News

-

Introducing Bryan Clahassey: Calder Capital’s Newest Buy-Side Associate

Calder Capital, a nationwide mergers and acquisitions advisory firm, is excited to welcome Bryan Clahassey as our newest Buy-Side Associate. Introducing Bryan: Hailing from East Grand Rapids, Michigan, Bryan brings a strong foundation in finance and economics along with early professional experience in the business services sector. He previously worked with US Signal and BHS Insurance, where he…

-

Calder Capital: 2025 Sell-Side M&A Recap

Join us as we recap Calder Capital’s 2025 sell-side momentum. With 30 sell-side transactions closed across 7 states and over $155 million in enterprise value advised, 2025 marked the most successful year in firm history. From manufacturing and construction to distribution, industrial services, and technology, buyers remained active for well-prepared companies. Learn what drove record-breaking…

-

January 2026 | Calder Capital’s Monthly Buy-Side Update

In January’s 4-minute update, we discuss a proposed SBA policy change, a confidential closing, recent market observations, and more. Have questions? We’ve answered the top buy-side FAQs here. Check out our clients who have been featured on the Acquiring Minds podcast: We have 2 searchers who recently closed deals with the Calder Capital Buy-Side team that…

-

Midstates Elevator of Mishawaka, IN, Acquired by Phoenix Modular Elevator of Mount Vernon, IL

“Calder did a fantastic job in lining up potential buyers for my 40-year-old business. They were thorough, precise, and extremely professional on all levels! I had a specific type of buyer in mind and expressed my concerns in finding this ideal candidate, but undaunted in their search, they delivered the perfect candidate/buyer that met my…

-

Why International Buyers Are Targeting the U.S. Lower Middle Market

Global mergers and acquisitions were strong in 2025 and entered 2026 with remarkable momentum. While much of the headlines in the J.P. Morgan M&A Market Outlook focus on mega-deals and transformative transactions well north of $1 billion, one of the most striking trends is the continued strength of cross-border dealmaking. Calder’s Sell-Side team and Buy-Side…

-

Ace Screen Repair & More of Fort Myers, FL, Acquired by Grove Oaks Capital of Atlanta, GA

Transaction Summary Calder Capital, a nationwide mergers and acquisitions advisory firm, is proud to announce the successful acquisition of Ace Screen Repair & More of Fort Myers, Florida, by Grove Oaks Capital of Atlanta, Georgia. The Acquisition Story Ace Screen & Repair (“Ace”) was founded in 2016 by Katie Jellerson with the support of her…

-

Introducing Lucas Matthews: Calder Capital’s Newest Sell-Side M&A Advisor

Calder Capital, a nationwide mergers and acquisitions advisory firm, is excited to welcome Lucas Matthews as our newest Sell-Side M&A Advisor. Introducing Lucas: Originally from Petoskey, Michigan, Lucas brings a strong entrepreneurial mindset and hands-on transaction experience shaped by both professional investing roles and family-owned businesses. He previously worked as a Junior Analyst at Blackford…

-

How Can Calder Know, Upfront, the Likelihood of a Buyer Closing?

No buyer enters a search with the intention of failing. No seller signs an LOI expecting it to fall apart. And yet, most failed deals don’t die because of valuation or diligence surprises. They die because the certainty of closure was misread from the start. You can never know with absolute certainty whether a transaction…

-

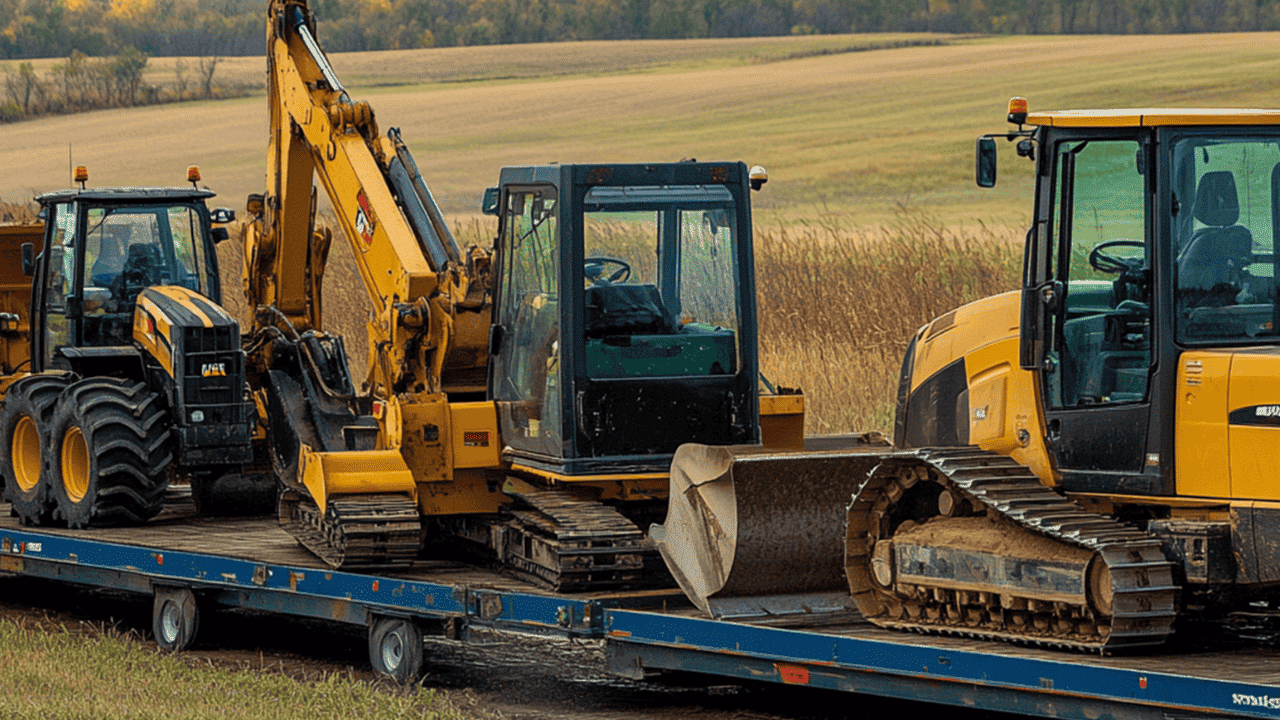

Midwest-Based Buyer acquires The Rental Branch of St. Joseph, MI

Transaction Summary Calder Capital, a nationwide lower middle market M&A advisory firm, is pleased to announce the successful sale of The Rental Branch of St. Joseph, Michigan, to a Midwest-Based Buyer. The Acquisition Story Founded in 1997, The Rental Branch has built a strong reputation in Southwest Michigan for providing reliable and affordable equipment rentals…

-

Calder Capital Delivers Record-Breaking Growth in 2025 with 58 Deals Closed

With the final closing on December 29th, 2025, Calder Capital and Small Business Deal Advisors (SBDA) surpassed previous annual revenue records by completing their 58th transaction of the year. This milestone marked an increase of 26% in deal volume and an increase of 15% in revenue. “I’m incredibly proud of our team’s dedication and execution,”…

-

Calder Capital’s Rudy Moeller Featured on the Journey to Business Ownership Channel

Calder Capital’s Rudy Moeller, a Business Development Advisor, recently joined the Journey to Business Ownership channel, hosted by Patrice Miles, a Career Ownership Coach with The Entrepreneur’s Source to discuss buying or selling an existing business. In this episode, Rudy Moeller talks about what an acquisition or sales process really takes, along with timeline expectations…

-

Calder Capital’s Jon Pastoor Featured on Provisio Retirement Partners’ Second Wind Podcast

Calder Capital’s Jon Pastoor, a Sell-Side Mergers & Acquisitions Advisor, recently joined the Second Wind podcast, hosted by Alex Overbeek of LPL Financial and Provisio Retirement Partners to discuss selling a business in pursuit of retirement. In this episode, Jon Pastoor talks about business valuations, bringing your business to market, and what the experience should…

-

2025 Buy-Side M&A Recap

In less than 5-minutes, we review each buy-side transaction in 2025, identify the secret sauce in off-market deal making, and share our outlook for 2026! Have questions? We’ve answered the top buy-side FAQs here. Check out our clients who have been featured on the Acquiring Minds podcast: We have 2 searchers who recently closed deals with…

-

Top 5 Things to Consider When Selling Your Business

In the Exit Planning Institute’s 2025 National State of Owner Readiness Report, they found that only 22% of baby boomer business owners had a formal, written business transition plan. When owners are not prepared emotionally, operationally, or financially for the scrutiny that they will receive from buyers and lenders, the sale process can become intensely…

-

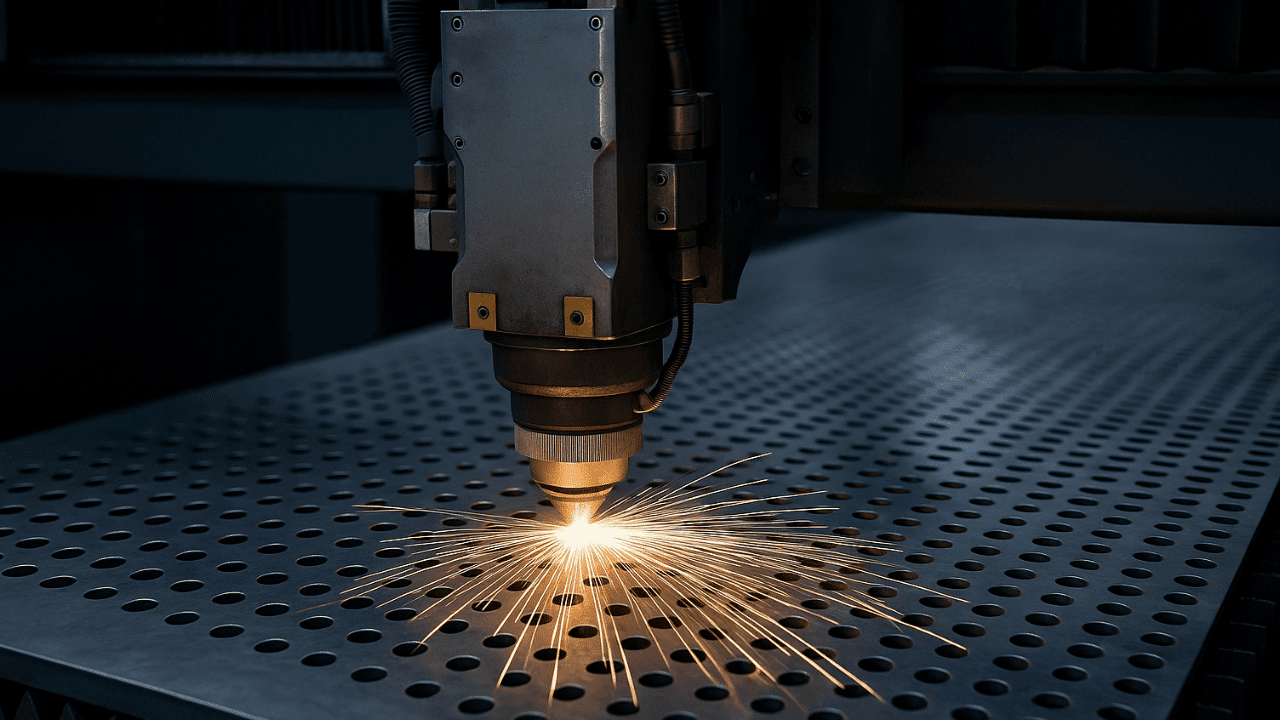

Nonprofit Acquires Education Provider

Transaction Summary Calder Capital is proud to announce the acquisition of an Education Provider by a Nonprofit. The Acquisition Story The Nonprofit (the Buyer) has advanced technology adoption and workforce development to bolster North America’s manufacturing competitiveness and national security. Working with Fortune 500 manufacturers, small and midsize companies, educational institutions, and government agencies, the…

-

Seddon Point Capital of Atlanta, GA, acquires Metro Metal Works of McDonough, GA

Calder Capital is pleased to announce the successful acquisition of Metro Metal Works of McDonough, Georgia, by Seddon Point Capital of Atlanta, Georgia. Seddon Point Capital, led by Founder and Managing Partner Paul Callahan, is an Atlanta-based investment firm focused on acquiring and scaling high-quality businesses. Paul leads Seddon Point Capital with a diverse skillset…

-

ENCON Evaporators of Hooksett, NH, acquires Apollos Water of Battle Ground, IN

Calder Capital is thrilled to announce the successful acquisition of Apollos Water of Battle Ground, Indiana, by ENCON Evaporators of Hooksett, New Hampshire. Founded in 1993, ENCON Evaporators designs, manufactures, and distributes wastewater minimization equipment exclusively, with thousands of systems installed globally. Mike Fregeau, President of ENCON Evaporators, engaged Calder Capital’s Buy-Side team to avoid…

-

Introducing Olivia Devereux: Calder Capital’s Sell-Side Business Development Lead

Calder Capital, a nationwide mergers and acquisitions advisory firm, is excited to welcome Olivia Devereux as our Sell-Side Business Development Lead. Originally from Petoskey, Michigan, Olivia brings a people-first mindset to Calder Capital. Previously, she worked in a strategic consulting role supporting a privately held small-business portfolio, advising ownership on growth initiatives across a group…

-

Calder Capital Announces Promotion of Nick Browning to Sell-Side Associate

Calder Capital is pleased to announce the promotion of Nick Browning from Sell-Side Analyst to Sell-Side Associate. As an Analyst, Nick supported Calder’s sell-side practice by collecting and analyzing client financials, building valuation models, integrating analyses into CIMs, and assisting advisors through the early stages of transactions. As a Sell-Side Associate, his role expands to…

-

Calder Capital Announces Promotion of Riley Hagen to Sell-Side Associate

Calder Capital is pleased to announce the promotion of Riley Hagen from Sell-Side Analyst to Sell-Side Associate. As an Analyst, Riley supported Calder’s sell-side practice by collecting and analyzing client financials, building valuation models, integrating analyses into CIMs, and assisting advisors through the early stages of transactions. As a Sell-Side Associate, his role expands to…