the increasingly competitive marketplace, a portion of the selling market desires not to and may never engage an intermediary to assist them with a sale, making off-market channels essential for reaching these sellers. These sellers often cite confidentiality concerns or disdain for paying an M&A advisor as the rationale for avoiding listing the business. In response to this growing sentiment, Calder has aggregated an expanding list of sellers that do not want to market their business but would talk to buyers and it currently stands at over 1.4k owners.

Engaging in off-market deal flow can yield several benefits, including spending more time engaged with the right kinds of business acquisition opportunities, negotiating with leverage leading to better prices and terms, and potentially closing deals faster. Calder has numerous case studies demonstrating the effectiveness of the off-market process, and the better deal structure and price attained.

Investing in the Acquisition Process

However, pursuing off-market deal flow requires a significant investment of time and resources, either personally or through professional assistance. The research and outreach work is not glamorous, and it is extremely time-consuming. Calder has reviewed previous search data and found that, on average, buyers need to submit six IOIs/LOIs (including renegotiations and counter-offers made to the same target) in order to achieve a signed LOI. It takes a buyer with resiliency to keep moving forward against these odds.

Early on, determining whether you will dedicate yourself to the process or work with a buy-side advisor is key.

Buying and owning a business is a serious commitment that demands dedication to the process. This includes being prepared to search for and evaluate deals thoroughly, understand market dynamics, and navigate competitive bidding environments. Many may initially believe that they want to buy and operate a business only to realize it’s not quite as easy sledding as they originally perceived it to be.

Calder’s Buy-Side Team: Your Partner in Success

For those who seek to streamline their acquisition journey without getting bogged down in the complexities of market research, outreach, and negotiation, Calder’s buy-side team offers tailored search and advising services.

Our team is equipped to help you navigate the 2024 M&A market, ensuring you don't miss out on prime opportunities while avoiding the pitfalls of overpaying or wasting time emailing investment bankers or owners with your criteria in hopes of an email or call back.

Conclusion

As we venture into 2024, the M&A market is evolving, becoming more challenging but also more rewarding for the well-prepared buyer. With the right strategy and support, you can successfully navigate this complex landscape and find the right investment opportunities to propel your success.