News

-

January’s 2024 Off-Market Sellers

There is no time to waste in 2024. Our team is already off to a quicker start this year and we’ve detailed our off-market efforts in a short 2-minute video below. Take a look! Have a question you’d like answered? Email [email protected] and Sam Scharich will do his best to answer it in next month’s update. Read…

-

As-Tech Industries of Warren, MI Acquired by Midwest-Based Privately Held Metal Fabricator

Calder Capital is thrilled to announce the successful acquisition of As-Tech Industries of Warren, Michigan by a Midwest-based privately held Metal Fabricator. Founded in 2000 by Steven Greenland, As-Tech Industries is a metal component fabrication company that has carved a niche in the automotive industry. As a tier-two supplier, the company provides crucial components used…

-

Exciting and Innovative New SBA 7(a) Loan Guidelines for Business Acquisitions

The SBA 7(a) program is a versatile loan platform offered by the Small Business Administration (SBA) to support small businesses in various financial endeavors, including business acquisitions. This initiative provides several benefits, such as reduced down payments, extended repayment periods, and flexibility in loan terms, making it an attractive option for entrepreneurs looking to acquire…

-

Calder Capital Wins Gold in Business Development Department of the Year in the 13th Annual Best in Biz Awards

Calder Capital was honored with the Gold Award in the Business Development Department of the Year category in Best in Biz Awards, the only independent business awards program judged each year by prominent editors and reporters from top-tier publications in North America. Calder Capital, a premier lower middle market investment bank, was founded in 2013…

-

Calder Capital Wins Silver in Sales Department of the Year in the 13th Annual Best in Biz Awards

Calder Capital was honored with the Silver award in the Sales Department of the Year category in Best in Biz Awards, the only independent business awards program judged each year by prominent editors and reporters from top-tier publications in North America. Calder Capital, a premier lower middle market investment bank, was founded in 2013 and…

-

2023 Buy-Side Recap

2023 was a turbulent year in the economy, with rising interest rates, bank failures, falling but high inflation, persistent labor challenges, and very low seller sentiment. This did not stop Calder’s buy-side team from soaring to new heights! Below is a 2023 recap and while it’s good to review the past, we won’t dwell on…

-

Calder Capital/SBDA Close Record-Breaking 48 Deals in 2023!

With the successful closings of two businesses on 12/28/23, the Calder Capital/SBDA team completed transaction #48 for 2023, surpassing previous annual transaction and revenue records. This is despite global M&A deal volume declining by 7% and 27% year-over-year dollar volume decline rounding off the lowest three-quarter total since 2013. (Source: Skadden) Calder reported 79.1% revenue growth…

-

Johnston Contracting of Midland, MI Acquired by Lee Industrial Contracting of Pontiac, MI

Calder Capital is proud to announce the successful acquisition of Johnston Contracting, Inc. (JCI) of Midland, Michigan by Lee Industrial Contracting of Pontiac, Michigan. Established in 1955, Johnston Contracting is a heavy civil contractor serving the Tri-Cities Region of Michigan. Johnston provides excavating, grading, and underground construction services. Lee Johnston, the second-generation owner, looking to…

-

The 2024 Buyer’s Outlook: Navigating a More Challenging M&A Market

In the dynamic world of mergers and acquisitions (M&A), 2024 presents a unique set of challenges and opportunities for buyers. With the landscape evolving rapidly, this blog post delves into what makes buying businesses in 2024 more complex and competitive, especially in the face of a surge in private equity (PE) investment and the growing…

-

Introducing Riley Hagen: Sell-Side Analyst

Introducing Riley Hagen, Calder’s Newest Sell-Side Analyst! Calder Capital, a leading mergers and acquisitions advisory firm, is pleased to announce the addition of Riley Hagen to its Central Services team as a Sell-Side Analyst. Riley’s favorite quote is “The proper function of man is to live, not to exist. I shall not waste my days…

-

Introducing Nick Browning: Sell-Side Analyst

Introducing Nick Browning, Calder’s Newest Sell-Side Analyst! Calder Capital, an award-winning national M&A advisory firm, is proud to announce the addition of Nick Browning as a new member of its team. A native of Clinton Township, Michigan, Nick is a proud alumnus of Grand Valley State University (GVSU), where he completed his degree in Business…

-

November’s 2023 Off-Market Sellers

Welcome to our November off-market update. Have a question you’d like answered? Email [email protected] and Sam Scharich will do his best to answer it in next month’s update. Read more about our top-tier Gold service by clicking below: Why work with Calder? Calder works with clients on a guaranteed basis, so if we don’t deliver our clients don’t pay.…

-

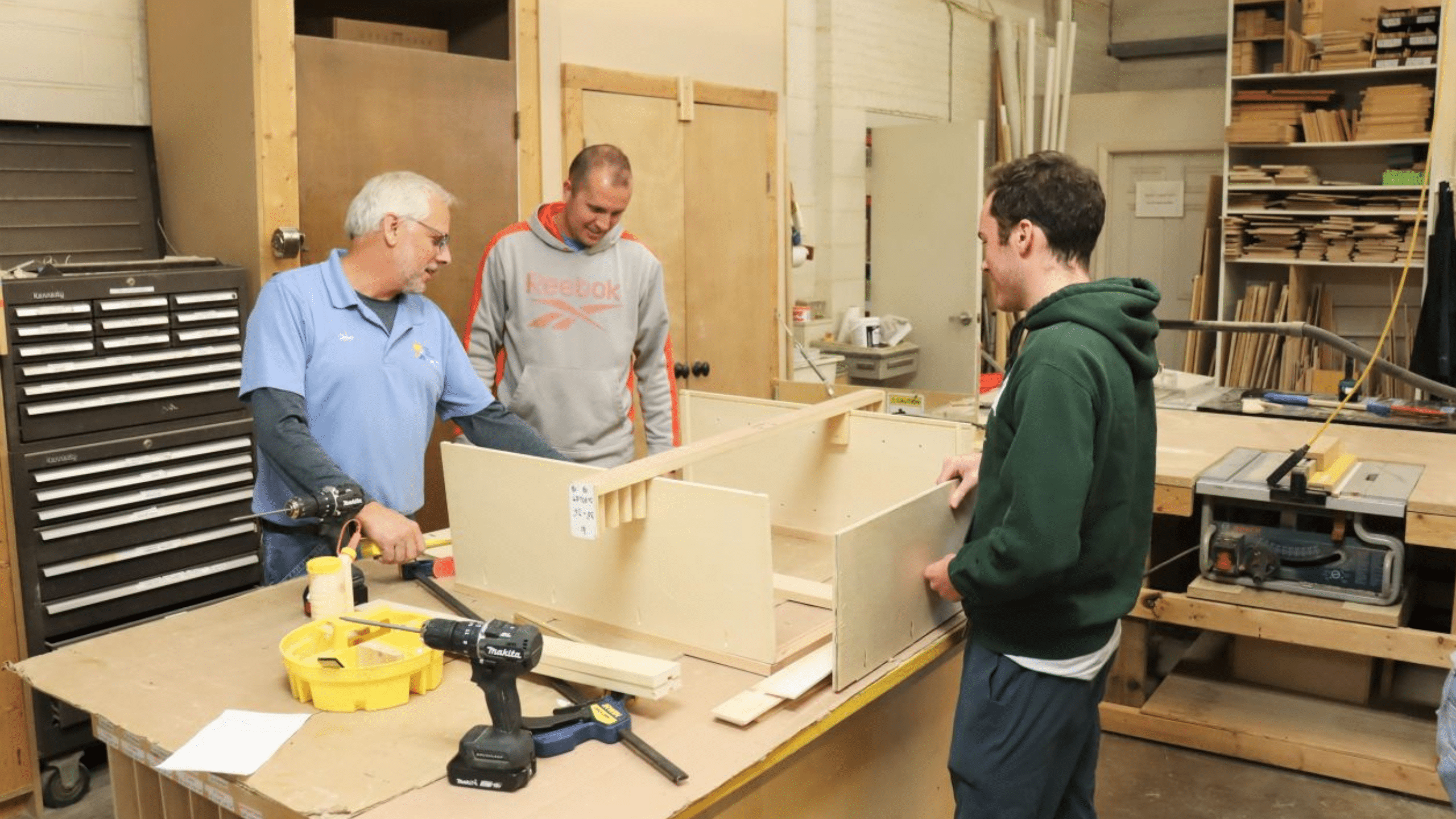

Home Repair Services and Calder Capital

Recently, the Calder team donated time to the Home Repair Services of Kent County‘s Cabinet Shop. Home Repair Services of Kent County is a non-profit organization local to Calder Capital’s headquarters. Their mission is to strengthen vulnerable Kent County homeowners because strong homeowners build strong communities. They do this by offering discounted repair services and…

-

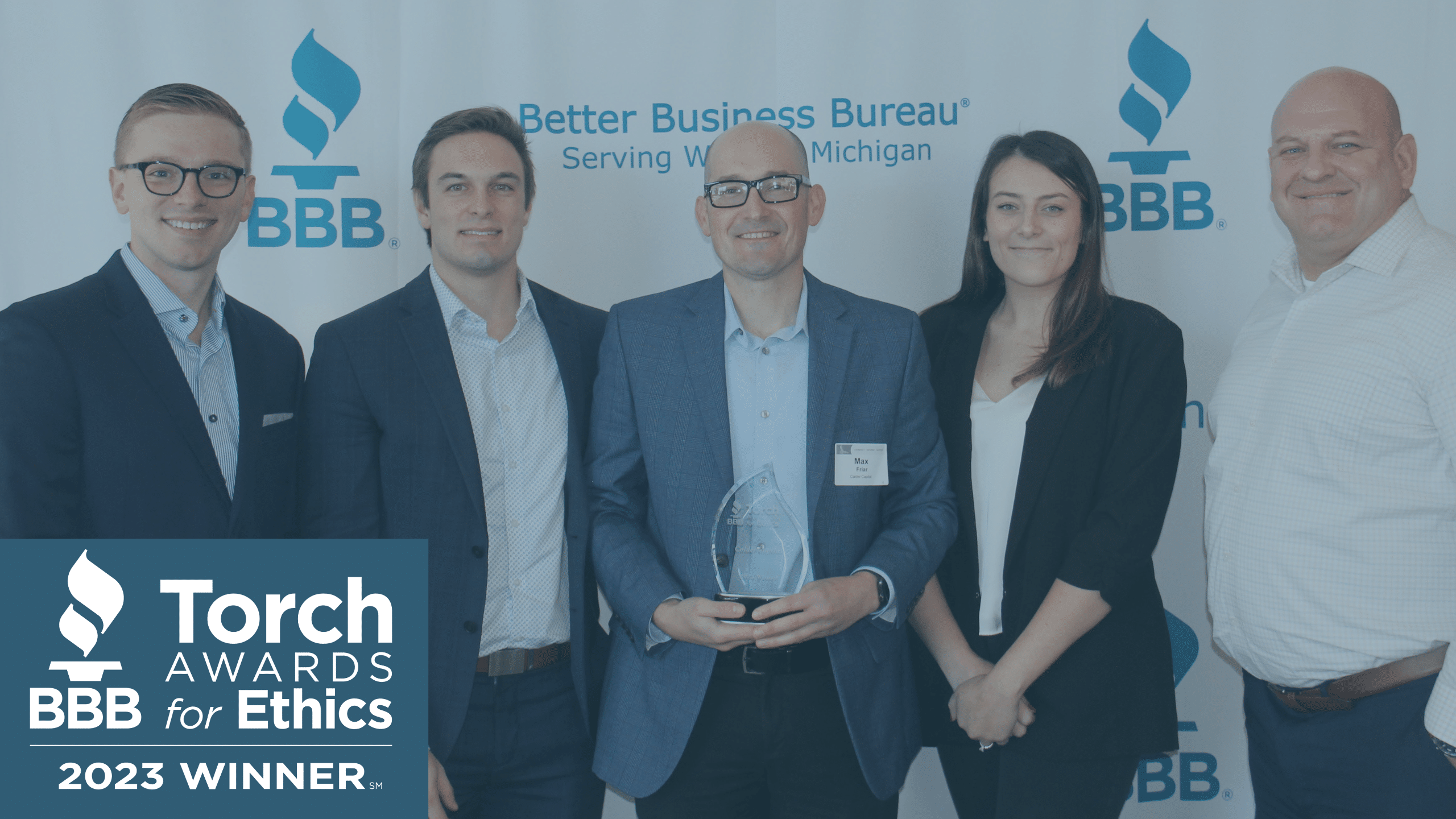

Calder Capital Honored for Ethical Business Practices, Named a 2023 BBB Torch Award Winner

The West Michigan Better Business Bureau Announced the 2023 Torch Award Finalists at a ceremony in Grand Rapids on November 13th. Calder Capital, headquartered in Grand Rapids, Michigan, has been named a 2023 Torch Award for Ethics Winner by the West Michigan Better Business Bureau. The Better Business Bureau is a standards-based nonprofit organization with…

-

Double O of Grand Rapids, MI Acquired by Integrated Manufacturing Group of Farmington Hills, MI

Calder Capital is pleased to announce the acquisition of Double Otis, Inc. of Grand Rapids, Michigan by Integrated Manufacturing Group, LLC of Farmington Hills, Michigan. Established in 1997, Double Otis, Inc. (“Double O”) is a leader in the commercial glazing, window, door, and historic restoration industry. With over 25 years of experience, the company has…

-

C&L Cylinder and Machine, LLC of Rome, GA Acquired by Caerus Equity Partners of Atlanta, GA

Calder Capital is proud to announce the acquisition of C&L Cylinder and Machine, LLC of Rome, Georgia by Caerus Equity Partners of Atlanta, Georgia. With 25 years of operational and leadership experience, Ben Eugrin established Caerus Equity Partners (Caerus) in 2021, focusing his expertise on acquiring and managing a manufacturing business. As the lead of…

-

Midwest-Based Distributor Acquired by a Local Buyer

Calder Capital is delighted to share that a local Buyer has acquired a Midwest-based Distributor. In a strategic move to streamline its search, the Buyer retained the services of Calder Capital’s Buy-Side team. The Acquired Company is a Midwest-based distributor. When Calder Capital’s Buy-Side team approached the Company, the seller had only recently started to…

-

Introducing Whit Webster: Philadelphia M&A Advisor

Introducing Whit Webster, Calder’s Newest Mergers and Acquisition Advisor! Calder Capital, a prominent mergers and acquisitions advisory firm, is delighted to announce the addition of Whit Webster to its team as an M&A advisor serving Philadelphia. Originally hailing from Tampa, Florida, Whit now calls Philadelphia, Pennsylvania home. He holds a Bachelor’s degree from the University…

-

Introducing John Harrington: Turnaround & Distressed M&A Advisor

We’re proud to introduce John Harrington! Calder Capital, a leading mergers and acquisitions advisory firm, is pleased to announce the addition of John Harrington to its team as an M&A Advisor specializing in distressed and turnaround businesses. John has more than 40 years of combined experience in bank management, executive leadership, and turnaround consulting covering…

-

October’s Off-Market Sellers

Welcome to our October off-market update. In 3-quick minutes we cover upgrades to the buy-side team, two new closings and how they were structured, and an update on YTD performance. Have a question you’d like answered? Email [email protected] and Sam Scharich will do his best to answer it in next month’s update. Read more about our top-tier…