Calder Capital is pleased to announce the successful sale of Chesapeake Technology, Inc., based in Los Altos, California, to Two Bridges Legacy Partners, a New York City-based search fund.

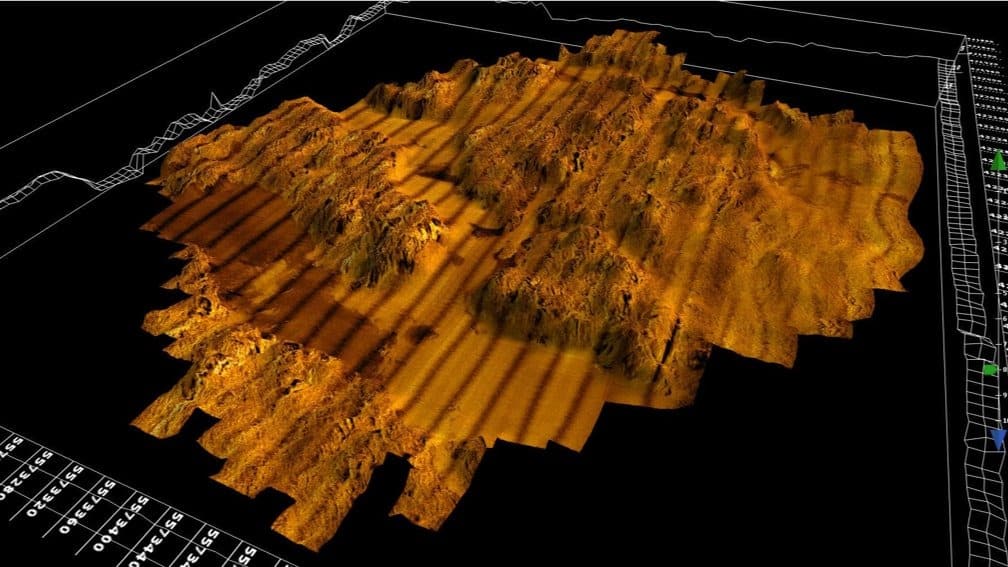

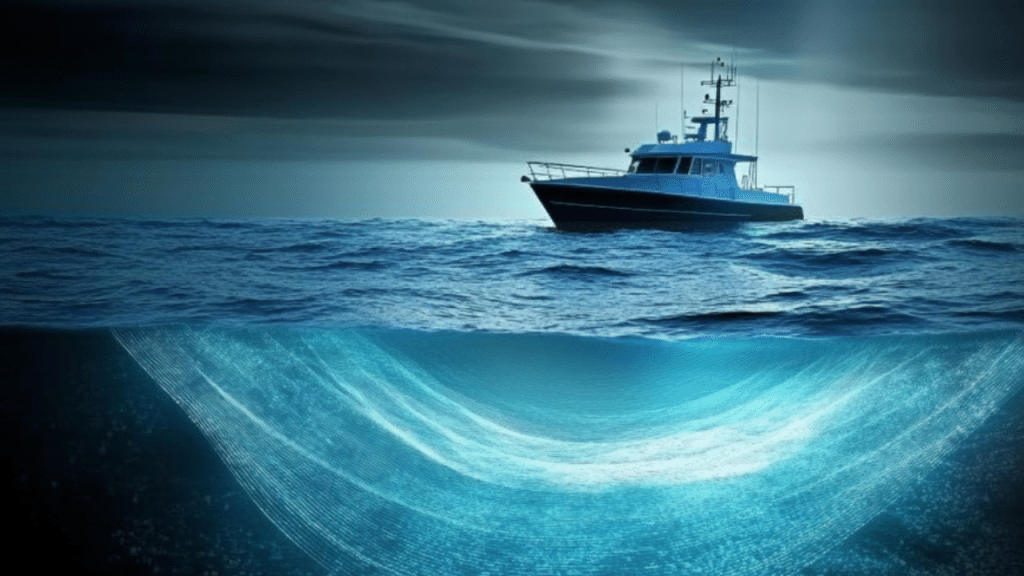

Chesapeake Technology was founded in 1995 by John and Eileen Gann in the heart of Silicon Valley. The company was launched with a simple mission: to make it easy to collect and interpret sonar data. Chesapeake Technology’s flagship product, SonarWiz, provides leading-edge sonar data acquisition and processing software for sidescan and sub-bottom sonar systems. The software is widely used by NAVO, NOAA, USGS, global navies, merchant marines, energy exploration firms, environmental authorities, and educational institutions worldwide. Ready to transition into full retirement, The Sellers engaged Calder’s Sell-Side Team to find a successor that would carry on their legacy.

Evan Reinsberg of Two Bridges Legacy Partners has acquired a majority stake in Chesapeake Technology. Two Bridges LP, a specialized investor focused exclusively on GIS, CAD/CAM, and BIM software companies, targets businesses with strong domain expertise, scalable technology, and opportunities for strategic growth. The acquisition strengthens Two Bridges Legacy Partners’ presence in the marine survey software sector and provides an opportunity for continued innovation and expansion.

“Earlier this year, I stepped into the role of President at Chesapeake Technology after acquiring the company from John and Eileen Gann,” wrote Evan Reinsberg, President of Chesapeake Technology, Inc. He continued, “I am especially thankful to the Chesapeake team for welcoming me with such professionalism and openness. For more than 25 years, Chesapeake has been a leader in sonar data processing—driven by a talented team, trusted partners, and a loyal global user base.”

Sell-Side Director, Garrett Monroe of Calder Capital served as the Exclusive Mergers & Acquisitions Advisor to The Sellers. Jonathan Dykstra served as Lead Associate on the transaction.

Calder’s Sell-Side Team generated significant interest in the software company, resulting in 580 CIMs sent to qualified buyers and 32 competitive offers.

“This transaction was a pleasure to work on, and I appreciate the trust that The Sellers placed in us to help find the right successor for their business,” said Garrett Monroe, M&A Advisor at Calder Capital. “Chesapeake Technology is a fantastic company with a bright future, and we’re excited to see where Evan takes it.”

“The acquisition of Chesapeake Technology continues to demonstrate that Calder’s aggressive and systematic marketing can effectively bring quality buyers and sellers together across the U.S.,” commented Max Friar, Managing Partner of Calder Capital. “The sellers have built an extraordinary company, and it was an honor to help them navigate this transition. We are confident that the buyer and his team will continue the sellers’ legacy while driving the company to new heights.”

Calder Capital served as the exclusive Mergers and Acquisitions Advisor to The Sellers of Chesapeake Technology, Inc.

About Calder Capital:

Founded in 2013, Calder Capital is a cross-industry mergers and acquisitions advisory firm with offices across the United States. Calder provides valuation, sell-side, and buy-side services. We are nationally recognized for excellence in advising $1-100M enterprise value transactions in manufacturing, construction, distribution, and business services. Calder serves business owners, entrepreneurs, family offices, financial buyers, and investors. Learn more at www.CalderGR.com.