News

-

Calder Capital Named a 2024 West Michigan Best and Brightest Winner For a Second Consecutive Year

National Association for Business Resources Announces the 2024 West Michigan’s Best and Brightest Winners April 24, 2024 — Calder Capital, headquartered in Grand Rapids, Michigan, has been named a 2024 West Michigan Best and Brightest Company to Work For Winner by the National Association for Business Resources for a second consecutive year. Only companies that…

-

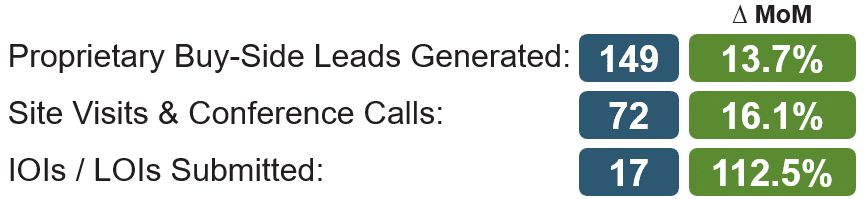

March’s 2024 Off-Market Sellers

Our brief March video update below includes an interview with our very own, Parker Schaap, who breaks down some of the off-market leads he uncovered and deal structures he negotiated last month! Have a question you’d like answered? Email [email protected] and Sam Scharich will do his best to answer it in next month’s update. Read more about…

-

Introducing Jared Friar: Exit Planning Advisor

Introducing Jared Friar, Calder’s Newest Exit Planning Advisor! Calder Capital, a nationwide mergers and acquisitions advisory firm, is delighted to announce the addition of Jared Friar to its team as a Exit Planning Advisor. Jared’s career spans over a decade across financial and direct selling sectors, including tenures at US Bank, JPMorgan Chase, and most…

-

Thread-Craft of Sterling Heights, MI Acquired by Depatie Fluid Power Group of Portage, MI

Calder Capital is thrilled to announce the successful acquisition of Thread-Craft of Sterling Heights, Michigan, by Depatie Fluid Power Group of Portage, Michigan. Founded in 1958 by Lloyd Johnson and Ture Lindholm with just three employees, Thread-Craft has grown into a leading manufacturer of mechanical linear movement actuators, including ball screw assemblies, acme or lead…

-

Lloyd’s Cabinet Shop of Pinconning, Michigan Acquired by a Strategic Investor of Ontario, Canada

Calder Capital, a leading national M&A firm, is pleased to announce the acquisition of Lloyd’s Cabinet Shop of Pinconning, Michigan by Strategic Investor, Ken Harris, of Ontario, Canada. Founded in 1961, Lloyd’s Cabinet Shop specializes in manufacturing and installing bespoke cabinets for residential spaces, focusing on kitchens and bathrooms. Over the last 24 years, Ken…

-

Midwest Automotive Metal Manufacturer and Supplier Acquired by Local Entrepreneurs

Calder Capital is delighted to share that a Midwest Automotive Interior Metal Manufacturer and Supplier has been acquired by local entrepreneurs. The Entrepreneurs closed the transaction in less than 5 months of partnership with Calder’s Buy-Side team! Calder’s Buy-Side team led an aggressive search process that resulted in 11 introductions to off-market sellers before the…

-

Calder Capital’s Growth Continues with Expansion into Florida

Calder Capital, a national lower middle-market mergers and acquisitions advisory firm, is proud to announce the opening of its office in Fort Myers, Florida. Veteran dealmaker, Matt Uhl, is spearheading the firm’s developments in Florida. The expansion into Florida is a testament to Calder’s continued growth trajectory and the Company’s commitment to providing top-notch M&A…

-

An Interview with John Harrington

Hannelore Green, Calder’s Continuous Improvement Director, recently sat down with John Harrington, Calder’s Distressed & Turnaround Advisor, to gain some insight into his processes, his experience, and his best advice for helping clients. Hannelore: “Can you outline the specific steps you take when first engaging with a distressed client? What is your initial assessment process…

-

Introducing Greg Weess: Sell-Side Associate

Introducing Greg Weess, Calder’s Newest Sell-Side Associate! Calder Capital, an award-winning national M&A advisory firm, is proud to announce the addition of Greg Weess as a new member of its team. Originally from Frankenmuth, Michigan, Greg is a proud alumnus of Grand Valley State University (GVSU), where he completed his Bachelor’s in Finance. He has…

-

Bakery Ingredients Manufacturer Bear Stewart of Chicago, Illinois Acquired by a Local Entrepreneur

Calder Capital is delighted to announce that Bear Stewart Corporation of Chicago, IL has been acquired by a local entrepreneur, Will Gano. Will Gano is a seasoned professional specializing in corporate growth and leadership. Based in Chicago, he has significant experience in food manufacturing at Cargill Inc. Seeking help in finding an acquisition while still…

-

Making a Splash: The Sale of Action Water Sports Receives Crain’s 2024 M&A Retail Deal of the Year Award

Calder Capital is proud to announce that the sale of Action Water Sports led by Calder Advisor, Pankaj Rajadhyaksha, has been honored by the Crain’s M&A Awards as the 2024 Retail Deal of the Year Award! Crain’s presents the 11th annual M&A Deals and Dealmakers Awards to spotlight best practices and excellence related to mergers,…

-

From Listing to Closing: How to Sell Your Business Efficiently with Max Friar

Calder Capital’s Managing Partner, Max Friar, recently was featured on the MCM Wealth Podcast where he discussed the intricacies of selling a business. Listen below on Spotify! Every business owner needs to exit their business eventually. So, what does that process look like, and how can it be carried out efficiently? Max Friar, Managing Partner…

-

Introducing Steve Wilcox: Lansing M&A Advisor

Introducing Steve Wilcox, Calder’s Newest Mergers and Acquisitions Advisor! Calder Capital, a nationwide mergers and acquisitions advisory firm, is delighted to announce the addition of Steve Wilcox to its team as an M&A advisor serving the greater Lansing and SE Michigan markets. Originally hailing from Davison, Michigan, Steve now calls East Lansing home. He holds…

-

February’s 2024 Off-Market Sellers

Don’t miss the off-market leads we’re uncovering. Watch our 2-minute update and contact us below. Our buy-side team is firing on all cylinders. Have a question you’d like answered? Email [email protected] and Sam Scharich will do his best to answer it in next month’s update. Read more about our top-tier Gold service by clicking below: Why work…

-

Inc 5000 Regionals 2024: Calder Capital Ranked #73 in Midwest, #7 in Michigan

With a Two-Year Revenue Growth of 159%, Calder Capital Ranks No. 73 on Inc. Magazine’s List of the Midwest Region’s Fastest-Growing Private Companies Companies on the 2024 Inc. 5000 Regionals: Midwest list had an average growth rate of 134%. Grand Rapids, MI, February 27th, 2024 – Inc. magazine today revealed that Calder Capital is No.…

-

Bontrager Pools of Elkhart, IN Acquired by MPD Pool Holdings of Chicago, IL

Calder Capital is delighted to announce the successful acquisition of Bontrager Pools, of Elkhart and South Bend, Indiana, by MPD Pool Holdings of Chicago, Illinois. Founded in 1977, Bontrager Pools has been a go-to choice for custom pool design, construction, and maintenance in the Michiana region. Ready to transition to the next phase of their…

-

Progressive Systems of Zeeland, Michigan Acquired by Local Individual Investor

Calder Capital is delighted to announce the successful acquisition of Progressive Systems of Zeeland, Michigan, by local entrepreneur Joshua Brewster. Progressive Systems, established in 1990, has carved a niche in the industry as a proficient designer and manufacturer of light gauge steel trusses. The company, co-founded by Stan Sluiter, initially focused on pre-assembled metal stud…

-

A Buyer’s Take on Outsized Seller Expectations

Guest Post: Friday Forward – Outsized Expectations (#419) by Robert Glazer, Founder of Acceleration Partners The following is a guest post by author and entrepreneur Robert Glazer of Acceleration Partners. Mr. Glazer distributes a thoughtful “Friday Forward” reflection on various topics each Friday morning. His post below caught our attention as it speaks clearly and…

-

Bridging the Gap: Creativity in Earnout Structure Can Get the Deal Across the Table

In mergers and acquisitions, bridging valuation gaps between buyers and sellers often requires more than just financial acumen-it demands creativity. A key strategy is the use of earnouts, which can alleviate buyer concerns and reward sellers for consistent performance or growth going forward. This post delves into the nuances of earnout structures, shedding light on…

-

Market Update / Q3 2023

Calder Capital’s market updates pull recent data from industry-wide reports, like BizBuySell, IBBA, M&A Source, GF Data, and internal transactions. We compile insights into current market conditions, published quarterly. With 40+ annual transactions closed, we offer accurate perspectives. Our analysis informs strategic decisions, backed by data and M&A expertise. Exceptional service is our pride.