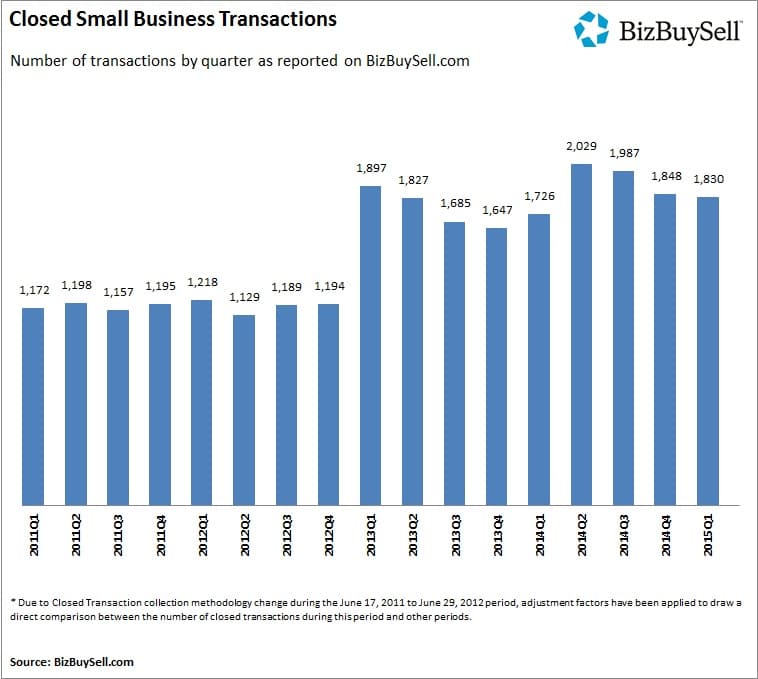

In February we at Calder blogged about the current good news in the small business market. 2014 was a record-breaking year for small business sales, and it’s looking like 2015 may bring even better news. Bizbuysell.com reports that first quarter business sales numbers are up 6 percent over those in 2014. This translates into 1,830 closed small business transactions, over a hundred more than in the first quarter of 2014.

Both supply and demand are up in the commercial real estate market due to a confluence of factors: with small business median revenue and median cash flow up, buyers are feeling more confident in the overall market, and Baby Boomers continue to retire and place their businesses up for sale. In the Midwest small businesses in the service sector were the most common type of business transaction. We have certainly seen that trend within our own client base: many of our recent clients, as well our current ones, have been in the service sector.

By focusing on communicating to buyers and sellers what a business’s strengths and weaknesses are in this market right now, as well as for the foreseeable future, we are creating a more honest representation of the risks and rewards on the table in small business transactions, as well as what opportunities for growth exist if buyers choose to take advantage of them. We believe this is more useful than an asking price, even when it’s based on professional valuation, because it incorporates the plans and actions of the buyer – who is essential to the future success of the business being sold.

If you are interested in the current commercial real estate market and how it may directly affect your financial future, contact Calder Capital today for a free valuation analysis of your company: