“Calder Capital did an outstanding job identifying a business that aligned with our long-term goals. Brad and his team guided us every step of the way, and we couldn’t have asked for a better partner in this process.”

– Buyers of The Company, New York City, New York (Client)

“Calder’s leadership, professionalism, and respect for what we’ve built opened the door to this sale. Through this process, The Buyers have earned our full faith and support to lead The Company moving forward.”

– Sellers of The Company, Pennsylvania, U.S.A.

Calder Capital is thrilled to announce the successful acquisition of a Pennsylvania-Based Sign & Awning Fabrication, Installation, and Maintenance Company (“The Company”) by two New York City entrepreneurs (“The Buyers”).

The Buyers bring decades of combined experience in finance and strategic advisory. The entrepreneurs hold degrees from Cornell University, the Wharton School of the University of Pennsylvania, and Duke University’s Fuqua School of Business. The pair met over 12 years ago in New York City and have since developed a strong professional and personal bond, working together in various corporate and non-profit capacities. Seeking to eventually transition from their corporate roles to become hands-on owner-operators, they approached Calder Capital’s Buy-Side team.

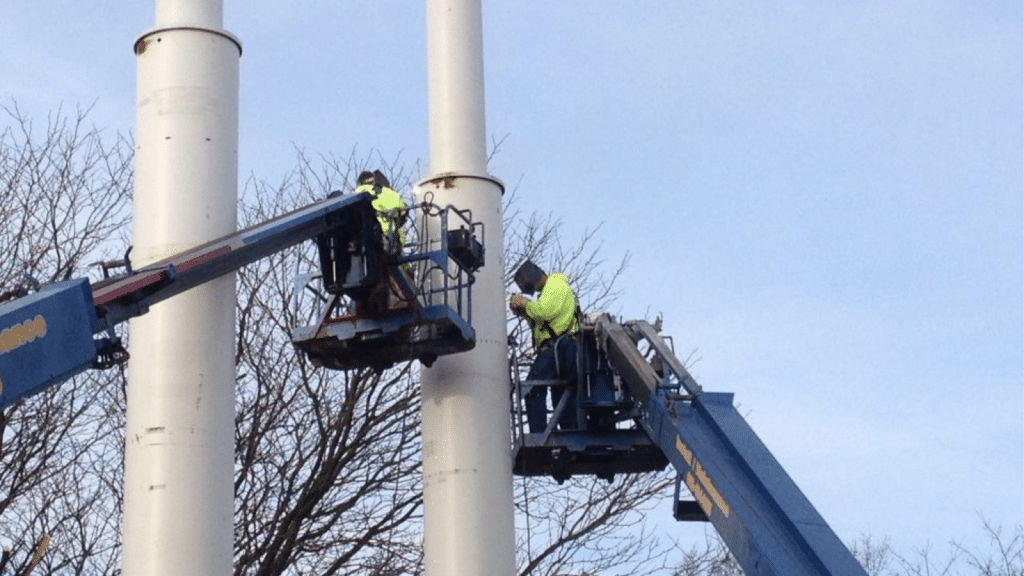

The Company is a full-service fabrication, installation, and maintenance company specializing in signs, awnings, flagpoles, and scoreboards. Founded and led by two business partners (“The Sellers”), The Company has served its community for over three decades. With a team of approximately 30 employees, The Company provides installation services, including high-rise, wayfinding, general outdoor maintenance, and wholesale capabilities across New England.

Brad Wallace of Calder Capital served as the Lead Mergers & Acquisitions Advisor to The Buyers. Aiding Brad in the facilitation of this transaction were Hannah Nabhan, Buy-Side Director, and Logan Granger, Buy-Side Associate.

Throughout The Buyers’ 7-month engagement with Calder Capital’s Buy-Side team, Calder Capital made 23 proprietary Buy-Side prospect introductions and entertained 13 leads, before closing on The Company. Notably, The Company was under letter of intent only 3.5 months into the Buyers’ engagement with Calder Capital.

“Calder Capital did an outstanding job identifying a business that aligned with our long-term goals,” stated The Buyers. “Brad and his team guided us every step of the way, and we couldn’t have asked for a better partner in this process.”

“Calder’s leadership, professionalism, and respect for what we’ve built opened the door to this sale,” shared The Sellers. “Through this process, The Buyers have earned our full faith and support to lead The Company, moving forward.”

“You couldn’t ask for two better parties to work with. The Buyers immersed themselves further into the business post-LOI. In going above and beyond, they formed excellent, lasting relationships with the Sellers and the Company’s employees. I feel that each party did all they could to ensure a smooth transition, and it shows,” noted Brad Wallace.

“The Buyers approached this acquisition journey with a great level of diligence and care,” shared Max Friar, Managing Partner at Calder Capital. “It was our pleasure to advise and source this transaction for them. Based on their leadership and commitment to expanding the Company’s footprint, we are confident in the trajectory of the business.”

Calder Capital served as the exclusive Mergers and Acquisitions Advisor to The Buyers. Sam Tallman of McDonald Hopkins provided legal counsel to the Buyers.

About Calder Capital:

Founded in 2013, Calder Capital is a cross-industry mergers and acquisitions advisory firm with offices across the United States. Calder provides valuation, sell-side, and buy-side services. We are nationally recognized for excellence in advising $1-100M enterprise value transactions in manufacturing, construction, distribution, and business services. Calder serves business owners, entrepreneurs, family offices, financial buyers, and investors. Learn more at www.CalderGR.com.