Over the past 2-3 months it seems like the mood in the M&A markets has been “hurry up and wait”. Sell-side prospects want to talk, want to meet, express the desire to sell, do a valuation, and then they most often sit. We have felt this way on the buy-side as well. Lots of “yes, we’re interested but want to wait a bit”.

This isn’t just a feeling either. Compared to 2021, Calder’s engagement rate on valuation presentations/pitches delivered has plummeted from 62% to 38%. While our number of new clients is up vs 2021 during the same period, we have had to grind a lot harder.

So, why are owners not moving forward?

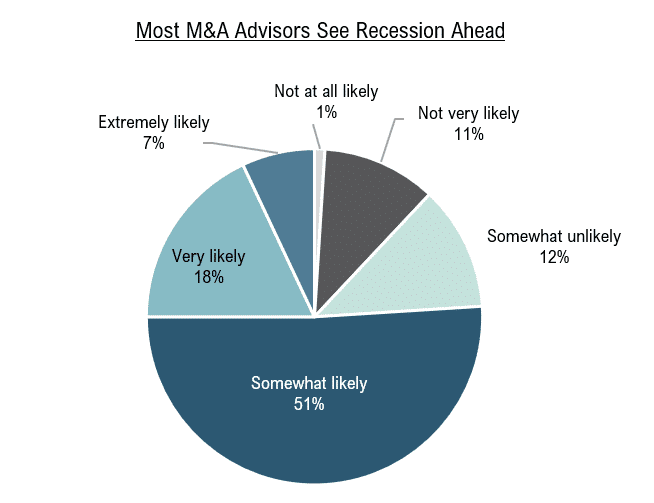

Personally, I think the talk of the recession and the stock market tanking is causing significant unease with business owners and some buyers. Many of these sellers are feeling margin pressure in their businesses, are invested in the market, and are also noticing the rapidly rising cost of everything. It’s tough to cut off your cash flow stream even if it’s growing weaker, when your net worth is getting hammered on and suddenly the amount you need to retire becomes a bit foggier.

Source: IBBA Q1 2022 Market Pulse

So, how should buyers and sellers be thinking about the market right now? Here are my thoughts:

- Many prospective sellers are doing well right now. They have healthy balance sheets and have not felt any slowdown in their business - yet. However, they are reading the headlines and it’s causing some unease. In my opinion, these sellers should be moving forward towards a sale now. Why?

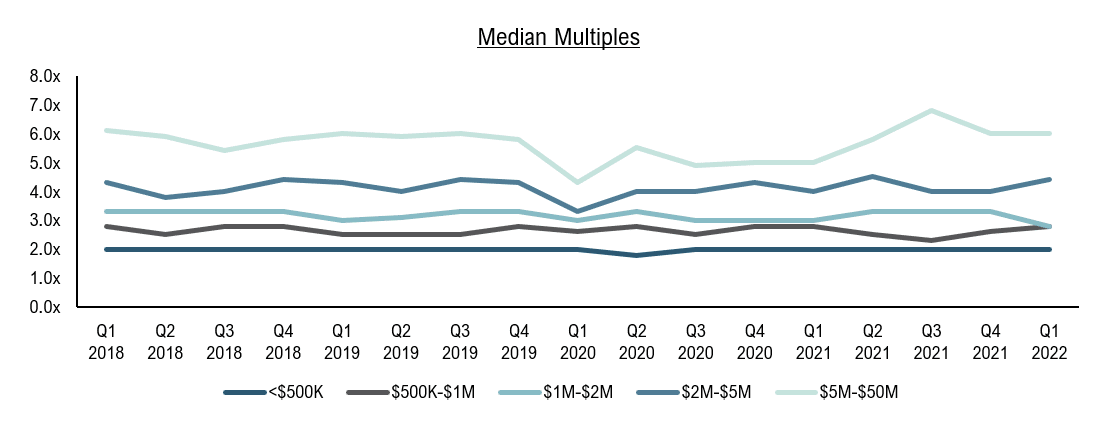

- With strong financials and interest rates rising but not astronomically high, they are ripe for a strong valuation. In its most recent May report, GF Data noted that average debt utilization has declined and stated that “...if this trend continues, we will look back on these figures as early evidence that rising interest rates have begun to outweigh the volume of dry powder to support private equity-backed transactions.”

- Now while many sellers will not transact with private equity, the same logic applies. As interest rates rise, the cost to borrow has a suppressing effect on business valuation because more of the business’s cash flow must be used to service the higher cost of debt used to acquire the business.

- Assuming the economy slows, business profits may also begin to take a hit more broadly. This will be potentially compounded by continued high labor and material costs. Many businesses will feel the pinch of not wanting to reduce staff or skimp on inventory given the staffing and supply chain nightmares of the past few years, respectively. This may cause many owners to suffer through margin compression waiting out a downturn.

- Combine this with rising rates and this is absolutely a recipe for lower valuations.

- Now, the silver lining presently is that the number of sellers on the market is low compared to the number of buyers searching. As GF Data notes, “...there remains a subset of businesses that would have traded but for the challenging conditions of the past two years. These businesses remaining on the sidelines reduces volume…”.

- In fact, GF’s report shows that only 56 businesses traded at $10MM+ in Q1 2022 vs 151 in Q4 2021. This means that if you are selling, you are going to get a lot of attention from prospective buyers. That attention can drive competition, which drives price and structure to become often more favorable to the seller.

- I am not forecasting doom and gloom. On the contrary, these trends generally take a while to settle in, which is all the more reason that I believe strong sellers should go now. Tightening seems like it is settling in, and the Fed is engineering it unabashedly.

Source: IBBA Q1 2022 Market Pulse

Valuation multiples rarely move quickly, and often trade rangebound for many years. What I don’t want to see are sellers that are wallopped with lower multiples, lower cash flows, and an influx of burned out business owners deciding to sell, sending the number of listed businesses higher and reducing competition. I do not think that the former scenario is huge risk as owners tend to hunker down and try to wait out recessions, however, per the commentary from GF Data, there are absolutely sellers that have been waiting for years to sell and they are getting very weary.