News

-

Calder Capital Announces Promotion of Jonathan Dykstra to Sell-Side Director of Operations

Calder Capital is pleased to announce the promotion of Jonathan Dykstra from Sell-Side Associate to Sell-Side Director of Operations. As an Associate, Jonathan oversaw analyst and intern work, supported advisors with due diligence and transaction execution in lower middle market deals, worked on valuations and marketing materials, and presented valuation analyses to clients. As the…

-

Bauer Sheet Metal and Fabricating, Inc. of Muskegon, MI, Acquired through BSM Acquisition, LLC of Cincinnati, OH

“We had a great experience with Calder. Sam was very good to work with, being very professional and personable.” – Mark Hoofman, Former Partner, Bauer Sheet Metal and Fabricating, Inc., Muskegon, MI (Seller) “Working with Sam Scharich at Calder Capital has been a great experience. Sam provided everything we needed promptly and managed the process…

-

Private Equity is Stuck, and No Playbook Can Fix It

Private equity has caught a lot of flak this year, and to be clear, that’s not our aim here. We have a deep respect for the profession and count many smart, hardworking PE professionals as friends and clients. They’re operating in a brutally difficult environment: quality deals are harder to source, competition is intense, multiples…

-

When a Buyer Calls You, Get Ready To Be Flattered

Often, business owners hear from potential buyers out of the blue. A message may come in from a private equity firm, a strategic operator, or an investment group expressing interest in a conversation. They typically compliment the owner, point to your company’s position in the market, and suggest there’s alignment with their investment goals, and…

-

November 2025 Buy-Side Monthly Update

Welcome to our November 2025 Buy-Side update! In November’s 6-minute update, we discuss whether it’s worth it to hire an advisor, along with analyzing a recent closing, and finally we review our outlook for the remainder of the year. Have questions? We’ve answered the top buy-side FAQs here. November 2025 Results: Check out our clients who…

-

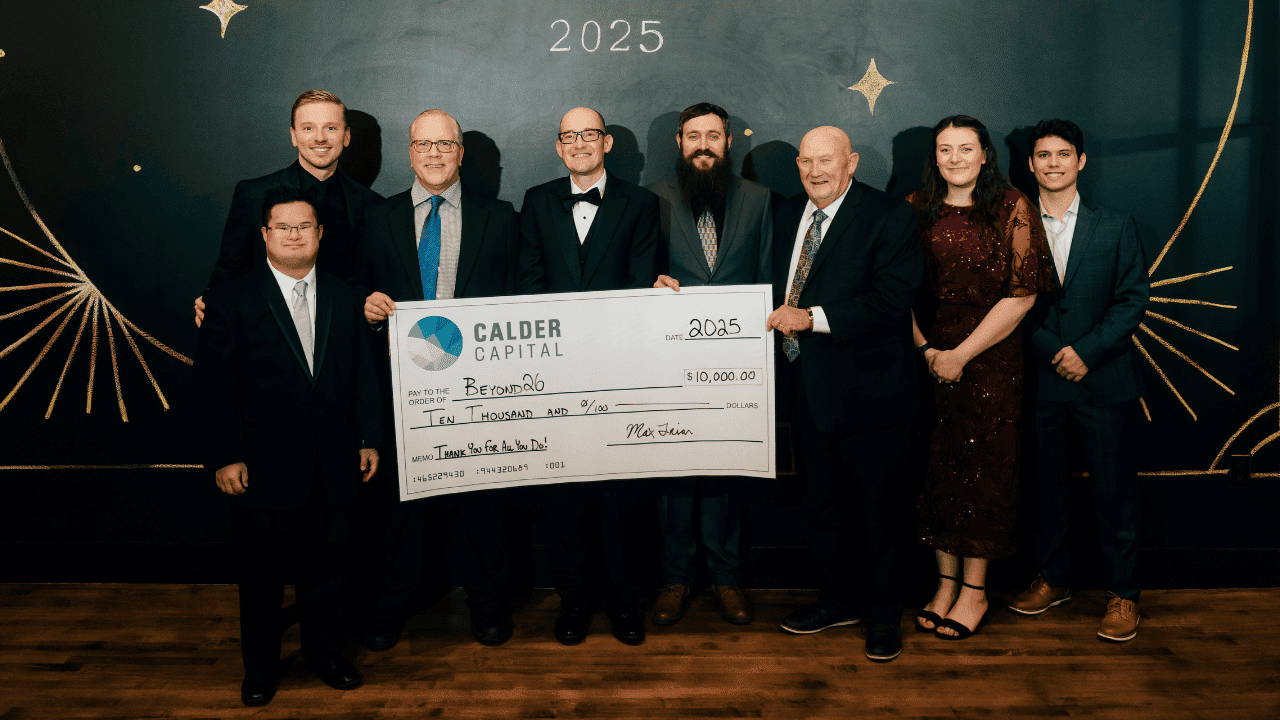

Calder Capital Donates $30,000 to Local Charities at the 2025 Calder Deal Ball

Grand Rapids, MI – December 5, 2025 – Calder Capital, a nationwide leader in mergers and acquisitions advisory services, celebrated a year of growth and gratitude by donating $30,000 to three local charities during its annual Calder Deal Ball. Held at The Rutledge in Grand Rapids, the event brought together 150 attendees, including clients, business…

-

Calder Capital Recognized in PitchBook’s 2024 Great Lakes Region League Tables

Calder Capital is proud to announce its inclusion in PitchBook’s 2024 Annual Global League Tables, earning the #21 position among the most active M&A advisors in the Great Lakes region, based on Calder’s volume of Midwest deals in 2024. This recognition places Calder among the top-closing advisory firms facilitating transactions across the Great Lakes region…

-

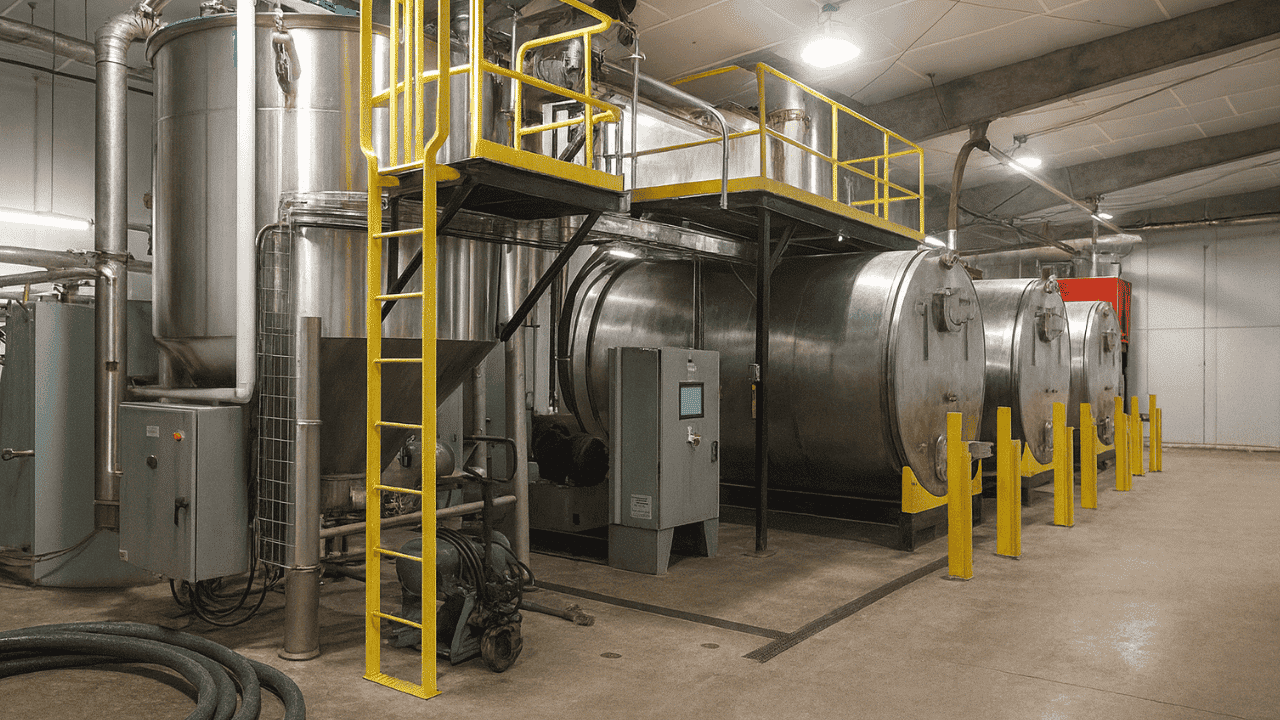

Freedom Finishing of Benton Harbor, MI, Announces Partnership With Acme Finishing of Elk Grove Village, IL

“The Calder team, and Shane specifically, were attentive, transparent, and truly cared about our legacy. We couldn’t have asked for better guidance through this important process and time in our lives.” – Erik Ender, Co-Owner, Freedom Finishing, Benton Harbor, MI (Client) “Calder’s team brought clarity to every stage. Shane’s industry insight and understanding of the…

-

How Will the “One Big Beautiful Bill” Affect Business Owners Considering a Sale?

A recent CNBC article by Cheryl Winokur Munk highlights how the One Big Beautiful Bill (OBBB) is reshaping the tax landscape for small business owners planning an exit. The law’s expansion of Qualified Small Business Stock (QSBS) benefits has already sparked new conversations between sellers, advisors, and M&A professionals with good reason. Under the OBBB,…

-

How To Source & Finance A Business Acquisition, with Pioneer Capital Advisory

Calder Capital recently collaborated with Pioneer Capital Advisory, an SBA 7(a) Loan Broker, for a joint webinar focused on helping individual buyers stand out in an increasingly competitive business acquisition market. In this session, Calder’s Sam Scharich, Ben Sundquist, and Aidan Cote, along with the Pioneer Capital Advisory team, walked through what it really takes…

-

Calder Capital Named Winner for Cross-Border Deal of the Year at the 24th Annual M&A Advisor Awards

New York, New York – Calder Capital, a leading nationwide middle-market investment bank, is honored to announce its recognition as a winner at the 24th Annual M&A Advisor Awards in the category of Cross-Border Deal of the Year. Calder is being recognized for its Sell-Side advisory role in the sale of BCU Electric, Inc., based…

-

Introducing Emma Westerhouse: Calder Capital’s Sell-Side Managing Director’s Executive Assistant

Calder Capital, a nationwide mergers and acquisitions advisory firm, is excited to welcome Emma Westerhouse as Executive Assistant to the Sell-Side Managing Director. Introducing Emma: Originally from Kalamazoo, Michigan, Emma brings hands-on experience from the construction and roofing industry, most recently working at Irish Roofing & Exteriors. While there, she witnessed the company’s sale to…

-

Market Update – Q3 2025

As of October 31, 2025, Calder Capital generated $15.4M in revenue, a 15% increase over the same period in 2024. This leap is supported by 45 closed deals, up from 39 in 2024, reinforcing Calder’s upward trajectory in a volatile lower middle market.

-

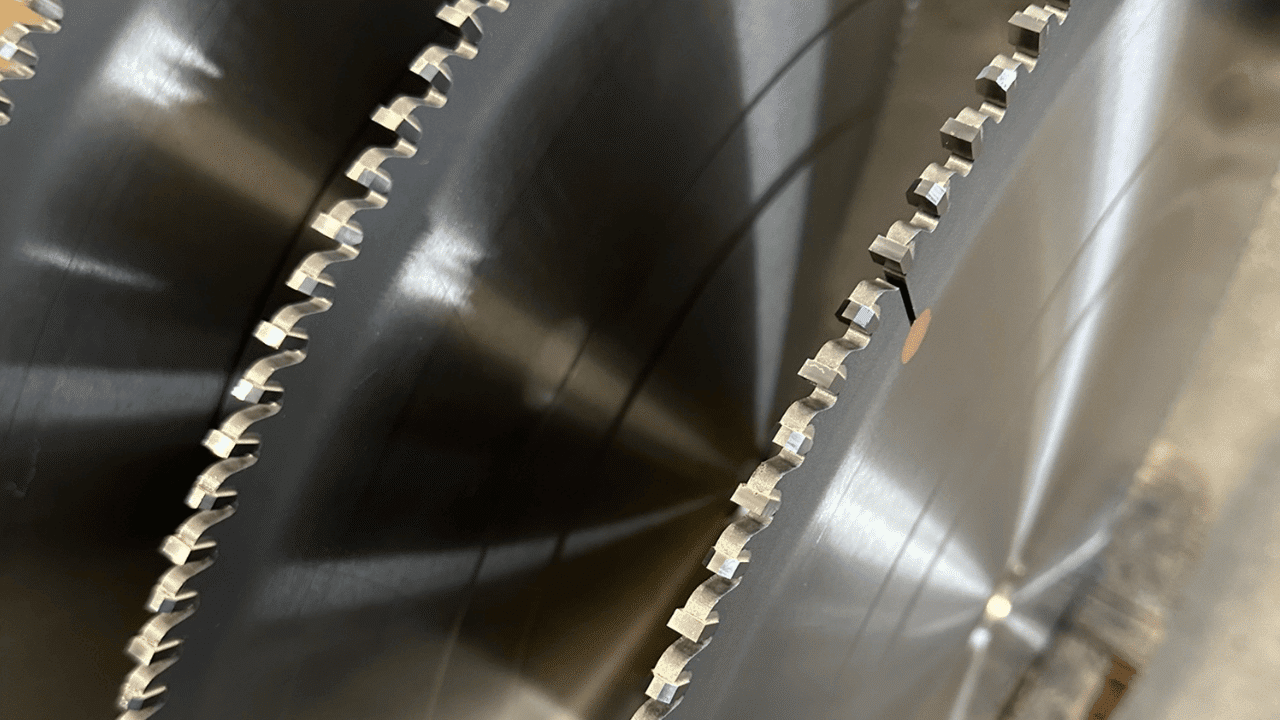

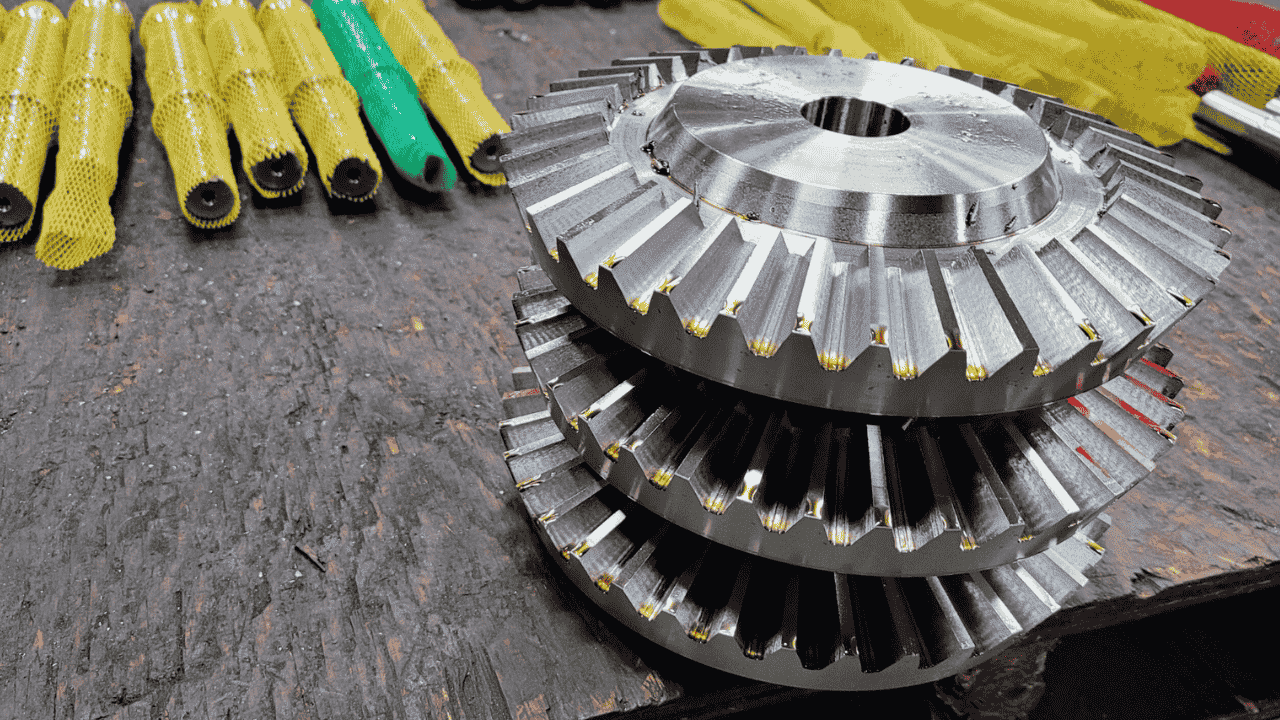

Century Drill & Tool of Green Bay, WI, acquires Everlast Saw of North America, LLC of South Hutchinson, KS

“Paul, Calder Capital, Century, and our team at Onward Capital collaborated well. Calder Capital was instrumental in helping all parties reach a successful closing.” – Laura Lester, Partner, Onward Capital, Skokie, IL (Buyer) Calder Capital is pleased to announce the successful sale of Everlast Saw of North America, LLC of South Hutchinson, Kansas, to Century…

-

October 2025 Buy-Side Monthly Update

Welcome to our October 2025 Buy-Side update! In October’s 5-minute update, a recent closing, how real estate can affect business valuation (positively or negatively!), and a record-setting YTD breakdown of deals! Have questions? We’ve answered the top buy-side FAQs here. October 2025 Results: Check out our clients who have been featured on the Acquiring Minds podcast:…

-

Calder Capital Gives Back: Supporting The Community Throughout October

October was a busy and meaningful month for the Calder Capital team, filled with opportunities to serve others, give, and connect with our community. Our team came together across multiple initiatives over the last month: from walking to support domestic abuse survivors to building accessibility ramps and sponsoring children’s programs. Walking for Change with the…

-

Cella Building Company of Grand Rapids, MI, acquired by an Individual Entrepreneur of East Grand Rapids, MI

“The Calder Team excelled at identifying qualified buyers and worked diligently to overcome obstacles, ensuring a smooth and successful transaction.” – Mike Coyne, Former Owner, Cella Building Company, Grand Rapids, MI (Seller) “It was a great experience working with Rick and the Calder Capital team. Rick was a true partner throughout the process and deeply…

-

Preece Machining and Assembly, Inc. of Boulder, CO, acquired by Highline Group of Denver, CO

“It’s been great to work with the Calder team. Logan is unmatched in his tenacity for bringing us qualified leads. He balances persistence and professionalism throughout the process. In many instances, he’s the first touch point of our firm’s brand with prospective future partners, and he does a good job representing us. And, Jon has…

-

Vector Companies of Dubuque, IA, acquires Northend Gear & Machine of Fairfield, OH

“Calder Capital’s buy-side team was outstanding. Jim was committed throughout the process. Calder’s ability to identify a strong match like Northend Gear and guide us to closing efficiently was very helpful. We look forward to working with Calder on future strategic initiatives.” – Steve Arthur, CEO & President, Vector Companies, Dubuque, IA (Buyer) “Working with…

-

Green Valley Manufacturing of Decatur, IL, acquires Benda Conveyor Solutions of Tinley Park, IL

“The Calder Capital team provided tremendous support throughout this sale. Jared’s professionalism and persistence were key factors in achieving a very timely and successful outcome for all parties.” – Bob Miller, CFO, Iroquois Industrial Group, Watseka, IL (Seller) “Jared and Drew’s professionalism and industry insight were critical in helping us close within 71 days. They…