With the final closing on December 29th, 2025, Calder Capital and Small Business Deal Advisors (SBDA) surpassed previous annual revenue records by completing their 58th transaction of the year. This milestone marked an increase of 26% in deal volume and an increase of 15% in revenue.

“I’m incredibly proud of our team’s dedication and execution,” said Max Friar, Founder and Managing Partner of Calder Capital. “We’ve never closed deals or onboarded new clients at this pace. As we look ahead, our focus remains on disciplined execution, creativity in winning deals, and consistently delivering strong outcomes for both business owners and buyers. With that momentum, we’re energized and focused on closing 60+ transactions in 2026.”

2025 Sell-Side Reflection

Starting in 2025, Calder had 51 sell-side clients. As we transition into 2025, that number is 48, following a record-breaking year of sell-side closings combined with many prospective sellers remaining on the sidelines. The Sell-Side team, along with many prospects and clients, faced notable challenges throughout the year:

- Economic uncertainty: The market faced heightened uncertainty driven by a change in presidential administration, tariff concerns, and intermittent SBA disruptions, all of which contributed to cautious decision-making.

- Increase in distress-driven inquiries: We observed a noticeable rise in distressed business owners reaching out in crisis mode in 2024, and saw this trend continue to rise in 2025. While not alarming, this trend was more pronounced than at any time in the recent past.

- Decision paralysis: While election-related uncertainty drove widespread hesitation last year, we are now seeing that pause transition into a period of recalibration. Both buyers and sellers are reassessing expectations around valuation, deal structure, and timing in light of the new administration, evolving trade policy, and interest rate environment. Rather than indecision, today’s market reflects more deliberate, data-driven decision-making as participants seek clarity and conviction before moving forward.

Looking ahead to 2026, we expect sell-side activity to gradually pick up, rather than surge, driven by:

- Pent-up supply coming back to market: Many owners delayed exits in 2024–2025 due to election uncertainty, rates, and policy ambiguity. Those sellers didn’t disappear; they aged, fatigued, or encountered personal or business forcing events, and that backlog should begin converting in 2026.

- A reset in valuation expectations: Sellers now have a more realistic view of rates, tighter lending, and what strong outcomes look like in today’s market, helping unlock forward momentum.

For well-performing businesses, the market should remain favorable. If policy impacts remain manageable and rates stabilize or decline modestly, we expect more Main Street and lower middle market sellers to enter the market, likely skewing toward the back half of 2026. Until then, quality companies with consistent performance should continue to command strong interest and competitive outcomes.

2025 Buy-Side Reflection

Calder’s Buy-Side services experienced intense growth in 2025, with Buy-Side clients increasing from 41 at the end of 2024 to 73 by year-end 2025. As sell-side inventory tightened and competition intensified, buyers increasingly turned to Calder to help them navigate a more challenging and competitive acquisition environment. Throughout the year, Buy-Side clients faced several notable dynamics:

- Heightened competition for quality assets: A growing number of well-capitalized buyers pursued a limited pool of high-quality businesses. This imbalance led to increased competition, tighter timelines, and frustration among buyers repeatedly losing deals to competitors willing to overpay or overpromise.

- Fatigue with broadly marketed processes: Many buyers grew weary of auction-style processes that offered limited differentiation and low certainty of closing, particularly in crowded lower middle market transactions.

- Exclusive opportunities: Our buy-side team’s ability to uncover off-market seller-owners preferring confidential negotiations with a single buyer has resonated strongly with clients seeking alternatives to traditional deal-making routes.

“In response, Calder’s Buy-Side team invested heavily in people, sourcing capabilities, and process refinement to deliver consistent off-market deal flow for our clients. These investments strengthened our ability to connect buyers with motivated off-market seller-owners.

Looking ahead, this foundation positions Calder’s Buy-Side practice for continued momentum as buyer demand remains strong and competition for quality assets persists.

2025 Strategic Growth

Calder Capital’s growth in 2025 was supported by strategic hires across key divisions, ensuring the foundation for continued success.

“2025 was a year defined by both growth and transition at Calder Capital. While we once again delivered record-setting results, the year tested our resilience as we continued to scale, welcoming many talented new team members and formalizing our leadership,” commented Friar. “Personally, it required me to step back, trust the team, and evolve my role as the firm grows. There are seasons in business, and growth requires change. My goal is to build a firm that continues to thrive long after I am gone, and that means ensuring my actions consistently align with that long-term vision.”

Buy-Side Team Growth

Calder Capital’s Buy-Side team celebrated the following new team members:

- Aidan Cote – Buy-Side Search Director

- Andy Garza – Buy-Side Associate

- Collin Hicks – Buy-Side Associate

- Dan Duba – Buy-Side M&A Advisor

- Francesco Pizzo – Buy-Side Associate

- Tyler Tingley – Buy-Side Associate

The Buy-Side team also celebrated the following promotions:

- Parker Schaap – Promoted to Buy-Side Director

- Sam Scharich – Promoted to Buy-Side Managing Director

Sell-Side Team Growth

Calder Capital’s Sell-Side team celebrated the following new team members:

- Drew Woods – Sell-Side Analyst

- Emma Westerhouse – Executive Assistant

The Sell-Side team also celebrated the following promotions:

- Garrett Monroe – Sell-Side Managing Director

Operations Team Growth

In 2025, Calder grew with the formalization of an operations team and celebrated the following new team members:

- Brandon Sinclair – Marketing and PR Associate

- Em Medich – CRM Administrator

- Morgan Klinker – People Operations Specialist

- Sherri Engel – Office and Listing Administrator

The Operations team also celebrated the following promotions:

- Hannelore Jones – Director of Operations

- Melissa Somero – Events and Engagement Manager

2025 Awards and Recognitions

Firm Honors

- Calder Capital ranked No. 2,296 on the 2025 Inc. 5000 list, marking its fourth appearance, an achievement that less than 10% of Inc. 5000 recipients achieve.

- In the Inc. 5000 Regionals Midwest Award, Calder secured the No. 30 spot in the Midwest region, climbing from the No.73 spot in 2025.

- The firm received its fourth Stevie Award in 2025, taking home Bronze in the Financial Services Company of the Year category for medium-sized businesses.

- For the third consecutive year, Calder Capital was honored as a 2025 West Michigan Best and Brightest Company to Work For and a 2025 National Best and Brightest Company to Work For, highlighting its innovative business practices and commitment to employee enrichment. The firm was also recognized for the first time as a 2025 Chicago Best and Brightest Company to Work For.

- Calder landed the No.8 spot on Axial’s 2025 Semi-Annual Top 10 Lower Middle Market M&A Advisor League Table.

- The Firm was honored as a finalist in The M&A Advisor 2025 Investment Bank of the Year – Middle Market Award.

- Calder was also recognized as a BBP Industry Expert in the following categories: Construction, Distribution & Wholesale, Service Businesses, Veterinary Practices, Auto Washes, Sign Manufacturing, Apparel Manufacturing, Wood Products Manufacturing, Manufacturing, Metal Fabrication, Machinery Manufacturing

Team Honors

- Calder’s Founder and Managing Partner, Max Friar, was recognized as a 2025 Notable Leader in Finance by Crain’s.

- M&A Advisor, Patrick Robey, was also honored by Crain’s as a 2025 Dealmaker of the Year Award.

- Two of Calder’s M&A Advisors, Patrick Robey and Matthew Baas, alongside Calder’s Buy-Side Managing Director, Sam Scharich, were 2025 recipients of The M&A Advisor Emerging Leader Award.

Patrick Robey was also recognized as a 2025 finalist in The M&A Advisor Investment Banker of the Year Award.

Deal Honors

- Calder’s Buy-Side Team was honored for 2025 Deal of the Year by Crain’s for its role in the acquisition of Portland Products.

- The Sell-Side Team’s work was honored for its role in the sale of BCU Electric by The M&A Advisor in both the 2025 Cross-Border Deal of the Year (<$100MM) and the 2025 International M&A Awards’ Industrials Deal of the Year ($10-50MM).

- The M&A Advisor named Calder a finalist in the following 2025 categories: Materials Deal of the Year (<$100MM), Industrials Deal of the Year ($10-25MM), Industrials Deal of the Year ($25-50MM), Private Equity Deal of the Year ($10-25MM), and Strategic Deal of the Year ($10-25MM).

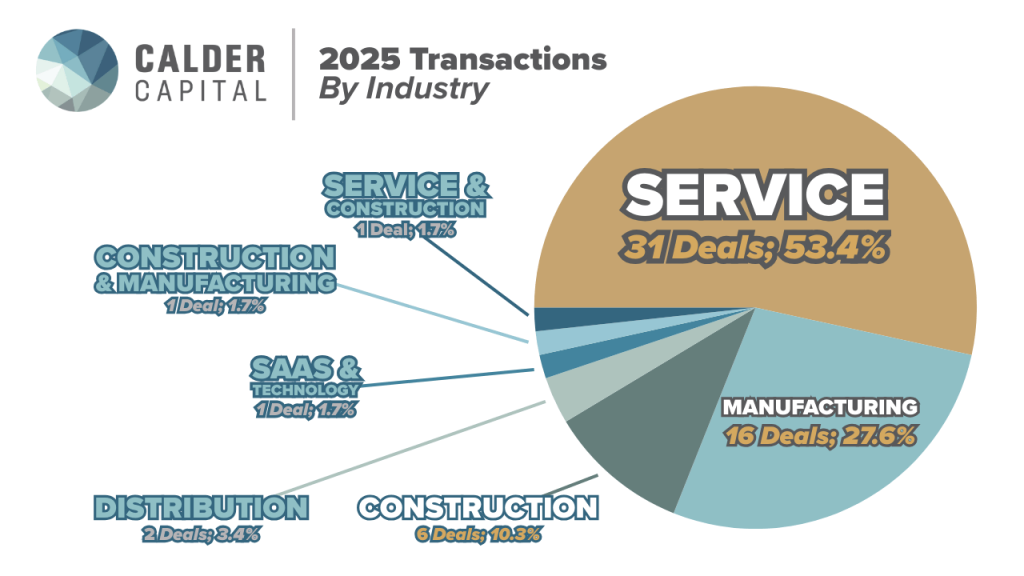

2025 Transactions by Industry

Calder Capital is a nationwide M&A firm with a focus on manufacturing, construction, service, and distribution transactions in the $1-100M EV space.

In 2025, service-based businesses emerged as the most active sector, accounting for roughly half of our completed transactions. This concentration reflects sustained demand for essential, recurring-revenue businesses.

Manufacturing remained a core pillar of our deal activity, representing just over 30% of transactions. While no longer the single largest category as in 2024, manufacturing continued to demonstrate resilience and strong buyer appetite, particularly for well-run companies with defensible niches and operational scale.

Construction transactions maintained a meaningful presence, supported by ongoing infrastructure investment, regional development, and consolidation within the industry. While smaller in overall share, construction continues to be a reliable contributor to deal flow.

Distribution provided additional diversification, reinforcing our industry-agnostic capabilities and experience navigating asset-heavy, logistics-driven businesses.

Overall, the 2025 results reflect a shift toward service-oriented businesses while maintaining strong representation in manufacturing and construction. This balanced mix underscores Calder Capital’s adaptability, strong buyer relationships, and ability to execute across market cycles, positioning the firm well as we move into 2026.

Beyond a diversity of industries, Calder/SBDA continues to expand its geographic reach, closing transactions in 2025 in the following 16 states: California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Kansas, Kentucky, Maryland, Michigan, Ohio, Pennsylvania, Texas, Utah, and Virginia.

As we enter 2026, Calder is positioned for another year of growth. With investments in new team members, a formalized leadership team, company alignment and values, and the continued strengthening of partnerships, we are ready to meet the needs of an evolving market. Our team’s resilience and innovation will ensure we capitalize on every opportunity, delivering exceptional outcomes for our clients.

About Calder Capital

Founded in 2013, Calder Capital is a cross-industry mergers and acquisitions advisory firm with offices across the United States. Calder provides valuation, sell-side, and buy-side services. We are nationally recognized for excellence in advising $1-100M enterprise value transactions in manufacturing, construction, distribution, and business services. Calder serves business owners, entrepreneurs, family offices, financial buyers, and investors. Learn more at www.CalderGR.com.