News

-

December’s Off-Market Sellers

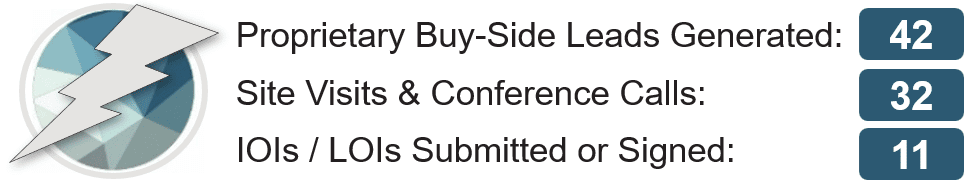

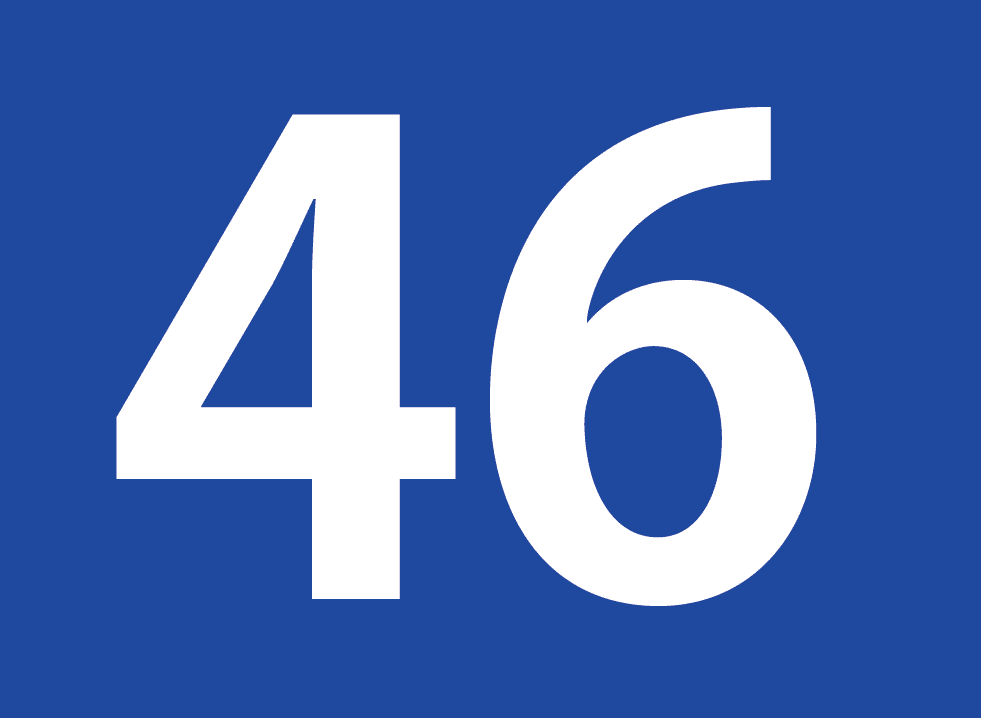

We hope 2022 finished strong for you! The Calder team was blessed to finish the year with a new record of 46 completed transactions! For a full deal by deal breakdown and analysis, please click here. The buy-side played a big role in helping Calder break our transaction closing record. And our momentum has us…

-

November’s Off-Market Sellers

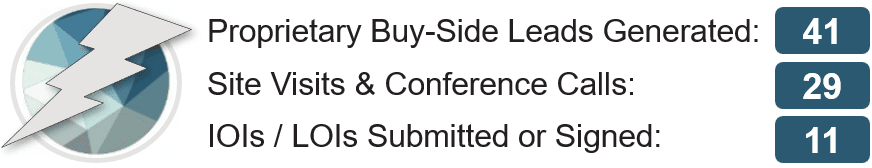

Welcome to the holiday season. Many think that M&A slows down during this time. That is far from the truth, at least for us. Last week the Calder team closed transaction #42 on the year tying our record set in 2021. A huge shout out to buy-side associate Parker Schaap for getting it done! Off-market lead flow also…

-

2023 is the right time to buy a business

The M&A market is shifting. In 2021, deal volumes and multiples rebounded from a COVID dip due to basement bottom interest rates and piles of cash on the sidelines. And the year prior (2020), the Calder team managed a record-setting year even through a global pandemic. Buyers maintained vast amounts of dry powder and outnumbered…

-

Calder Capital/SBDA Crush Transaction & Sales Records

Demonstrating their adeptness at maneuvering during the pandemic, Calder/SBDA prove that they are among the fastest-growing M&A firms in the US.

-

Going Out Like Lionel Messi

As a business owner, it is important to be realistic about when it may be time to consider selling your business. Just like in soccer, there are times when it is better to walk away from the game while you are still performing at a high level, rather than risk letting your skills or interest…

-

Introducing Zach Smith: Major New York Sports Fan

Introducing Zach Smith to our Central Services Team! Calder Capital is excited to welcome the newest addition to our Central Services team, Zach Smith! Calder Capital’s Central Services team is made up of skilled analysts who provide the financial and operational backbone of Calder’s sell-side practice: business valuations, producing Confidential Information Memoranda (CIMs) and marketing…

-

Todd & Debbie Strain Testimonial

Max, I just wanted to take a minute and personally thank you and Garrett for getting this deal over the finish line! Your company has been a pleasure to work with, and Garrett has been a major player in getting this deal done on time and before the new year; you should be very proud…

-

What is a 338(h)(10) Election and How Does It Impact an M&A Transaction?

A Section 338(h)(10) election is a tax election that allows the buyer and seller of a target company to treat the sale as an asset sale for federal income tax purposes. This means that the buyer can take a basis in the assets of the target company equal to the purchase price, and the seller…

-

Corporate Clean Services of Grand Rapids Acquired by a Local Investor

Calder Capital is excited to announce the acquisition of Corporate Clean Services of Grand Rapids, MI by a local individual investor, Harry Kobrak. Harry has previous experience in sales and marketing, on a global scale. After a 20-year international career with Caterpillar, Harry moved back to West Michigan from Tokyo to be closer to family…

-

The Key Benefits of a Business Appraisal

A business appraisal is an assessment of the value of a business, which can be helpful for a variety of reasons. Business owners may wish to have their business appraised for a number of reasons, including to determine the value of their business for tax or estate planning purposes, to prepare for a sale or…

-

Control Electric, Inc. of Grand Rapids, MI Acquired by an Individual Investor

Calder Capital is electrified to announce the sale of its client, Control Electric (“Control”), to a local individual investor! Founded in 1985 by Steve Dalga, Control Electric is an electrical services provider located in Grand Rapids, Michigan. Control provides residential, commercial, and retail services in the West Michigan area. Control Electric also owns a separate…

-

Leading Hot Tub Manufacturer Nordic Products Acquired by NY-Based Monomoy Capital Partners, LP

Grand Rapids, MI – Calder Capital, LLC is pleased to announce that it served as the exclusive financial advisor to Nordic Hot Tubs (“Nordic” or the “Company”) in its sale to New York, NY-based Monomoy Capital Partners (“Monomoy”). Headquartered in Grand Rapids, Michigan, Nordic is a manufacturer of high-quality therapeutic hot tubs for residential markets…

-

Leading Hot Tub Manufacturer Nordic Products Acquired by NY-Based Monomoy Capital Partners, LP

Grand Rapids, MI – Calder Capital, LLC is pleased to announce that it served as the exclusive financial advisor to Nordic Hot Tubs (“Nordic” or the “Company”) in its sale to New York, NY-based Monomoy Capital Partners (“Monomoy”). Headquartered in Grand Rapids, Michigan, Nordic is a manufacturer of high-quality therapeutic hot tubs for residential markets in North America and…

-

IBID County Electric of Benton Harbor, MI Sold to Individual Investors

Calder Capital, LLC is excited to announce the acquisition of IBID County Electric of Benton Harbor, MI to individual investors! Founded in 1969, IBID County Electric is a well-known electrical contractor in the Southwest Michigan area. IBID’s long-term customer base consists of some of the area’s largest employers including hospital systems, casinos, beverage companies, manufacturers, and retail…

-

IBID County Electric of Benton Harbor, MI Sold to Individual Investors

Calder Capital, LLC is excited to announce the acquisition of IBID County Electric of Benton Harbor, MI to individual investors! Founded in 1969, IBID County Electric is a well-known electrical contractor in the Southwest Michigan area. IBID’s long-term customer base consists of some of the area’s largest employers including hospital systems, casinos, beverage companies, manufacturers,…

-

M&A Financing in a Rising Rate Environment

Interest rates are rising quickly. In fact, rates in 2022 have risen twice as fast as the rate hike cycle of 1988-1989! Given this, many investors, buyers, and sellers of businesses are asking, “What impact is the rising rate environment having on mergers and acquisitions financing?” One logical conclusion that you could draw is that…

-

Jer-Den Plastics of St. Louis, MI Acquired by Jasper Holdings, Inc. of Jasper, Indiana

Calder Capital is elated to announce the acquisition of Jer-Den Plastics of St. Louis, MI to Jasper Holdings, Inc., a 100% associate owned ESOP. Founded in 1995, Jer-Den Plastics is the market-leading custom rotational molder in Michigan, and one of the largest in the Great Lakes Region. The Company produces products such as pool slides,…

-

Jer-Den Plastics of St. Louis, MI Acquired by Jasper Holdings, Inc. of Jasper, Indiana

Calder Capital is elated to announce the acquisition of Jer-Den Plastics of St. Louis, MI to Jasper Holdings, Inc., a 100% associate owned ESOP. Founded in 1995, Jer-Den Plastics is the market-leading custom rotational molder in Michigan, and one of the largest in the Great Lakes Region. The Company produces products such as pool slides, construction bollards,…

-

Construction and Industrial Supplies Distributor B&L Bolt Acquired by Colony Hardware Corporation, a Portfolio Company of Audax Private Equity

Calder Capital, LLC is thrilled to announce the acquisition of The Bolt Bin, West Michigan Technical Supply, and Clear Vision Inspection by investment partners Jordan and Travis Vander Kolk! Grand Rapids, MI – Calder Capital, LLC is pleased to announce that it served as the exclusive financial advisor to B&L Bolt, Inc. and Slip-On Lock Nut,…

-

Construction and Industrial Supplies Distributor B&L Bolt Acquired by Colony Hardware Corporation, a Portfolio Company of Audax Private Equity

Grand Rapids, MI – Calder Capital, LLC is pleased to announce that it served as the exclusive financial advisor to B&L Bolt, Inc. and Slip-On Lock Nut, LLC (“B&L” or the “Company”) in its sale to Colony Hardware Corporation (“Colony”), a portfolio company of Boston-based Audax Private Equity. With locations in Grand Rapids and Kalamazoo,…