“Calder Capital’s buy-side team was outstanding. Jim was committed throughout the process. Calder’s ability to identify a strong match like Northend Gear and guide us to closing efficiently was very helpful. We look forward to working with Calder on future strategic initiatives.”

– Steve Arthur, CEO & President, Vector Companies, Dubuque, IA (Buyer)

“Working with Calder Capital and Jim Oren was a great experience. Their team was professional, responsive, and instrumental in connecting us with a buyer that shared our values and strategic goals.”

– Jared Baehl, CFO, Nix Companies, Poseyville, IN (Seller)

Calder Capital, a nationwide, cross-industry Mergers and Acquisitions advisory firm, is thrilled to announce the successful acquisition of Northend Gear & Machine of Fairfield, Ohio, by Vector Companies of Dubuque, Iowa.

Vector Companies, a privately owned holding company led by President and CEO Steve Arthur, serves as a global platform of gear, shaft, and custom component manufacturers. Its portfolio includes The Adams Company, Atlas Global, and Atlas Gear Company. Together, their portfolio has more than 250 years of combined motion control and power transmission expertise. Vector Companies’ acquisition strategy was centered on diversification, increasing production capabilities, expanding their customer base, and exploring new markets. Steve Arthur, President and CEO of Vector, engaged Calder Capital’s buy-side team to identify a well-established company ready for new ownership, aligned with these strategic goals.

Founded in 1988, Northend Gear & Machine is a dominant precision machining and gear manufacturing company in its Midwest-based market. The business was founded by partners Dave Shope, Duane Ratcliff, and Dan Rockenfelder, and grew from a small garage operation into a 27,000-square-foot, state-of-the-art facility. In 2021, Nix Industrial, a fifth-generation family business based in Poseyville, Indiana, acquired Northend, retaining all staff and maintaining its operations as an independent division.

With the acquisition of Northend Gear & Machine, Vector Companies continues to diversify their customer base and capabilities. Vector looks forward to utilizing the expanded capabilities of Northend by offering additional services to its existing customer base and becoming an enhanced supplier.

Jared Baehl, CFO of Nix Companies, shared, “Vector Companies’ culture and strategic vision aligned with Northend and their commitment to people, quality, and long-term growth made this a great fit. We are confident that Northend will continue to thrive and find new opportunities for innovation and growth under Vector’s ownership.”

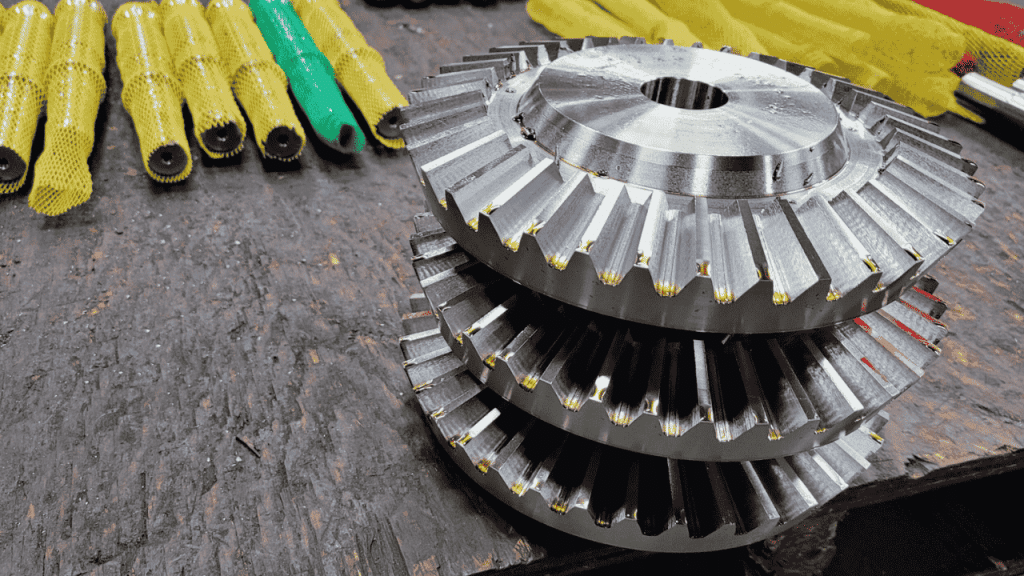

Photo courtesy of Northend Gear and Machine.

Jim Oren of Calder Capital served as the Lead Mergers & Acquisitions Advisor to Vector Companies. Serving as Buy-Side Directors in the search were Parker Schaap and Hannah Nabhan of Calder Capital.

In this Buy-Side search process, Calder Capital generated 42 proprietary buy-side leads, submitted 3 IOIs/LOIs, resulting in the acquisition of Northend Gear and Machine. From engagement start to close, the process spanned approximately 10 months, and the company closed within 3.5 months after the letter of intent execution.

“Calder Capital’s buy-side team was outstanding. Jim was committed throughout the process,” shared Arthur. “Calder’s ability to identify a strong match like Northend Gear and guide us to closing efficiently was very helpful. We look forward to working with Calder on future strategic initiatives.”

Working with Calder Capital and Jim Oren was a great experience. Their team was professional, responsive, and instrumental in connecting us with a buyer that shared our value and strategic goals.

“Vector Companies has been a fantastic client to partner with,” commented Oren, “Steve has a clear vision as to what type of business fits with the existing Vector capabilities. He was able to see that Northend Gear’s precision manufacturing processes, range of capabilities, and outstanding team will align seamlessly with Vector for operational and product offering synergies.”

“We’re proud to support growing industrial businesses like Vector Companies, who continue to strengthen the Midwest manufacturing ecosystem,” added Sam Scharich, Buy-Side Managing Director at Calder Capital. “Our buy-side advisory team has expertise in helping acquirers identify, evaluate, and integrate precision manufacturing businesses across the country. We also have the relationships and grit to see these projects through.”

Calder Capital served as the exclusive Buy-Side Mergers and Acquisitions Advisor to Vector Companies in the acquisition of Northend Gear and Machine.

Photo courtesy of Northend Gear and Machine.

About Vector Companies:

Vector Companies is a privately owned holding company comprised of synergistic industrial businesses, including The Adams Company, Atlas Global, and Atlas Gear Company. Together, they provide customers over 250 years of combined expertise in motion control and power transmission, offering manufacturing resources for low-volume, high-volume, and custom projects. The company is committed to ethical standards, empowering local management, and fostering long-term sustainability. To learn more, please visit www.VectorCompanies.com.

About Northend Gear and Machine:

Founded in 1988, Northend Gear & Machine of Fairfield, Ohio, is a trusted provider of high-precision machining and gear manufacturing services. Operating out of a 27,000-square-foot facility, the company serves industrial clients with a focus on quality, reliability, and craftsmanship. Since 2021, Northend has operated as a division of Nix Industrial, maintaining its long-standing team and commitment to service excellence. To learn more, please visit https://NorthendGear.WPEnginePowered.com.

About Nix Industrial:

Nix Industrial, founded in 1902 and headquartered in Poseyville, Indiana, is a fifth-generation, family-owned business specializing in fabrication, machining, coatings, and field services. With multiple operating divisions, Nix Industrial supports American industry through safe, efficient, and innovative solutions across manufacturing and maintenance sectors. To learn more, please visit www.NixIndustrial.com.

About Calder Capital:

Founded in 2013, Calder Capital is a cross-industry mergers and acquisitions advisory firm with offices across the United States. Calder provides valuation, sell-side, and buy-side services. We are nationally recognized for excellence in advising $1-100M enterprise value transactions in manufacturing, construction, distribution, and business services. Calder serves business owners, entrepreneurs, family offices, financial buyers, and investors. Learn more at www.CalderGR.com.