Calder Capital’s Matthew Baas Recognized as Finalist for Investment Banker of the Year at 23rd Annual M&A Advisor Awards

Calder Capital proudly announces that Matthew Baas, M&A Advisor, was named a Finalist for Investment Banker of the Year at the 23rd Annual M&A Advisor Awards. This recognition underscores Matt’s exceptional contributions to the field of mergers and acquisitions and his dedication to delivering outstanding results for clients. As a Managing Partner and Co-Founder of […]

January’s 2025 Off-Market Sellers

Welcome to January’s 2025 Off-Market Sellers update! In our 3-minute January update, Buy-Side Directors Ben Sundquist and Sam Scharich discuss January’s results and what buyers are missing without proprietary deal flow. January’s Results: Have a question you’d like answered? Thanks for watching this January’s 2025 Off-Market Sellers update! Email [email protected] with any questions and Sam Scharich will […]

Introducing Cade Peterson: Calder Capital Buy-Side Associate

Calder Capital, a nationwide mergers and acquisitions advisory firm, is thrilled to welcome Cade Peterson as its newest Buy-Side Associate. Introducing Cade Originally from Traverse City, Michigan, Cade brings a strong background in finance and business management, with experience in both private equity and business solutions. He previously worked at Blackford Capital, where he was […]

Introducing Brandon Sinclair: Calder Capital’s Marketing & Public Relations Associate

Calder Capital, a nationwide mergers and acquisitions advisory firm, is thrilled to welcome Brandon Sinclair as its Marketing and Public Relations Associate. Introducing Brandon Originally from Rockford, Michigan, and now residing in Lowell, Michigan, Brandon brings a wealth of experience across multiple sectors. He has held roles at Blackford Capital, the U.S. House of Representatives, […]

Calder Capital Recognized By Axial As A Top 10 Lower Middle Market M&A Advisor

Calder Capital proudly announces that it was recognized as a Top 10 Lower Middle Market M&A Advisor by Axial for the period 2020-2024. This recognition acknowledges M&A advisory excellence in the sub-$10M M&A market. Calder Capital is ranked #10 nationally, is the only Michigan-based firm on the list, and only one of three firms in […]

Master Precision Mold of Greenville, MI Acquired by Big Shoulders Capital of Northbrook, IL

Calder Capital is pleased to announce the successful acquisition of certain assets of Master Precision Mold of Greenville, Michigan by Big Shoulders Capital of Northbrook, Illinois. Founded in 1962, Master Precision Mold has been a cornerstone in the mold design, engineering, and manufacturing industry. Under the leadership of Steve Drake Jr., Master Precision Mold has […]

Breck Graphics, Inc. of Grand Rapids, MI Acquired by Foremost Graphics Group of Walker, MI

“Calder Advisor Jon Pastoor has been reasonable, reachable, and professional throughout this process. His expertise and guidance helped make this all possible and it’s been a pleasure to work with him. I’m looking forward to any future deals we may work on together.” – Ron Bush, CFO, Foremost Graphics, Walker, MI (Buyer) “Calder has been […]

2024 Buy-Side Recap

See what Yan Vinarskiy (Buyer) who acquired Floorguard Products had to say about working with the buy-side team to source and close the deal! Take a listen to Calder buy-side client Will Gano’s success story in the acquisition of food products manufacturer Bear Stewart Corp on the Acquiring Minds podcast. Also, featured on the podcast, […]

Buy-Side Services Testimonial: Yan Vinarskiy

Yan Vinarskiy, a buy-side client of Calder Capital, recently shared his experience of working with the Calder team and successfully completing a business acquisition in just six months. Tune in to hear more about his journey and how Calder’s expertise helped make his acquisition a success! About the Acquisition: Floorguard Products has established itself as […]

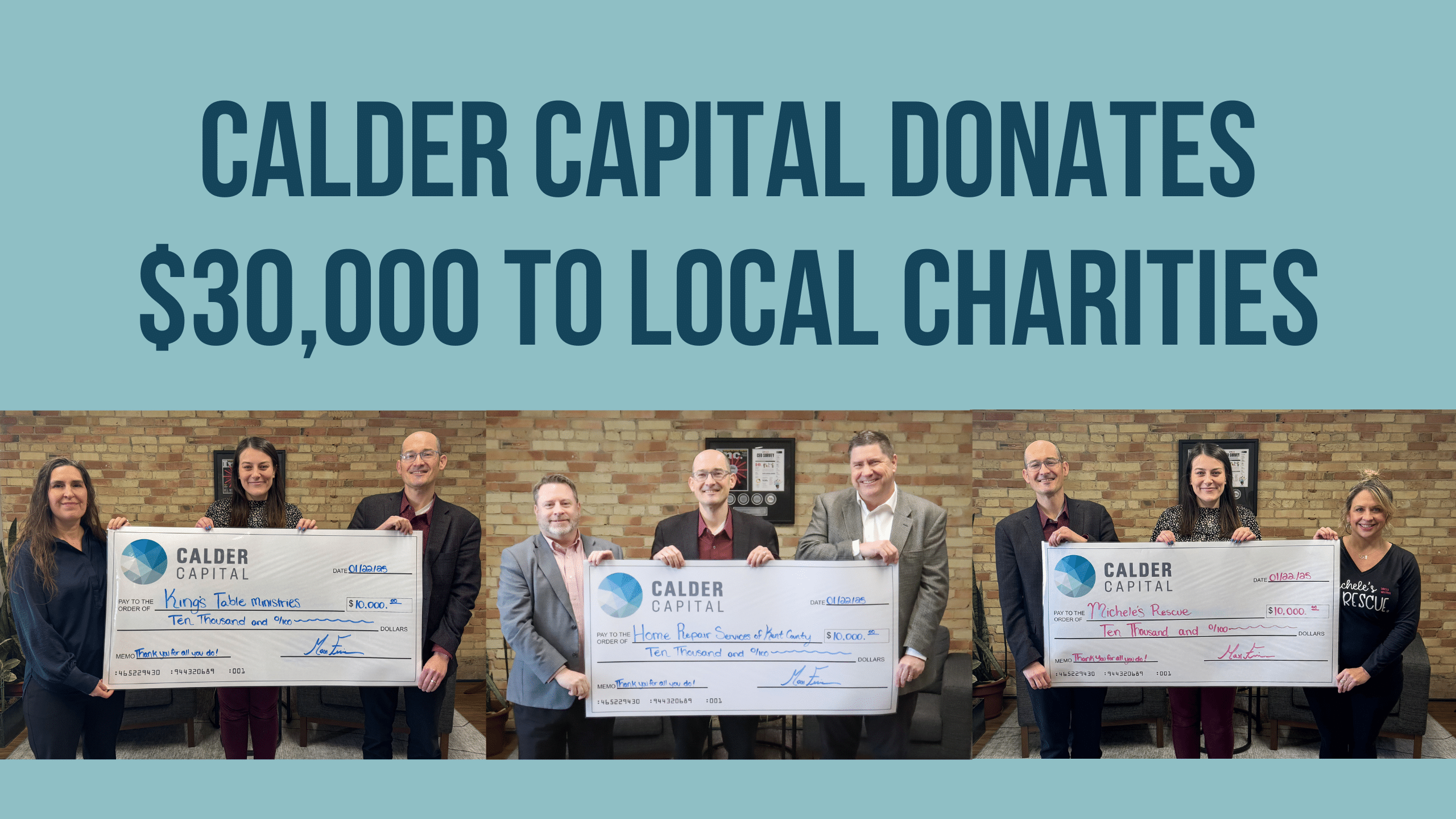

Calder Capital Donates $30,000 to Local Charities at the 2024 Calder Deal Ball

Grand Rapids, MI – December 6, 2024 – Calder Capital, a leader in mergers and acquisitions advisory services, celebrated a year of growth and gratitude by donating $30,000 to three local charities during its annual Calder Deal Ball. Held at The Rutledge in Grand Rapids, the event brought together 150 attendees, including clients, business associates, […]

Calder Capital: 2024 Sell-Side Recap – Market Insights & Exit Planning

Join us as we review Calder Capital’s 2024 sell-side successes. With 42 sell-side transactions, 5 new offices, and the launch of a dedicated exit planning division, 2024 marked a pivotal year for our team. Learn about key trends impacting the market, such as election-year uncertainty, interest rate fluctuations, and shifts in buyer behavior, and discover […]

Calder Capital Breaks Revenue Records, Closes 46 Deals in 2024!

With three successful closings on December 31, 2024, Calder Capital and SBDA surpassed previous annual revenue records by completing their 46th transaction of the year. This milestone marked another significant achievement for the firm, further solidifying its position as a leader in the M&A sector. “I’m incredibly proud of our team’s dedication and hard work,” […]

Majority Stake in Midwest-based Capital Stoneworks Strategically Acquired by Leelanau Private Capital

“Thank you to Calder Capital for your dedication and hard work. This is a monumental milestone for me, representing half a lifetime of commitment and passion.” – Brandon Hornung, CEO, Capital Stoneworks (Seller) Calder Capital is pleased to announce the successful majority equity investment in Capital Stoneworks, headquartered in Bridgeport, Michigan, by Leelanau Private Capital […]

Tigmaster Welding of Baroda, Michigan Acquired by Local Entrepreneur, Adam Schaller

Calder Capital is pleased to announce the successful acquisition of Tigmaster Co., a longstanding provider of welding, fabrication, and machining services, by Adam Schaller, of Baroda, Michigan. Founded in 1981 by Jeff Sukupchak, Tigmaster began as a small welding service provider to the local tool and die industry. Over the decades, the company expanded its […]

Calder Capital’s Buy-Side Gold Service Named Finalist for Product/Service of the Year at 23rd Annual M&A Advisor Awards

Calder Capital proudly announces that its Buy-Side Gold Service was recognized as a Finalist for Product/Service of the Year at the 23rd Annual M&A Advisor Awards. This recognition highlights the innovative and impactful contributions of Buy-Side Gold to the mergers and acquisitions landscape. Calder Capital’s Buy-Side Gold Service is a pioneering solution designed to address […]

David Arthur Consultants of Dundee, MI Acquired by Designlink Engineering of Crown Point, IN

“Working with Calder Capital was an exceptional experience from start to finish. Rob Stasiak and the team were professional, responsive, and deeply committed to helping us achieve our goals. Their ability to bring multiple qualified offers to the table gave us confidence that we were making the best decision for the future of our business. […]

Midwest-Based Restaurant Distribution Company Acquired by a Private Equity Firm

Calder Capital, a nationwide M&A firm, is thrilled to announce the successful acquisition of a Midwest-based restaurant Distribution Company by a Private Equity Firm. The acquired company, founded in 1965, offers an extensive inventory of products, from heavy-duty cooking equipment to paper and plastic disposables, as well as dining room furniture and janitorial supplies. Looking […]

Great Lakes Window Coverings of Holland, MI Acquired by an Individual Entrepreneur of Grand Rapids, MI

“We are so grateful to Calder Capital and Jon Pastoor for their guidance and expertise throughout this process. Selling a business is not easy, but Jon and the Calder team made it seamless and reassuring. They truly understood our goals and found the perfect buyer to carry on the legacy of Great Lakes Window Coverings.” […]

Calder Capital Buy-Side Client Peter Ciaverilla Featured on Acquiring Minds Podcast

Peter Ciaverilla, a buy-side client of Calder Capital, was recently featured on Acquiring Minds, a podcast for entrepreneurs who buy businesses. Peter’s journey through the acquisition process offers valuable insights, and we’re proud to have worked with him. Tune in to hear his story and learn more about the strategies that led to a successful […]

Floorguard Products of Chicago, Illinois Acquired by Local Entrepreneur Yan Vinarskiy

Calder Capital is thrilled to announce that Floorguard Products of Chicago, Illinois, a provider of floor coating solutions, has been acquired by local entrepreneur Yan Vinarskiy. Yan Vinarskiy brings a wealth of experience in business leadership, growth, and innovation. A graduate of the University of Chicago with a degree in Economics and Public Policy, Yan […]

Allied Electric of Walker, MI Partnering with Continuum Legacy Partners of Chicago, IL

Calder Capital, a construction expert M&A business broker, is electrified to announce the acquisition of Allied Electric, a premier electrical contractor based in Walker, MI, by Continuum Legacy Partners of Chicago, IL. This strategic partnership aims to enhance Allied Electric’s service offerings in design-build, low-voltage projects, and specialized installations such as conveyor systems, refrigeration, and […]

Client Spotlight: Tim Irwin Shares His Journey Selling a Business

Hear directly from Tim Irwin, a former client of Calder Capital, as he shares his journey from building his distribution business to a successful exit. Learn about the challenges he faced, the smooth process with Calder Capital’s sell-side services, and how life has transformed post-sale. Whether you’re exploring the idea of selling or actively planning, […]

November’s 2024 Off-Market Sellers

In our 3-minute November update, Buy-Side Director Sam Scharich covers what typical deal structure looks like depending on deal size, struggles, and insights of how to keep momentum post-LOI, and the use of escrows or holdbacks for true-up purposes! November’s Results: Have a question you’d like answered? Thanks for watching this November’s 2024 Off-Market Sellers […]

Market Update / Q3 2024

Calder Capital’s market updates pull recent data from industry-wide reports, like BizBuySell, IBBA, M&A Source, GF Data, and internal transactions. We compile insights into current market conditions, published quarterly. With 40+ annual transactions closed, we offer accurate perspectives. Our analysis informs strategic decisions, backed by data and M&A expertise. Exceptional service is our pride.

November’s 2024 Sell-Side Update

Welcome to November’s 2024 Sell-Side Update! Senior Advisor Scott Nicholson joins Sell-Side Director Garrett Monroe to provide a firsthand look at what an M&A advisor does at Calder Capital. Learn about Scott’s journey, the most rewarding deals he’s worked on, and why he loves helping business owners achieve their goals. Whether you’re looking to sell […]

Calder Capital’s Success in the Chicago Market

Our experience in the vibrant metro Chicago market is characterized by a focus on lower Middle Market transactions in the manufacturing, service, and construction trades industries. Calder’s Chicago-based team consists of experienced M&A advisors equipped with a diverse set of skills. This expertise is crucial in navigating complex transactions effectively. Calder Capital’s physical presence in […]

Phillips Lifestyles of Grawn and Traverse City, Michigan Acquired by Naples, Florida Entrepreneur

Calder Capital is pleased to announce the successful acquisition of Phillips Lifestyles, a premier leisure product dealer based in Northern Michigan, by individual entrepreneur Dennis Riedel of Naples, Florida. Founded in 1980 by Rick Phillips, Phillips Lifestyles has grown into a leading dealer of hot tubs, grills, fireplaces, and game tables. The company, located in […]

Lakeland Mills, Inc. of Edmore, MI Acquired by Individual Entrepreneurs of Anderson, IN, and Bradford, IL

Calder Capital is excited to announce the successful acquisition of Lakeland Mills, Inc. of Edmore, Michigan by Individual Entrepreneurs of Anderson, Indiana, and of Bradford, Illinois. Founded in 1928, Lakeland Mills has a long-standing reputation for producing unique rustic and log furniture products. The company sells to customers through retail stores and online dealers and […]

Champagne & Marx, Inc. of Saginaw, MI Acquired by Major Contracting of Detroit, MI

Calder Capital is thrilled to announce the successful acquisition of Champagne & Marx, Inc., an underground utility and excavation contractor based in Saginaw, Michigan, by Major Contracting of Detroit, Michigan. Founded in 1973, Champagne & Marx is a family-owned, second-generation excavation business that offers a wide range of services, including site utilities, foundation excavation, site […]

Ann Arbor-Based Advertising Agency Brandworks Detroit Acquired by Highland Group of Grand Rapids, MI

Calder Capital is elated to announce the acquisition of Brandworks Detroit of Ann Arbor, Michigan by Highland Group of Grand Rapids, Michigan. Brandworks Detroit is a brand development and advertising agency dedicated to serving the marketing needs of southeast Michigan-based business-to-business firms. Before founding Brandworks in 2009, Jay Kargula was a partner and Creative Director […]

Wolverine Lawn Services, Inc. of Kalamazoo, MI Acquired by Total Property Management Group of Plainwell, MI

Calder Capital is proud to announce the successful acquisition of Wolverine Lawn Services, Inc. (“Wolverine”) of Kalamazoo, Michigan, by Total Property Management Group of Plainwell, Michigan. Founded in 1973 by Charles Block, Wolverine Lawn Services is a landscape maintenance company offering residential and commercial services. Charles’ son, Thomas “Tom” Block, has led the company since […]

CM Industries of Lake Zurich, IL Acquired by Stacker Holdings of Chicago, IL

Calder Capital is thrilled to announce the successful acquisition of CM Industries of Lake Zurich, Illinois, by Stacker Holdings of Chicago, Illinois. Founded in 2001 by Zenny Kukich, CM Industries has grown into a market-leading manufacturer of high-performance welding products. The Lake Zurich-based company manufactures a range of welding products sold through its international distribution […]

Courtesy Driving School of Shelby Township, MI Acquired by Anthem Management Group of Chicago, IL

Calder Capital is pleased to announce the acquisition of Courtesy Driving School, based in Shelby Township, MI, by Anthem Management Group, a Chicago-based firm. Founded in 1970 by David Semrau, Courtesy Driving School has been a trusted provider of affordable and safe driver education across Michigan for over five decades. Following David’s passing, his wife […]

October’s 2024 Off-Market Sellers

Welcome to October’s 2024 Off-Market Sellers update! In our 4-minute October update, Buy-Side Director Sam Scharich covers leftover leads from past searches, changes in the M&A marketplace, crucial insights for closing deals and avoiding deal disintegration! October’s Results: Have a question you’d like answered? Thanks for watching this October’s 2024 Off-Market Sellers update! Email [email protected] with any […]

Introducing Ben Sundquist: Calder Capital’s New Buy-Side Search Director

Calder Capital, a nationwide mergers and acquisitions advisory firm, is thrilled to welcome Ben Sundquist as our new Buy-Side Search Director. Originally from Ann Arbor, Michigan, Ben brings a diverse background with experience in various roles across multiple industries. He previously worked in the Corporate Finance Division at Whirlpool Corporation, where he identified energy-efficient real […]

Introducing Jim Oren: Calder Capital’s New Buy-Side M&A Advisor

Calder Capital, a nationwide mergers and acquisitions advisory firm, is excited to welcome Jim Oren to the team as its new Buy-Side M&A Advisor. Raised in Kokomo, Indiana, and having lived in Holland, Michigan, for the past 35 years, Jim brings a wealth of experience from his previous roles at prominent companies such as ODL, […]