News

-

Calder Founder Max Friar Selected for Grand Rapids Top 200 List!

Calder Capital, LLC is pleased to announce that Managing Partner, Max Friar, made the Grand Rapids 200! The Grand Rapids 200 is a comprehensive list of the top 200 executives in Grand Rapids compiled yearly by the Grand Rapids Business Journal. This list is compiled based on a number of factors including the size of…

-

Strategizing the Sale of Your Business With Your Community & Legacy In Mind

It probably won’t surprise you to know that locally owned / family-owned businesses are good for the economy and good for the community as a whole. The sale of your business, and the subsequent trajectory of its future, affects more than just those directly involved in your company. Your company’s future affects the surrounding community,…

-

Featured: Garrett Monroe

Mergers & Acquisitions Advisor at Calder Capital Graduate of Grand Valley State University Fantasy Football Aficionado Motto: Intelligence is the ability to adapt to change. Favorite Activity: Hiking and walking with his wife Karaoke Night Song: Queen’s “Don’t Stop Me Now” What motivated you to become an M&A advisor? I get to help business…

-

Calder Capital/SBDA Close 30th Transaction of 2020, Continue Blistering Pace!

Demonstrating their adeptness at maneuvering during the pandemic, Calder/SBDA prove that they are among the fastest-growing M&A firms in the US.

-

The Do’s and Dont’s of Selling Your Business

Before You Sell There are a handful of elements that are fundamental to positioning a company for a sale. It is well worth a business owner’s time upfront to understand these elements. – Don’t force an owner-operator situation by making yourself irreplaceable or indispensable. It narrows the pool of buyers tremendously. – Don’t borrow a…

-

Featured: Scott Nicholson, Mergers & Acquisitions Advisor

About Scott Nicholson Mergers & Acquisitions Advisor at Calder Capital Bachelor of Science in Economics from Aquinas College Master of Business Administration from West Michigan University Skilled Vocalist & Showman Motto: Be brutally honest and treat each client like they are your parent. Favorite Activity: Hanging with friends – the activity is just a bonus.…

-

HEI Wireless Acquired By Individual Investor!

Calder Capital is proud to announce that Benton Harbor, MI-based HEI Wireless has been acquired by an Individual Investor, Jasen Drenth. Don Scharnowske, the seller, greatly enjoyed owning and operating HEI Wireless for over two decades, and he fostered a great work environment for his staff, as well as exceptional customer satisfaction. He has spent…

-

HEI Wireless Acquired By Individual Investor!

Calder Capital is proud to announce that Benton Harbor, MI-based HEI Wireless has been acquired by an Individual Investor, Jasen Drenth. Don Scharnowske, the seller, greatly enjoyed owning and operating HEI Wireless for over two decades, and he fostered a great work environment for his staff, as well as exceptional customer satisfaction. He has spent…

-

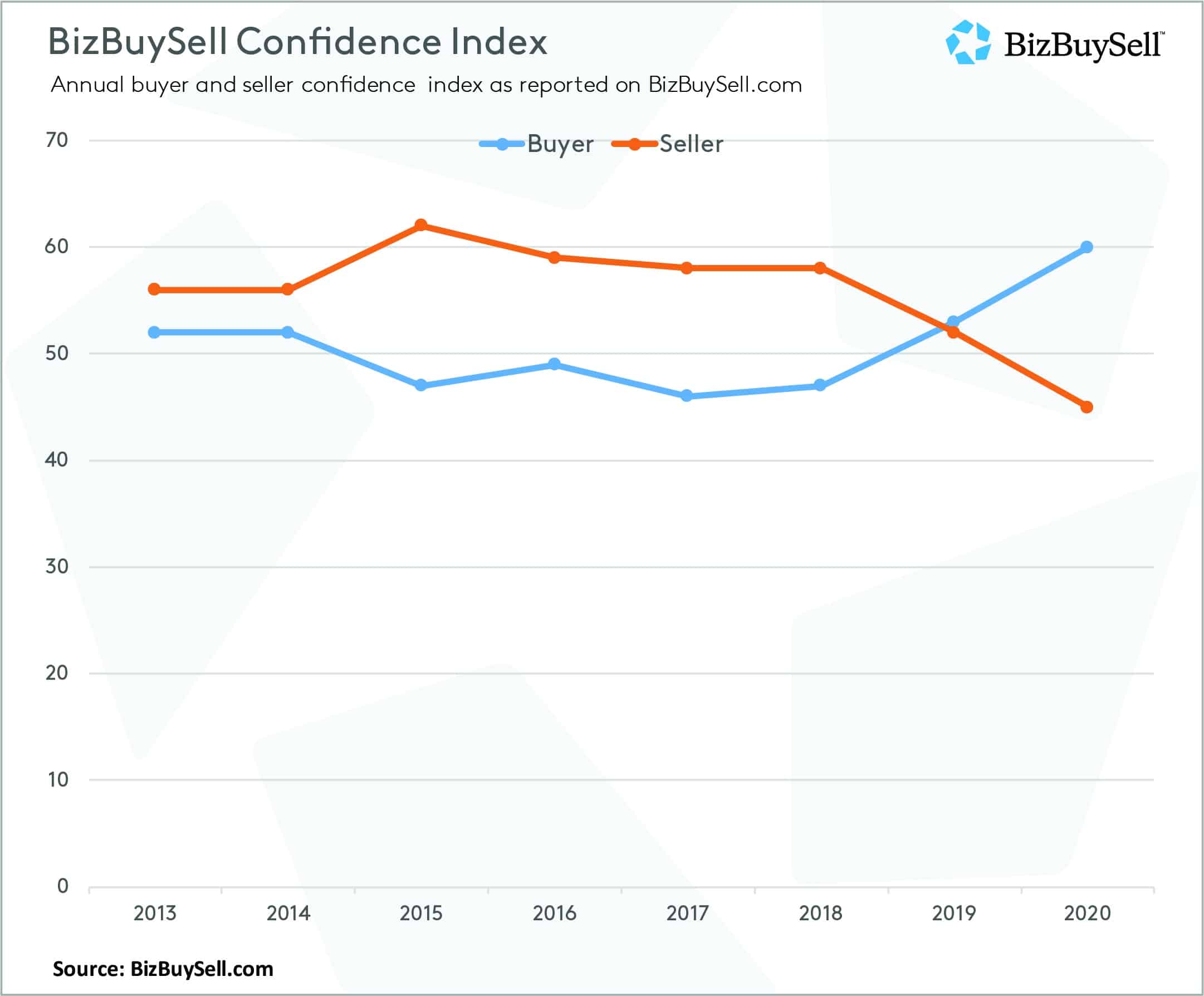

Analysis of Q3 2020 Small Business Transactions

We all know what a bizarre year it’s been; and let’s face it, it’s not over yet. BizBuySell recently published its periodic Insight Report, which only further illuminates uncertainty and mixed feelings. BizBuySell’s Small Business Confidence Survey It seems that buyer confidence is relatively high, while seller confidence is relatively low, in 2020. This is…

-

Days Machinery Movers of Elkhart, IN Acquired by Barnhart Crane & Rigging!

Calder Capital, LLC is pleased to announce the successful sale of Days Machinery Movers of Elkhart, IN to Barnhart Crane & Rigging of Memphis, TN. Founded in Memphis, TN in 1969, Barnhart Crane & Rigging is a well-known heavy transport brand with over 40 branches across the United States. Barnhart provides innovative solutions to complex…

-

Days Machinery Movers of Elkhart, IN Acquired by Barnhart Crane & Rigging!

Calder Capital, LLC is pleased to announce the successful sale of Days Machinery Movers of Elkhart, IN to Barnhart Crane & Rigging of Memphis, TN. Founded in Memphis, TN in 1969, Barnhart Crane & Rigging is a well-known heavy transport brand with over 40 branches across the United States. Barnhart provides innovative solutions to complex…

-

Quick Calder Q&A with Advisor Shane Kissack

Why did you become a business broker? Ten years ago I was building my own small businesses – several of them – simultaneously. The work I did expanding those enterprises culminated in positive exit experiences when I sold two of the businesses a few years later. Although I used a business broker for one of…

-

Business Brokerage Specialization? It’s Different Than You Think!

You may be surprised to discover that, for us, business brokerage is largely industry-agnostic. Within the mergers and acquisitions (M&A) industry, we have encountered firms and brokers who focus their expertise in a specific niche, be it restaurants or healthcare-related businesses or otherwise. While these preferences serve their own strategic business goals, we find this…

-

Keep It In the Family: FAQs About Selling Your Business To Family Members or Employees

Selling your business to your family member or employees can be stressful. An M&A Advisor can assist with valuation, deal structure, financing, and the closing process to ensure that the transaction is fair and setup for success!

-

SBA Guidelines Regarding the Sale of a Business with a PPP Loan – SBA Procedural Notice October 2020

What happens with your PPP loan if you sell your business? Among all the other uncertainties of the pandemic-stricken world, a lot of business owners are finding themselves having to navigate questions and frustrations over how to deal with their PPP loan. If your business is undergoing a change of ownership, you may be even…

-

Financing the Acquisition of Unprofitable or Distressed Businesses

Guest Post by John Klehm of SPECTRUM Commercial Services Most acquisitions, a sale to a strategic partner, new entrepreneurial owner, or buyout group are financed by debt which is serviced via the cash flows of the company being sold. With unprofitable or otherwise distressed businesses, this may not be available. How does the sale of…

-

How To Maximize Your Business Valuation While Maintaining Confidentiality

As an owner, you naturally want to maximize the value you will receive for your business. The best way to accomplish this is to put the business in front of a wide and aggressive pool of qualified buyers. In doing so, owners maximize the chance that they will get multiple offers for their business simultaneously.…

-

Calder Founder Max Friar Awarded GRBJ 40 Under 40 2020!

Grand Rapids, MI – September 2020 – Calder Capital is proud to announce that Max Friar has been selected as one of Grand Rapids Business Journal’s 2020 40 Under 40 Business Leaders. The GRBJ 40 Under 40 2020 award recognizes forty individuals under the age of forty who are making a significant impact in West…

-

Calder Capital/SBDA Smash Record, Close 25th Deal of the Year!

Demonstrating their adeptness at maneuvering during the pandemic, Calder/SBDA prove that they are among the fastest-growing M&A firms in the US.

-

The Impact of COVID-19 on Business Valuation

The financial effects of COVID-19 on our society are ongoing, and the full effects may not be known for some time, but the damage to our society because of efforts to contain the pandemic and to our economy, with tens of millions out of work, are very clear and very real. As a business owner,…